BlackRock Not Worried About Equity Market Valuations

Image © Adobe Images

The impressive stock market rally of recent months can continue say analysts at BlackRock, who note that while some pockets of excess have emerged the global economy should ultimately catch up to valuations.

"Equity valuations have been top of mind after major stock indexes have scaled new highs. Last week’s volatile market moves as a result of technical deleveraging added fuel to these concerns. We do not see risk asset valuations as obviously stretched overall," says Jean Boivin, Head of BlackRock Investment Institute.

U.S. stock markets hit record highs just two weeks ago, with tech shares lifting the major indexes on anticipation that more fiscal spending will revive economic growth and bolster corporate earnings.

Risk appetite amongst investors was boosted by President Joe Biden’s push for nearly $2TRN in additional spending and plans to jumpstart a federal response to the pandemic.

The rally comes despite some major economies being in recession and growth starting to taper off in the U.S. Even though the U.S. economy continues to outperform European peers, it is still encumbered by an unemployment rate of 6.7%, with employers cutting some 140,000 jobs in December.

The concern amongst some investors is that the stock market is overvalued, and a potentially destabilising correction lower is due.

But despite the market's gains against underwhelming fundamentals, BlackRock research suggests there is little evidence of significant froth in the market:

"We do not see risk asset valuations as obviously stretched overall, and expect low interest rates – and a vaccine-led restart – to support risk assets over the next six to 12 months," says Boivin.

The analyst concedes that assessing equity valuations can be difficult as structural shifts such as persistently

lower interest rates make it difficult to judge the signals from traditional metrics such as price-to-earnings ratios.

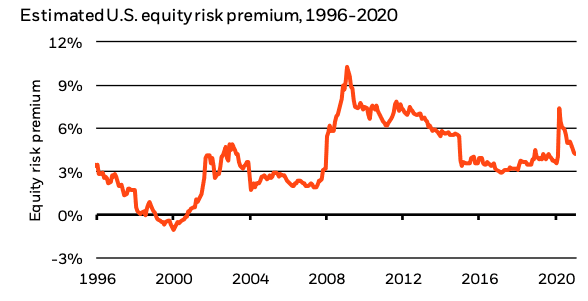

"The key question is whether the compensation investors are getting to take on additional equity risk, after factoring in current low interest rates, is fair. This is why we prefer to gauge valuation by looking at the expected return of equities over the risk-free rate, and our estimates for the U.S. market don’t appear stretched, as the chart above shows," says Boivin.

BlackRock's 'new nominal' thesis assumes interest rates will stay low amid stronger growth and higher inflation, as central banks lean against any sharp rises in nominal rates.

This should keep "real", or inflation adjusted yields, negative, and support risk assets, in their view.

"But if rates were to revert to historical averages, valuations would look a lot more stretched," says Boivin.

BlackRock view the stock market's rally as being unjustified given the nature of the current crisis - the cause of the economic downturn is clear, as is the exit from the downturn.

For investors, this visibility is what makes the current environment different to previous shocks.

"It as akin to a natural disaster followed by a rapid activity restart, and see the cumulative economic shortfall as just a fraction of that seen after the global financial crisis – an outlook markets have been quick to price in. Valuations do not look obviously stretched, as our estimate of the compensation for taking equity risk shows. The flip side: The eventual restart may not give stocks as much of a lift as past recoveries," says Boivin.

BlackRock are pro-risk overall on a tactical basis, and overweight equities and credit. They favour a "barbell approach" in equities: quality stocks on one end to counter any hiccups caused by the slow vaccine rollout and the spread of new strains; and selected cyclicals on the other to capture the upswing led by the restart.