Sunak Won't Want to Boost Inflation with Budget Giveaways

- Written by: Gary Howes

- UK finances show windfall for Chancellor Sunak

- Widespread calls for Sunak to delay tax rises

- And provide cash to households

- But doing so would only fuel inflation further

Image © Gov.uk

A boost to the government's tax intake won't sway Chancellor Rishi Sunak from his quest to cut the budget deficit as he will be wary of stoking inflation and maintaining his credentials as a truly conservative Chancellor.

A cost of living crisis driven by surging inflation rates has piled pressure on Sunak to boost fiscal support and cancel a planned hike to employment taxes.

However any additional fiscal stimulus from the government only risks boosting inflation which is now running at multi-decade highs of 5.5%, with the Bank of England expecting it to at last reach 8.0% this year.

"While many observers are calling for broad-based support measures – such as scrapping the planned rise in the national insurance tax – Sunak is likely to be wary about adding to demand and worsening the inflation problem," says Kallum Pickering, Senior Economist at Berenberg.

In a note ahead of the March 22 budget, Pickering says surging inflation rates could feed into higher wage settlements, in turn leading to persistent excess nominal demand and even higher inflation.

"In that scenario, the Chancellor should be cautious of adding fuel to the fire," says Pickering.

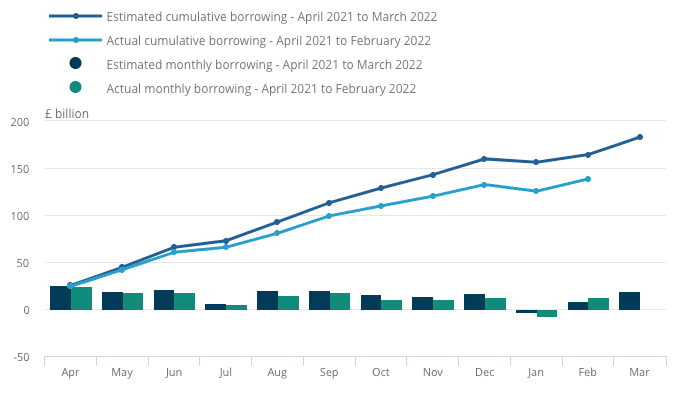

Public finance data from the ONS for the 11 months of the current fiscal year - due to end next month - show the government borrowed £138.4BN.

Projections suggest March borrowing will come in around £15BN, meaning the total deficit for the year is now likely to be around £153BN.

This is some £30BN lower than the Office for Budget Responsibility forecast at the time of the Autumn Statement last October, implying something of a windfall for Sunak to dip into.

Above: "Public sector net borrowing excluding public sector banks, UK, compared with the same period in FYE 2021" - ONS.

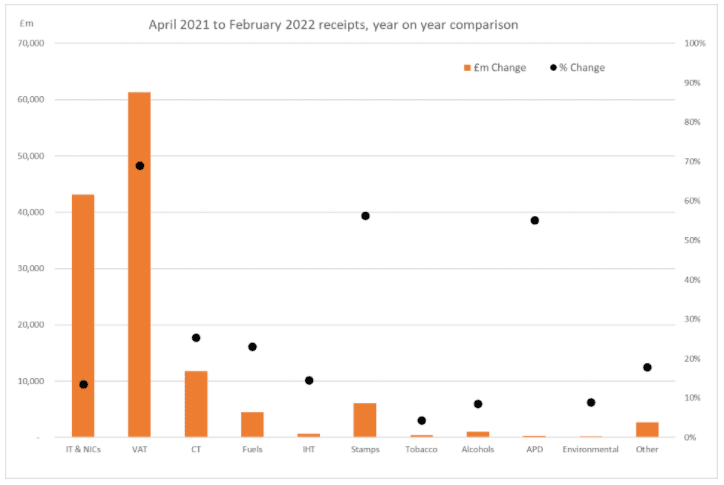

The improved outturn comes amidst a 6% boost to the government's tax intakes, driven largely by VAT which was up 69% at £61.3BN for the fiscal year to date.

"Underlying this improvement was the stronger outturn in VAT receipts and in labour taxes, both a reflection of the strengthening performance of the economy. Also beneficial were direct effects from the closure of the furlough schemes at the end of last September," says economist Sandra Horsfield at Investec.

Income Tax, Capital Gains Tax & National Insurance Contributions (NICs) added £43.2BN to government coffers with Corporation Tax adding £11.8BN, Stamp Taxes £6.1BN and Hydrocarbon Oils £4.5BN.

In percentage terms, receipts were higher from Stamp Taxes by 56%, Air Passenger Duty by 55%, Corporation Tax by 25%, Hydrocarbon Oils by 23%, Inheritance Tax by 14%, and Income Tax, Capital Gains Tax & NICs by 14%.

The ONS also made downward revisions to previous monthly borrowing, taking the fiscal year-to-date borrowing lower by £13.2BN.

At the time of October's Autumn Statement the OBR projected that the deficit would fall from 15% in 2020 to below 2.0% by 2024.

Debt as a percentage of GDP was forecast to fall from 98.2% to 84.7% over this period.

But Sunak is widely expected by economists and political commentators to maintain a commitment to keep the budget deficit down and ultimately reduce debt as a percentage of GDP over the course of his tenure at the Treasury.

"After setting the UK on course for the highest government spending and taxation as a percentage of GDP in decades, Sunak’s credentials as a prudent Conservative are at stake," says Pickering.

Press reports suggest the Chancellor will offer some additional support to households, potentially lowering fuel taxes and increasing benefit support to poorer households.

But, "they would be not a game changer that could fully dampen the shock to come," says Pickering.

Pickering says although overall fundamentals for the business cycle remain positive, the near-term inflation and confidence shock is severe and will destabilise the upswing for a while.

"Public finances may face a number of increased headwinds. Most immediately, the ONS has indicated that the one-off £150 council tax rebate for about four fifths of households in England will be treated as a current transfer by central government to households, which will add to public sector net borrowing in April," says Horsfield.

Furthermore, she notes expenditure on debt servicing is almost certain to continue to rise over the coming months, as inflation stands to climb further as a result of the upcoming 54% April utility cap hike, which at this point looks likely to be followed by another sizeable increase come October.

"The bigger question is, however, how resilient the economy will be to the indirect consequences of the war in Ukraine, which is hard to gauge accurately in such a fluid situation," adds Horsfield.