Matching Income Tax & National Insurance Threshold Welcomed by Economists

- Written by: Gary Howes

Above: File image of Rishi Sunak. Image © Pound Sterling Live, Image courtesy of Parliament.tv

Economists have welcomed the merging of the threshold at which National Insurance and income tax are merged, a move some say has been long over due.

The decision by Government to raise the National Insurance Contribution threshold by £3,000 means £12,500 tax free earnings for everyone.

"Raising the NI threshold to match the Income tax threshold is a very good and much-needed reform," says Andrew Sentance Senior Adviser at Cambridge Econometrics, describing it as the "best news" of the 2022 budget.

Torsten Bell, Chief Executive at the Resolution Foundation says the move amounts to a tax cut worth up to £300 odd per worker.

"Excellent tax simplification measure from the UK Chancellor to align the NICS LEL and Income Tax personal allowance from April. Long overdue - but welcome nonetheless," says Simon French, Chief Economist at Panmure Gordon.

The decision eases some pressure on workers who are facing inflationary pressures unseen in 30 years.

Above: Change in real household disposable income per person

Gerard Lyons, Economist at NetWealth says the decision to increase the national insurance allowance and to align it with the income tax allowance "is an excellent move by the Chancellor."

"It is the right use of his fiscal sums and will be positive for many people and for the economy," he says.

Chancellor Rishi Sunak also announced an increase in the Employment Allowance from £4,000 to £5,000.

The move was welcomed by the Federation for Small Businesses which had advocated for the move.

But the good news out of the budget is scant given the significant pressures the economy faces courtesy of surging inflation.

The Office for Budget Responsibility (OBR) downgraded 2022 GDP from 6% to 3.8%.

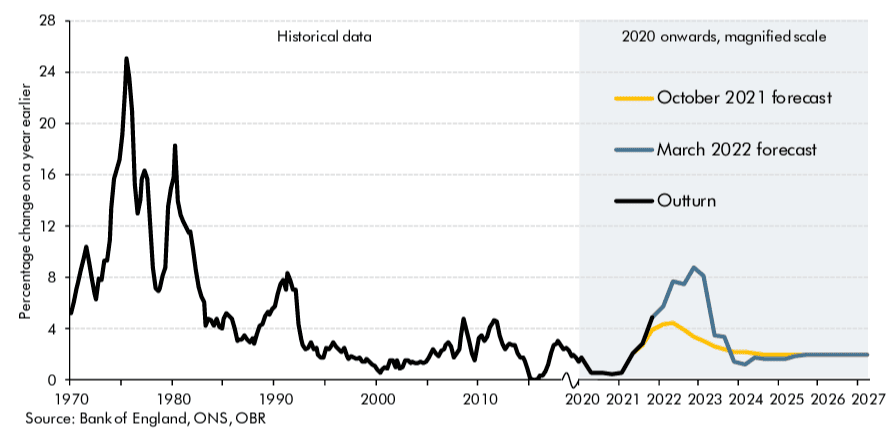

The OBR forecasts inflation will now average 7.4% this year: a remarkable forecast given the Bank of England's inflation target is set at 2.0%.

Above: The OBR's latest inflation forecasts show a significant upgrade.

Sunak told Parliament next year debt interest will be at around £83BN, "almost four times the amount we spent last year".

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics however says the Chancellor has displayed a sense of caution.

He says the rise in the NICs threshold and the fuel duty cut shouldn't distract from the fact that in 2022-23:

2) Taxes will absorb the highest percentage of GDP since 1984-85

3) Tax and benefit changes will subtract 1.3% from households’ real disposable incomes

"Sunak did the bare minimum," says Tombs.