Record Rise in Starting Salaries to Turn up the Heat on the Bank of England

- Written by: Gary Howes

- UK economic slack might be less than expected

- Rising salaries could boost inflation

- Inflation already likely to remain above 2.0% for next 3 years

- Data justifies BoE's latest hawkish tilt

Image © Adobe Images

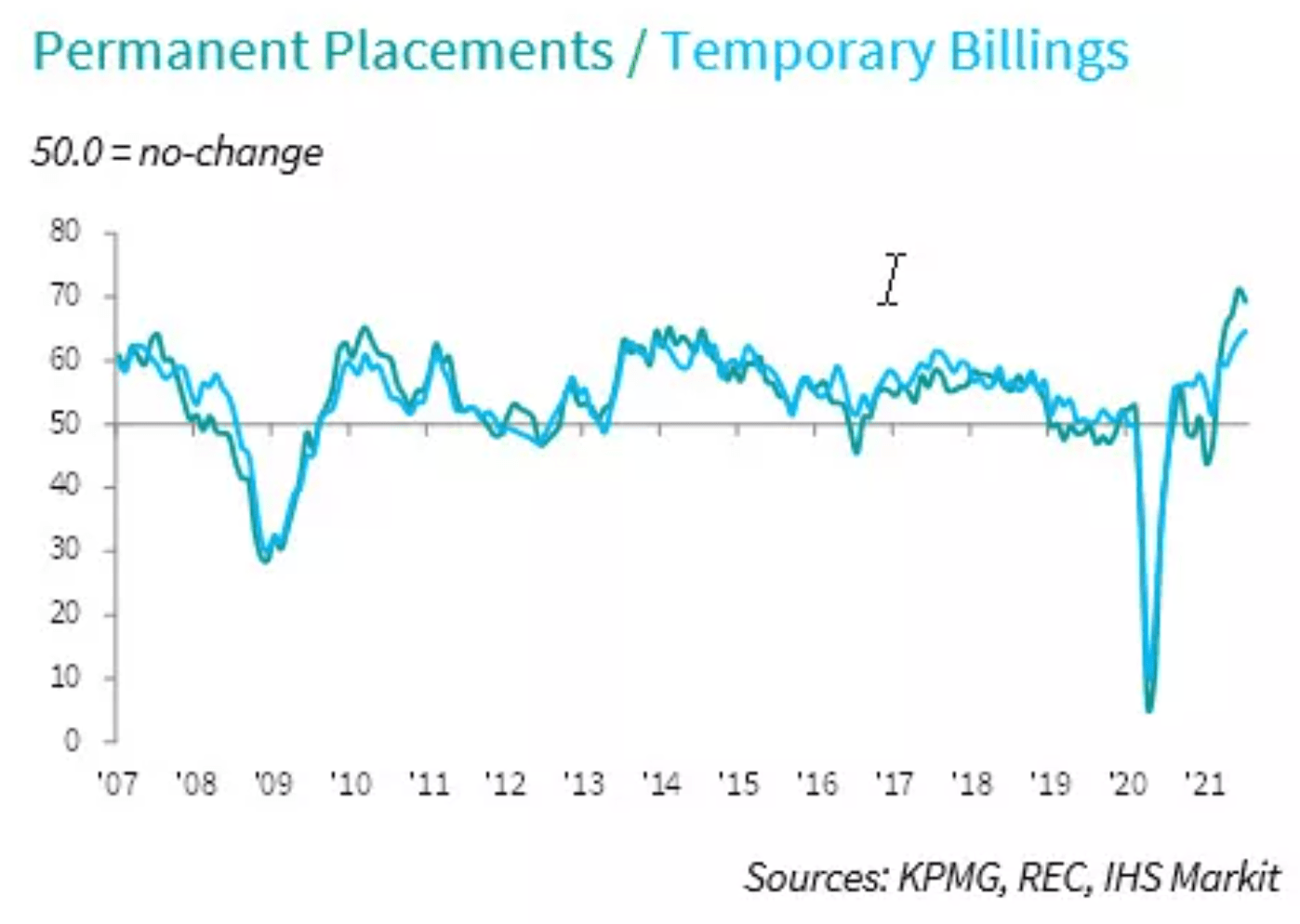

Permanent staff appointments and temporary billings have both risen to near-record rates, according to a regular UK jobs survey.

KPMG and REC's UK Report on Jobs for July showed a record rise in starting salaries as candidate availability falls sharply also show are reflected in other similar surveys, suggesting the UK's labour market continues to rapidly improve.

The 'slack' in the UK economy caused by the Covid crisis might therefore be smaller than anticipated which could justify the hawkish tilt of the Bank of England's August policy update.

The Report on Jobs reveals growth in demand for staff hit a fresh series high as Covid-19 restrictions eased further and economic activity continued to pick up.

Despite surging demand, KPMG/REC says the availability of candidates continued to decline rapidly in July, driven by concerns over job security due to the pandemic, a lack of European workers due to Brexit, and a generally low unemployment rate.

The disconnect between demand and supply of workers suggests diminishing slack in the economy and points to higher domestically generated inflationary rates in the future.

Economic 'slack' is a phrase used to describe the amount of resources in the economy that are not used, for instance machines left idle in a factory or people who cannot find a job represent slack to an economist.

Understandably slack grows during an economic downturn, as was the case following the 2008 financial crisis and the 2020 Covid crisis.

Excess economic slack means there is little pressure on inflation as jobs can be filled without pushing up wages. For the Bank of England interest rates should therefore only rise when slack has been depleted as this will help prevent higher inflation in the future.

But the Bank of England's August policy report revealed inflation will likely be above their 2.0% target rate for the next three years.

Combine this with labour surveys that suggest the UK could already be running out of staff and it becomes clear that the Bank was right to signal interest rate rises are necessary over coming years in order to combat inflation.

"Notably, the rate of salary inflation was the sharpest seen in nearly 24 years of data collection. Moreover, temporary/contract staff hourly pay rates rose at the second-quickest rate since the survey began," reads the KPMG/REC report.

From a foreign exchange perspective, should the tight jobs market bring forward the timing of the expected first interest rate - and signal more interest rates in subsequent months and years - the Pound would appreciate.

But, the Bank of England and economists are concerned that the ending of the UK's job support scheme in September will result in rising unemployment.

Therefore, the October edition of the Report on Jobs will prove itself to be an early indicator as to whether or not the Bank is right to be concerned over a surge in unemployment.

"There’s no doubt the 'pingdemic' has added an extra dimension to the recruitment challenge. Plus, with furlough due to end soon, there may be a downward pressure on pay to come," says Claire Warnes, Partner and Head of Education, Skills and Productivity at KPMG UK.

But Warnes says business and government need a long-term plan for skilling up workers as skills shortages have been with us for a while and as our data shows are getting worse.