Record Drop in Imports Means UK's Trade Deficit Actually Shrank in January

Image © Adobe Stock

The first official data detailing the UK's trade performance since leaving the EU has been released, and understandably economists will give it more attention than has been the case in previous years.

The headline is that the impact to the UK's persistent trade deficit has been less severe than many had expected.

The Trade Balance for January was -£9.83BN according to the ONS, which is less severe than the -£12.50BN the market was anticipating and the -14.32BN that was reported in December.

The trade balance is the difference between the value of exports and imports, the UK's negative balance reflects that the country imports more than it exports.

The data does however reveal a 40.7% drop in goods exported to the EU in January and given that many companies stockpiled ahead of the end of the transition period overall trade volumes were likely lower.

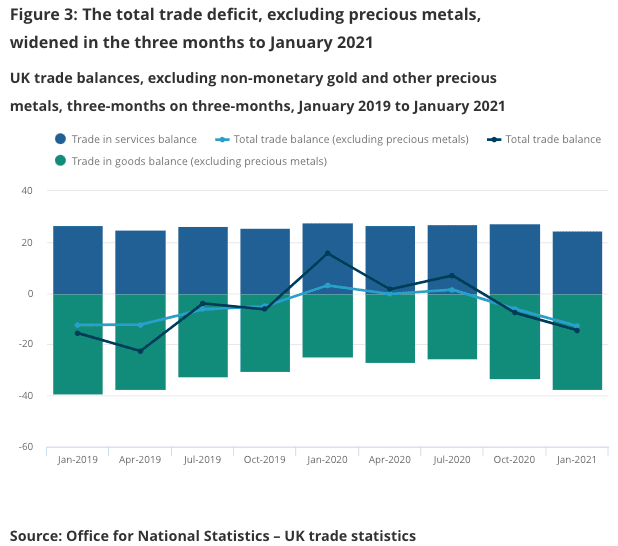

Imports of goods, excluding non-monetary gold and other precious metals, fell by £8.9BN (21.6%) in January 2021, driven by a £6.6BN (28.8%) fall in imports from the EU.

The ONS reports the January 2021 monthly fall in goods imports and exports are the largest monthly falls since records began in January 1997.

The UK's trade deficit is an important fundamental driver of Pound Sterling valuation; an obvious point if we consider that a currency will likely fall if more money is leaving the country to pay for imports than is entering the country to pay for exports.

Of course, there are other flows at work, but from a purely trade-related angle the country's trade deficit has been a thorn in the side of Sterling's valuation for many years. Therefore, on balance, a smaller-than-expected deficit should be somewhat supportive.

It is clear from the ONS data that January was exceptional a trade volumes were low, understandably given many companies would have wanted to avoid teething problems at the border.

The ONS said that November and December 2020 saw increasing imports and exports of goods, particularly in machinery and transport equipment and chemicals.

They explain these increases were consistent with potential stockpiling of goods from the EU in preparation for the end of the EU exit transition period.

UK goods imports from the EU also peaked in the weeks approaching previous Brexit deadlines in March and October 2019.

All of these are potential contributing factors to the fall in January trade in goods, says the ONS.

It could take some time for companies that export and import to find a new rhythm with data from Lloyds Bank showing half of UK companies have faced supply chain disruptions in February, with the majority of these disruptions being blamed on the new border regime with the EU.

The ONS says that despite the slow start for trade in January 2021, data from their Business Insights and Impact on the UK Economy series suggests that importing and exporting began to increase towards the end of January.