Institutional Investors Now Heavily Invested in the Rotation Trade

- Written by: Gary Howes

Image © Adobe Images

Institutional investors are now largely bearish finds the much-watched Bank of America Global Fund Manager Survey, although they say any fall in U.S. CPI inflation could catalyse a more sustained improvement in sentiment.

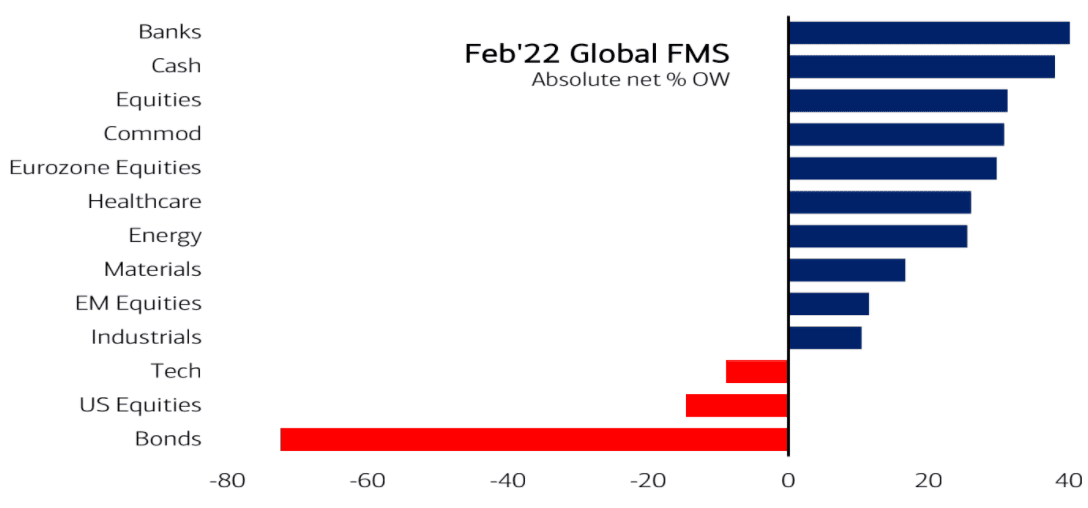

A breakdown of asset class allocations also reveals the 'rotation trade' away from high-growth U.S. technology stocks in favour of 'value' stocks is well underway, and can potentially run further.

The BoFA survey canvasses the views of approximately 200 institutional, mutual and hedge fund managers around the world.

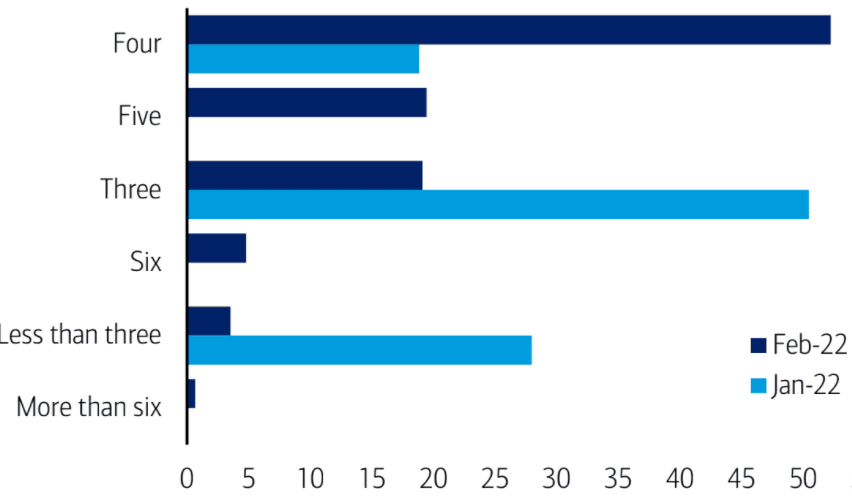

An easy majority of respondents now expects the Federal Reserve to hike four times in 2022, up on the three times the majority expected when surveyed in January.

Above: "How many times do you think the Fed will raise hikes in 2022" - BofA.

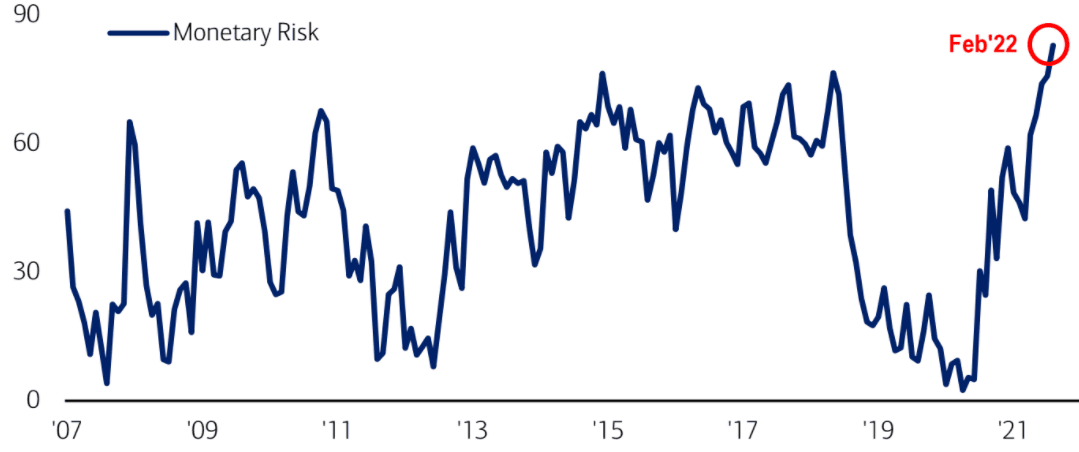

Indeed, the Fed tightening cycle now represents the single biggest risk to the outlook, with the highest ever proportion of fund managers (83%) now citing "monetary risk" as "the greatest financial market stability risk".

"Hawkish central banks remains the biggest ‘tail risk’," finds the Bank of America survey.

Above: "Monetary risk now at the highest level ever - net % that monetary risk to be above normal" - BofA.

The survey also reveals the 'rotation' trade is well underway, with the net allocation for technology stocks falling to the lowest level since Aug 2006.

Banks are now the most loved sector, as is energy.

Underscoring the 'rotation trade' are findings that a net 60% of investors now believe value will outperform growth, the highest ever (+10).

This comes as a benefit to European markets to the expense of U.S. markets.

Above: "Investors are bullish cyclicals and cash" - BofA.

Yet investors say they still believe the "long tech" trade to still be the most crowded, suggesting the potential for a further unravelling of the sector that performed strongly during the pandemic-era central bank pump.

What could turn broader investor sentiment positive on a more sustained basis?

Given the overwhelming concern amongst institutional investors relates to central bank tightening, it is of little surprise that the underlying cause of this tightening is inflation.

"Investors believe a fall in CPI will be most bullish for equities," finds the survey.

37% of institutional investors think a fall in U.S. CPI to 3% would be the most likely trigger of a S&P 500 rally to 5000.

Indeed, despite institutional investors being largely bearish, 66% of still don’t expect an equity bear market in 2022.

"Sentiment is bearish but not extreme bearish. Only 30% of investors expect an equity bear market," says BofA.

And although global growth expectations have deteriorated to net -20% in February 2022 "only 12 out of 100 investors believe there will be a recession in the next 12 months," says BofA.