Are Japanese Investors Capping U.S. Bond Yields?

Image © Adobe Images

The Dollar's recent rally has come to a shuddering halt as the rise in U.S. bond yields stalls and reverses, with analysts saying renewed demand by Japanese investors could be a crucial driver of the development.

The rise in U.S. 10-Year Treasury yields has been a particularly significant driver of gains in the Dollar and declines in growth/momentum stocks over the past ten days, how the bond market evolves will therefore likely be crucial in determining whether these moves are merely pausing or have ended.

Investors have steadily sold Treasuries for months now but the pace picked up last week and early this week as they feared higher inflation rates over coming months and years; as they sold bonds the yield offered by those same bonds rose.

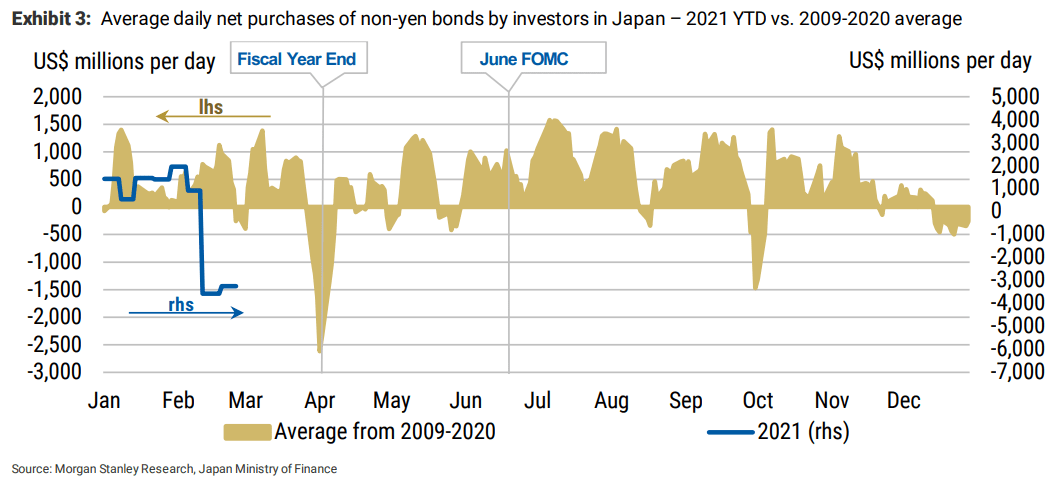

"Aggressive selling from investors in Japan that began in mid-February, just over a month before the end of Japan's fiscal year on March 31, shows how Japan has sold ~$3.3bn worth of long-dated non-yen bonds every day, on average, from the week ending February 12 to the week ending February 26," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

The rise in yield in turn creates demand for the Dollar but for stocks the development is a potential headwind as the cost of finance in the economy rises.

"Bond yields are essentially the price of money. If yields are low, investors are more likely to deploy funds to riskier plays like stocks, but if yields are rising then equities are no longer quite as attractive from a risk/reward perspective. This phenomenon is especially true if valuations are elevated, explaining why the tech sector has taken a beating lately," says Marios Hadjikyriacos, Investment Analyst at XM.com.

Morgan Stanley don't Yet know which type of investor in Japan sold the non-yen bonds, which currencies the sales involved, or which securities were sold.

However, looking at which investors sold during the "taper tantrum" in mid-2013 suggests to Morgan Stanley that commercial banks in Japan probably played the leading role.

"History suggests investors in Japan will not abandon the U.S. rates market forever, especially given the more attractive yield levels today," says Hornbach.

The yield on ten-year Treasuries peaked at 1.6% on Monday before paring back to 1.550% on Tuesday. They had been as low as 0.90% at the start of the year.

David Tepper of Appaloosa Management said in a CNBC interview Monday that the move higher in yields may be just about over as demand is expected to recover.

Tepper says Japanese demand is likely to increase and they will become net buyers as they seek out the improved yields on offer.

Neil Wilson, Chief Analyst at Markets.com says this week will see the bond markets tested as 10-year and 30-year bond auctions this week will be crucial tests of demand – it was a weak sale of 7-year debt last month that sent reverberations around the market.

"Investors will be angsty about how these auctions go off – a repeat of the Feb 25th 7-year auction would undoubtedly create another broader sell-off in rates and lead to yet more instability in equity markets," says Wilson.