UK's Current Account Deficit Tipped to Widen Substantially Over Coming Months

- Written by: Gary Howes

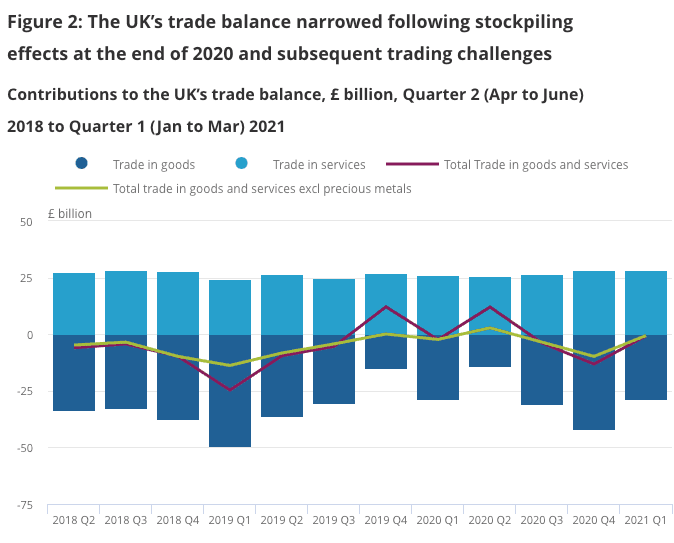

The UK's current account deficit shrank in the first quarter of 2021, a development that is fundamentally supportive of Sterling exchange rates on a long-term basis.

However, a look at the details of the latest Balance of Payments statistics from the ONS shows that the shrinking deficit is almost certainly likely to be temporary as Brexit played a significant role in altering trade dynamics in early 2021 and is therefore likely to be overturned.

"The small current account deficit in Q1 largely can be attributed to the lull in imports, as British firms ran down the inventory they had panic-bought before the deadline for a Brexit trade deal," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Image courtesy of the ONS

But, a surplus on the country's services account - which means the country takes in more than it spends on services (banking, insurance, legal services etc.) - helped shrink the overall deficit.

The dynamics are longstanding: the UK operates a deficit in the trade of goods but a surplus in the trade of services.

Traditionally the trade in goods accounts for more of the trade balance than services, which tends to leave it in deficit.

Image courtest of the ONS

Pantheon Macroeconomics expects the current deficit to widen significantly and probably will exceed, as a share of GDP, last year’s 3.5% average.

"For a start, the U.K.’s demand for imports is relatively insensitive to price rises - note that there was no import substitution after sterling’s big depreciation in 2016 - suggesting that higher prices for manufactured goods and raw materials will boost the value of imports," says Tombs.

The eventual recovery in global travel is expected by Pantheon Macroeconomics to lead to the re-emergence of the UK’s trade deficit in tourism.

"Finally, new barriers to trade with the E.U. countries - especially for services - will impede the recovery in exports," he adds.

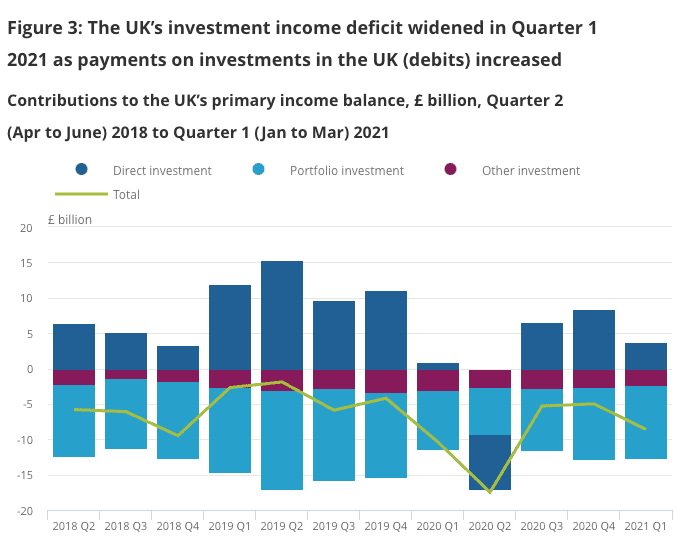

Also providing a positive contribution to the current account in the first quarter were incoming capital flows for direct investment purposes.

But overall the UK's primary investment account deficit widened in the first quarter as more money flowed out of the UK to pay non-residents on their UK investments than UK residents’ earned on their investments abroad.

Image courtesy of the ONS

As the UK operates a current account deficit it is a net borrower with the rest of the world, therefore the UK must attract net financial inflows to finance its current account deficit, and ultimately keep its currency stable.

This can be achieved through either disposing of overseas assets to overseas investors or accruing liabilities with the rest of the world.

The ONS says the UK's financial account recorded a decreased net inflow of £28.5BN in the first quarter, from a net inflow of £38.7BN recorded in the final quarter of 2020.

The financial account covers transactions that result in a change of ownership of financial assets and liabilities between UK residents and non-residents, for example, the acquisitions and disposals of foreign shares by UK residents.

The data shows the net inflow was mostly because of non-residents investing in UK-issued debt securities (£65.1BN) and UK investors selling foreign equities (£53.1BN).

But the ONS says partially offsetting these was a large increase in UK 'other investment' assets as UK monetary financial institutions deposited currency (£62.2BN) and extended loans (£36.5BN) abroad.