Why the Retail Swarm on Silver Might not Work

- 923% surge in silver demand at The Pure Gold Company

- Silver prices rise as retail investors pounce on silver

- But a successful 'short squeeze' is unlikely say market analysts

Image © Adobe Images

Retail investors are said to be targeting a massive rise in the price of silver by coordinating and focussing their buying interest in the commodity, with one physical retailer of silver in the UK reporting a 923% rise in sales over the past week.

The rises are a symptom of the new trend amongst small retail investors to pile into assets they believe are ripe for a 'short squeeze' - which is loosely defined as a rally driven not just be organic demand but also by the flushing out of 'short' bets in the market.

The hope by retail investors is that the sharp price rises in silver will force the closure of substantial bets being held by big institutions that would return profit if the price of silver fell, creating a cascading effect in the market and eye-watering surges in its value.

"The war between the establishment on Wall Street and small-time investors is far from over as not only are retail traders still betting against short sellers of GameStop and other Reddit favourites, but they are now moving into the commodities sphere," says Raffi Boyadjian, Senior Investment Analyst at XM.com.

Such swarm behaviour famously pushed the share price of GameStock higher in the previous week, and in the process of doing so burnt the 'short' positions on the stock held by Hedge Funds. Interest in this market behaviour has grown as the profits being realised by those who were involved in the GameStock swarm spreads.

The swarm also targeted shares such as American Airlines and AMC Entertainment, but can the same approach to silver deliver eye-watering gains for small investors lucky enough to get into the move at the right time?

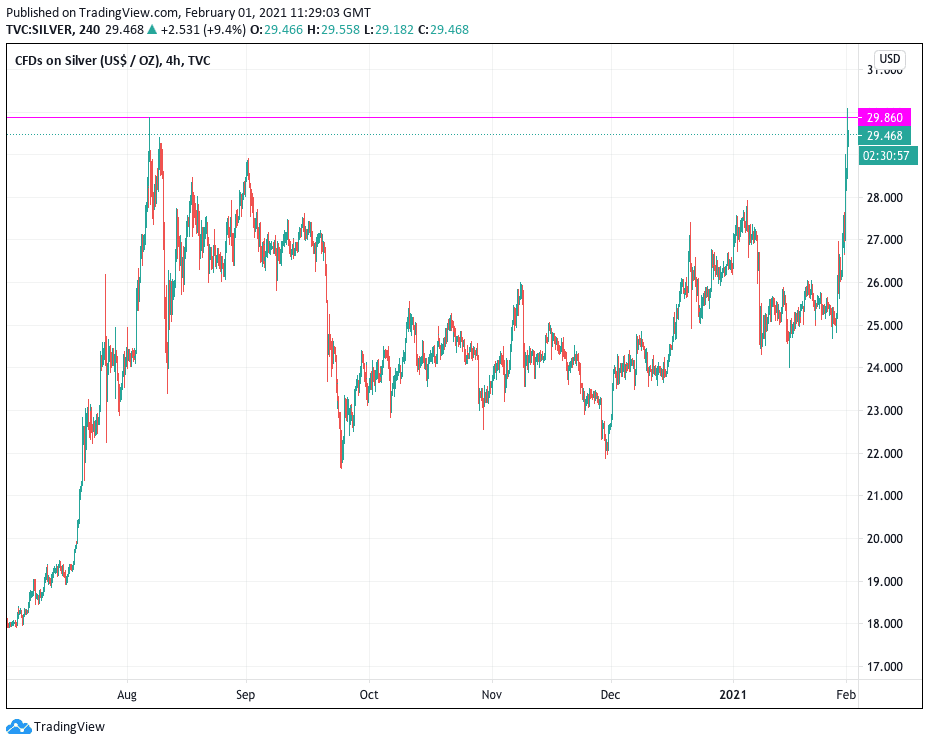

Above: the surge in silver prices take the metal back to Aug. 2020 highs.

"Silver has become the new target for Reddit traders after someone on the online forum posted that it was “the biggest short squeeze in the world". The spot price of silver has shot up about 10% today following two days of strong gains," says Boyadjian.

The immediate reading of the above chart is that the rally in silver has taken it back towards the August 2020 highs located around 29.86, and technical analysts will say it must break and hold above these highs for the trend higher to extend.

If some classic technical market forces come into play and this level is not broken it could signify some underlying resistance in the market that could ultimately end the rally and leave the orchestrators of the silver pile-on disappointed.

However, a break above here could mean a more sustained trend can be built.

Mobilisation for the frenzied buying of silver appears to have occured on the WallStreetBets forum on Reddit, the source of the GameStop pile-on.

One poster said silver could be "the world’s biggest short squeeze", and buy buying silver there was a chance to flush out these short bets and open the door to an astronomical run higher.

