Bank of England Tipped to Ignore Retail Sales "Shocker"

- Written by: Gary Howes

Image © Adobe Images

UK retail sales fell in December as a result of the spread of the Omicron variant and shoppers pushing forward spending into October and November.

Although retail sales fell by a far greater margin than the market was looking for, economists say the data are unlikely to prevent the Bank of England from raising interest rates again in February.

Retail sales fell 0.9% year-on-year in December said the ONS, a sizeable miss on the 3.4% growth the market was looking for. Month-on-month sales fell 3.7%, where the market had been looking for a fall of 0.6%.

"The latest UK retail sales figures for December don’t make for pleasant viewing," says James Smith, Developed Markets Economist at ING, who describes the data as a "shocker".

Retail sales form the last major data release from the ONS ahead of the February 03 Monetary Policy Report, where markets see a 90% chance of a 25 basis point hike to Bank Rate.

"These latest figures are unlikely to move the needle much for the Bank of England, which looks poised to hike rates again in February," says Smith.

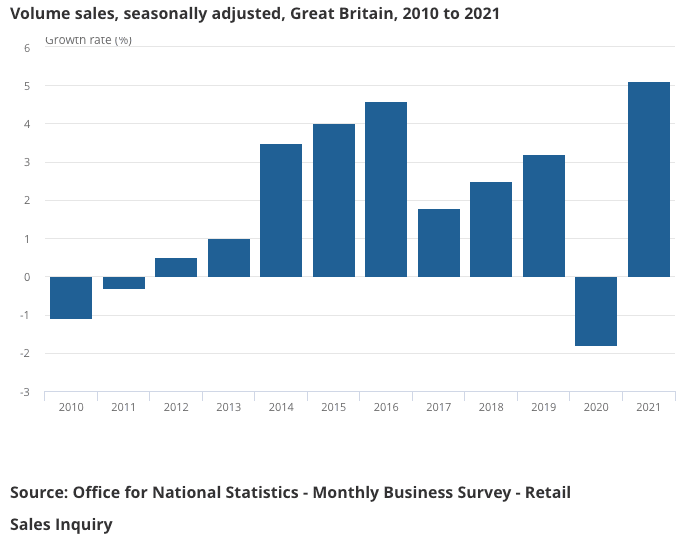

Above: "Retail sales volume rose by 5.1% in 2021" - ONS.

December retail sales appear to have been impacted by the rapid spread of the Omicron variant at the time, which prompted shoppers to stay exercise caution lest they catch Covid and were required to spend Christmas alone.

Furthermore the strong retail sales outturn for October and November (+1.0%) suggests many shoppers were done with Christmas shopping by December.

"Underlying the pullback was 'payback' from earlier Christmas shopping after government messaging that store shelves might be empty by December on supply chain worries," says a FX strategy note from TD Securities.

A global supply chain crunch and distribution bottlenecks also meant consumers didn't want to risk waiting until December to make purchases.

"Should the latest figures spark concern over a fresh downturn in consumer activity? In our view, no," says Philip Shaw, an economist at Investec.

Shaw says although the interest rate and inflation background will undoubtedly put some downward pressure on high street demand, "the income background seems sufficiently robust to weather the storm".

Retail sales are expected to be supported by strong household balance sheets: the household saving ratio in the third quarter of 2021 stood at 8.6%.

"This compares with an average of below 5% in the three years before the pandemic, implying that consumers will largely be able to maintain their spending patterns by saving less," says Shaw.

Furthermore, Investec's estimates suggest the sector’s aggregate level of excess savings was in the region of £165BN in November, which provides an additional means of expenditure.

February is meanwhile expected to see a rebound in economic activity as the Omicron wave subsides and the government lifts remaining restrictions.

But, ING's Smith says prospects for a "more gradual consumer story" leads him to suspect subsequent Bank of England rate rises will be more gradual than the market is currently anticipating.

"We expect two rate hikes this year," says Smith.

The market is expecting the Bank Rate to go as high as 1.25%, suggesting as many as four hikes are expected.

Investec are more hawkish though and have revised their interest rate forecasts:

"We now expect the MPC to raise the Bank rate by a further 25bps in August as well as in February and May. Accordingly this would take the Bank rate up to 1.0% by the end of the year," says Shaw.

A further 50 basis points of tightening over the course of 2023 are expected by Investec.

"The motivation behind our shift is primarily this week’s inflation surprise (the CPI measure now stands at 5.4%) and the breadth of the contributing factors, which hint at a more widespread set of inflation pressures than we believed hitherto," says Shaw.