UK Economy Outdoes Expectations in January

Image © Adobe Images

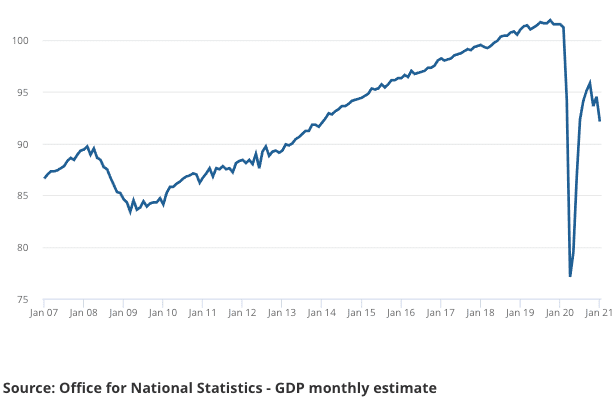

The UK economy shrank by 2.9% in January according to the official statistics, an outcome that was less severe than the -4.9% figure the market was expecting.

The year-on-year decline of of 9.2% was alslo less severe than the -10.9% investors were expecting.

Helping deliver a better-than-expected performance in January was the construction sector which actually grew by 0.90%, whereas the market had expected it to shrink by 1.0%.

The initial impact of the data on Sterling exchange rate was minimal given foreign exchange markets are forward-looking and the main concern for investors is how fast the unlocking of the economy proceeds and whether progress on vaccinations continues to impress.

The main downward pull on economic growth in January was understandably the services sector given the nationwide lockdown that was put in place to try and stem the spread of covid-19, however here the decline was less severe than the market had been expecting.

Falls in consumer-facing services industries and education drove a contraction of 3.5% in the services sector in January 2021, says the ONS.

"The decline was notably smaller than the first lockdown in Spring 2020, demonstrating the growing ability of businesses and households to adapt to greater restrictions on mobility," says Alpesh Paleja, CBI Lead Economist. "Nonetheless, a year of repeated restrictions have taken their toll on growth, jobs, costs and wellbeing."

Also weighing was a decline in the production sector which fell by 1.5% in January 2021, after manufacturing contracted for the first time (by 2.3%) since the initial pandemic-driven fall in output in April 2020.

The ONS said there was growth in five sub-sectors of the economy, most notably in health activities, and information and communication services.

This is understandable given the huge surge in spending on health by the Government and the ongoing demand for remote working services.

Economist Paul Dales at Capital Economics says the January slump in economic activity will likely mark the low-point as vaccinations and the reopening of the economy will combine to trigger a rapid rebound in activity before long.

The reopening of schools on March 08 will provide a significant boost to the economy given the school closures in January knocked 16.3% m/m off education sector activity.

"This lockdown has been a bit more painful for the economy than November’s, but much less painful than April's," says Dales.

"January’s lockdown left the economy in a fairly big hole. But the government’s easing roadmap has provided the ladder and the vaccinations are providing the willingness to climb out of it. By early next year, we think the economy will be peaking its head out of the top as GDP returns to the pre-pandemic level," he adds.

The outlook for the economy rests heavily with the success of the vaccination programme in keeping the covid-9 caseload down say economists.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The rate at which people receive a first vaccine dose should not slow dramatically in April, even though the number of people returning for a second dose will increase sharply, because deliveries also are expected to rise significantly. This, in turn, should ensure that the reopening timetable outlined by the government can be stuck to without overwhelming the NHS again," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Tombs doubts households will run down their savings materially this year, but a strong rebound in consumption will materialise simply if they return to spending most of their current incomes again.

Pantheon Macroeconomics look for a quarter-on-quarter increase in GDP of about 5.0% in Q2, which would kibosh the chances of the MPC reducing Bank Rate this year.

UK consumers have built up a sizeable savings pile owing to the lockdown and generous jobs support schemes from the government.

As a result, the UK economy will be boosted if pent-up savings are unwound according to economists at Deutsche Bank, who also warn that the Bank of England might be underestimating the scale of an impending consumer-lead rebound.

Analysis from Deutsche Bank released this week shows that the scale of the boost to UK economic growth from the spending of savings could amount to 1.0% of GDP, more than twice that expected by the Bank of England.

An unexpectedly strong economic rebound could in turn drive inflation meaningfully above the Bank of England's 2.0% target.

"For some households, the recent lockdowns and tighter social restrictions have resulted in a significant increase in savings. For others, dependent on full income, the consequence has been an increase in debt," says Sanjay Raja, Economist at Deutsche Bank. "In aggregate terms, however, household savings have ballooned".