Some Russian Economic Forecasts as Sanctions Start to Bite

- Written by: Gary Howes

- Russia to fall down the GDP league table

- Economists see major economic pain

- But Wells Fargo are more sanguine

- Capital Economics says Russia economy can bounce back

- But only if lead by the right people

Image © Adobe Stock

On the day Russia's Deputy Prime Minister Yuri Borisov laments the scale and impact of sanctions imposed on his country following its invasion of Ukraine, economists continue to assess and gauge the future potential impact.

With the invasion now nearly a week old, Borisov was quoted by the Interfax newswire as saying "it was hard to predict the full scope and depth of these new sanctions on the Russian economy."

The admission is the clearest signal yet the Kremlin miscalculated the global economic and financial response to the invasion, and they are nervous.

"Sanctions operate on a different timescale than an unfolding war. But make no mistake about it: they will create a deep recession and financial crisis in Russia on par with the break-up of the Soviet Union in 1991. For the average Russian, who never thought an actual war would break out over Ukraine, there will be a hefty price to pay," says Jan Lambregts, Global Head of Research at Rabobank.

Amongst the latest developments includes the United States announcing it would close its airspace to all Russian flights.

"Tonight I am announcing that we will join our allies in closing American airspace to all Russian flights," Biden said in an address to the nation.

But these are just the latest moves in what is now a long list of measures with one of the most significant being the ejection of key Russian banks from the SWIFT inter bank messaging system, a move that will starve them of global liquidity.

But the SWIFT decision joins additional sanctions on the Central Bank of Russia and sanctions directly targeting individual Russian banks and companies, which will impact the country's trade beyond the West.

"The idea that Russia-sympathetic or typically neutral states would let their banks test the limits of combined US/European sanctions was always pretty silly but it's still impressive to see how quickly it collapsed," says Mike Bird, Asia business & Finance Editor at The Economist.

He cites the following financial headlines:

- Singapore Banks Halt Russia Commodities Lending to Cut Risks - Bloomberg.

- China's CIPS Won't Rescue Russian Banks from SWIFT Ban - Caixin Global.

- China's Russian Coal Purchases Stall as Buyers Struggle to Secure Funding - Reuters.

- India's Top Lender Stops Handling Trade with Sanctioned Russian Entities - Reuters.

Indeed, the centrality of the dollar and Western financial centres will be keenly felt when it comes to depriving Russia of financial flows and export orders.

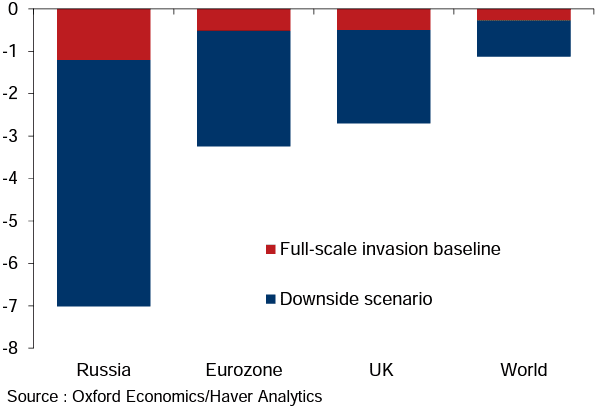

Oxford Economics have modelled what they call a "plausible" downside scenario for the Russian economy, based on an assumption fighting in Ukraine lasts well into 2023.

Under such circumstances, "the impact on Russian GDP is very severe," says Innes McFee, Chief Global Economist at Oxford Economics.

GDP would fall 7.0% below a non-conflict baseline.

"This is not a worst-case scenario. More severe conflict scenarios are possible. But we regard this downside scenario as a relatively high probability," says McFee.

Above: "By 2023 the level of GDP is 7% lower in Russia than our no-conflict baseline and more than 3% lower in the eurozone." - Oxford Economics.

"One immediate effect of the war in Ukraine will be to push Russia several places down the league table of the world’s largest economies," says Neil Shearing, Group Chief Economist at Capital Economics. "The war, and in particular the response to it by Western governments, has already caused a major economic and financial crisis in Russia."

