No Inflation Shock, Yet

Image © Adobe Images

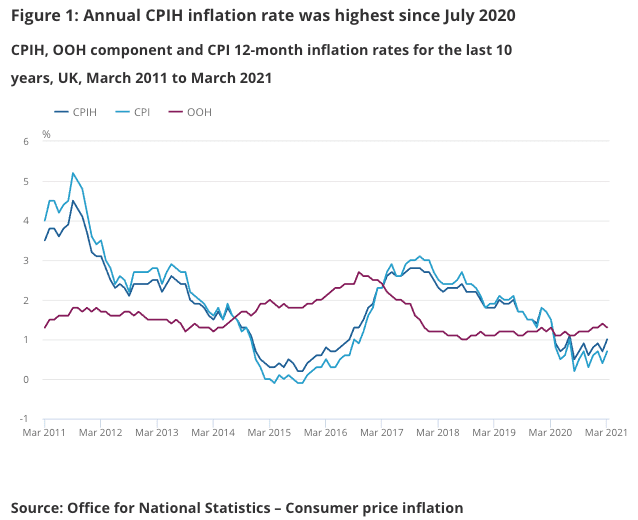

Inflation in the UK is rising again, with the annual CPI inflation rate going from 0.4% in February to 0.7% in March according to the ONS, driven by a 0.3% month-on-month rise recorded in March.

The month-on-month reading met analyst expectations but the annual figure was just shy of the 0.8% the market was looking for.

Core CPI - which strips out more variable inputs such as fuel - rose 1.1% year-on-year in March, while the Producer Price Index (PPI), which gives an insight into the cost pressures facing producers, rose more aggressively.

"The UK has reached a turning point in its economic reaction to the pandemic where price growth is now on an upward trajectory, and should remain so for some time to come. Year-on-year consumer price growth slowed to 0.4% in February from 0.7% in January, primarily due to falling prices in clothing and footwear," says Paul Craig, portfolio manager at Quilter Investors.

PPI (input) for March rose 1.3% in March, a rapid increase on February's 0.9% increase and the 0.6% increase expected by the market.

The rise in PPI often serves as an indicator of where the CPI inflation might be headed in the future as factory costs are often expected to be passed on to consumers.

The market impact of the data was negligible given that investors are more likely to move Sterling based on how the country's route back to normality progresses.

The release of PMI data for April, due out Friday, will arguably be the most closely watched by markets as it will offer a first snapshot of how strong the rebound following the April 12 stage of the reopening programme was.

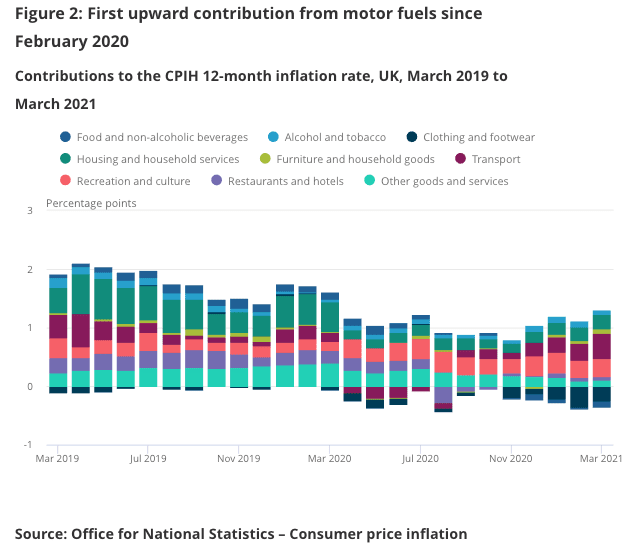

The ONS says a pick up in inflation from February to March was principally because of price movements for motor fuels and clothing.

Prices for these goods rose between February and March 2021, compared with a fall between the same two months a year ago, says the ONS.

"From here, inflation may tick markedly higher if the steady drip of consumer spending morphs into a waterfall as lockdown restrictions are lifted and households spend some of their accumulated pandemic savings," says Craig.

Quilter Investors say consumers turning on the spending taps once again shouldn’t evoke too much concern at the Bank of England.

"Even once restrictions are lifted, we will still be living in economically abnormal times, and the Bank will give the economy time to normalise before beginning to worry about inflation," says Craig. "We are a long way away from central banks moving interest rates higher".

The Bank of England has stressed it will not consider raising interest rates again until the economy has made up its pandemic losses and the inflation target has been met.