"Booming, for Now" - UK Industry in Growth Spurt

- Written by: Gary Howes

Image © Adobe Images

UK industry experienced its fastest growth since the end of 2018 during May, confirmation that the post-covid economic rebound is well underway.

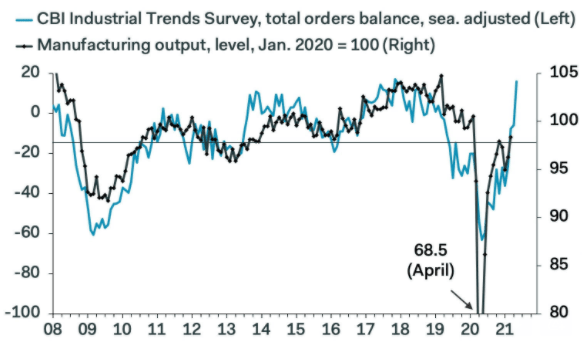

The CBI Industrial Trends Survey reported a total orders balance of +17 in May, up from -8 in April.

The outcome beats the consensus amongst economists for a reading of +2 and makes for the first material growth in almost two years.

Chemicals producers, electronic engineering firms, and metal factories reported the strongest growth, with output up in 12 of 17 sub-sectors.

Manufacturers are also upbeat, predicting output will accelerate further in the next three months.

That’s driven by an increase in demand, with orders growing at the fastest rate in three and a half years.

"The jump in the total orders balance to its highest level since December 2017 provides more evidence that the industrial sector is booming," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Tombs says orders would be even stronger if it were not for Brexit as the export orders balance merely matched its 2000-to-2019 average, despite soaring global demand.

He also cautions that the total orders balance represents the net balance of manufacturers reporting that orders are “above normal”, so it might overstate the rebound, if their assessment of normal conditions has changed over time.

In addition, "concerns about supply shortages might have led many customers to over-order now, in order to build up their own stocks. This, together with the imminent pivot by households towards purchasing more services and fewer goods, suggests that manufacturing output likely will peak in the summer and then fall back towards the end of this year," says Tombs.

The above chart courtesy of Pantheon Macroeconomics shows that the total orders balance points to a V-shaped recovery in manufacturing output.

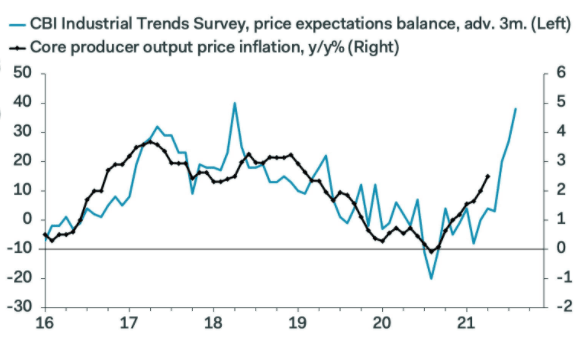

The below chart shows that the price expectations index points to core producer output prices inflation rising to nearly 5% in Q3, from 2.5% in April.

"We doubt, however, that consumer goods prices will rise much, given that most retailers have widened their margins over the last year and will struggle to increase prices further as goods demand fades in the second half of this year," says Tombs.