The CBR hiked its base lending rate to 20% on Monday in response to the financial shock fermented in Western capitals over the weekend, a move that will strangle the flow of credit and liquidity through an economy that is seeing significant demand on cash deposits.

Numerous media are reporting queues outside the country's retail banks as citizens opt to draw down deposits and sit on cash.

The impact on business and consumer confidence by itself would be enough to trigger a small recession.

"At the end of last year, Russia was the world’s 11th largest economy with a GDP of $1.65trn. By the end of this year we think it could fall to 14th place with a GDP of $1.4trn," says Shearing.

The United States banned U.S. dollar transactions with the Russian central bank in a move designed to prevent it accessing its "rainy day fund," a senior U.S. administration official said.

The same official said the aim was to make sure that the Russian economy goes backward as long as Russia continues with the invasion of Ukraine.

"Sanctions have resulted in a meltdown in Russian financial markets, sent the ruble to all-time lows against the U.S. dollar, and crippled Russia's ability to access financing as well as most of the central bank's foreign exchange reserves," says Brendan McKenna, International Economist at Wells Fargo.

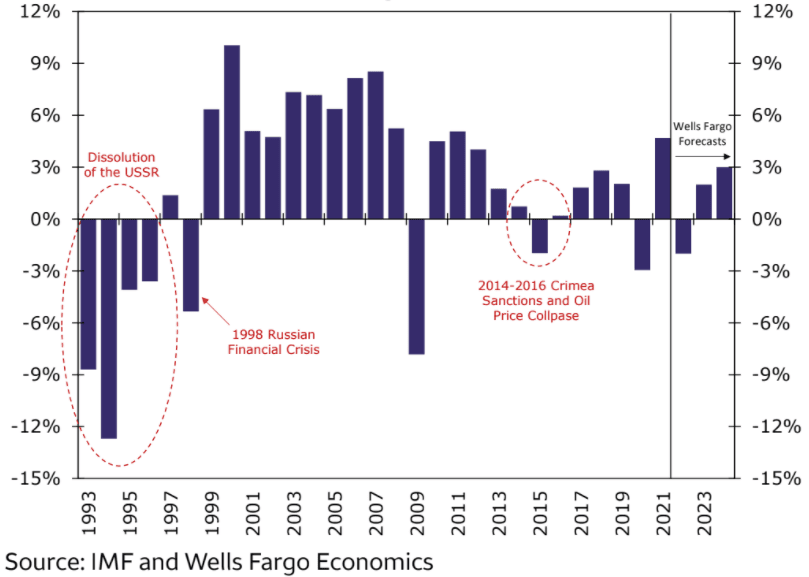

But the Wells Fargo team says to call another Russian financial crisis would be bold, and while there have been lines at ATM machines across Russia, "another full-fledged financial crisis and sovereign default is not our base case scenario, although we would note the probability of this scenario unfolding has risen dramatically," says McKenna.

Above: Wells Fargo forecast a relatively benign outcome for the Russian economy.

Wells Fargo notes that Russia's government currently operates a primary and overall fiscal surplus, which makes the country less vulnerable than at the time of the 1998 crisis.

Indeed, oil prices around $100 per barrel as opposed to ~$20 per barrel in 1998 should also keep Russia's budget more balanced relative to the 1990s, they say.

Nevertheless, Wells Fargo acknowledge Russia's economy will fall into recession this year and inflation could spike to 18.5%.

"The effects of sanctions, a sharp ruble depreciation, and aggressive monetary tightening will likely begin to take shape in Q2 and persist throughout the rest of this year. High oil prices should offset some of those effects," says McKenna.

But Capital Economics remind their clients that it is too soon to anticipate where the war will end and what Russia's international standing will look like this time next year.

Indeed, longer-term Russia's potential is great if lead by the right people.

"Were Russia to transition towards liberal market-friendly policies, it could plausibly regain its position among the top ten global economies over the coming decades," says Shearing.

"Their underperformance over the past three decades has left them with greater scope for 'catch-up' growth," he adds.

But to fulfil its potential Russia would require wholesale economic and institutional reform says Shearing.