But, those with an insight into the market question the validity of this view.

"It remains to be seen whether Reddit traders will have the same success in triggering a massive short squeeze for silver as they did for downtrodden stocks such as GameStop. Unlike single stocks, the market for silver is much larger and more complex and therefore more difficult to manipulate," says Boyadjian.

"Between 2010 and 2020, the silver content per newly installed kilowatt of solar capacity fell from 85 grams to 25 grams. While another short-term rally seems to have started, it is not based on fundamentals and does not reflect a healthy market, in our view," says Carsten Menke, analyst at Julius Baer.

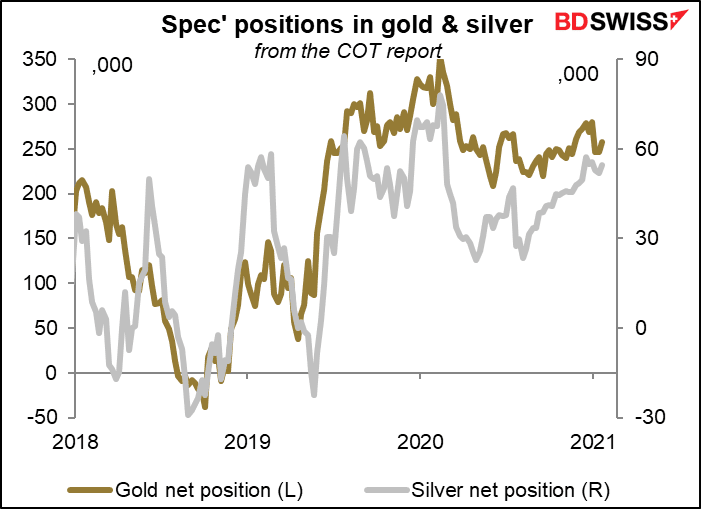

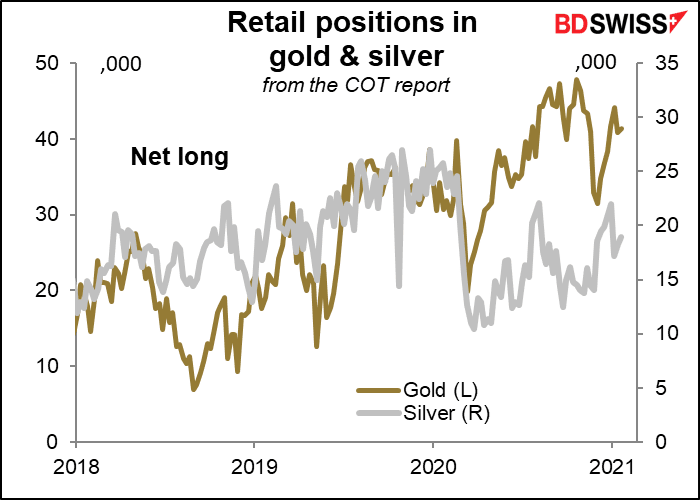

Analysts also question an assumption amongst some in the retail trading army that institutions and hedge funds are bearish on silver and therefore at risk of a short squeeze.

Indeed, many hold huge short positions simply to hedge against the long large long positions they simultaneously hold, therefore a surge in silver is going to be of little impact to many big market participants.

The market meanwhile indicates no sizeable imbalance in positioning by traders on silver, indeed, there is a greater net 'long' position - i.e. bets for upside - than there are bets for downside, i.e. 'shorts'.

The most recent Commitments of Traders (CoT) report from the Commodities Futures Trading Commission shows the net position on silver actually increased during the course of the past week to 54.5k from 52.0k (+4.7%).

"When the wallstreetbets crowd talks about attacking the silver shorts, I don’t know who they’re talking about – only the producers are short in the futures market, and they’re normally short as they’re selling their production ahead to lock in prices," says Marshall Gittler, Head of Investment Research at BDSwiss Group.

Regardless, the retail swarm phenomenon is having a real impact on the market with reports coming in that retail sites selling silver have been overwhelmed with demand for bars and coins.

Silver demand from first time investors at UK-based The Pure Gold Company surged 923% in the last week as a new retail investor army, galvanised by social media, pile into the precious metal, pushing the price up 16% in a week.

Josh Saul, CEO of the company said over 20% of clients purchasing metal for the first time have confessed to being Reddit traders involved in propping up the share value of GameStop by almost 700%.

"We have been order taking since Thursday evening with some clients converting their equities into silver to capitalise on this rally. What has further motivated clients to purchase physical silver instead of paper silver like mining stocks or exchange traded funds, is that it is exempt from capital gains tax if they buy legal tender silver coins like the Britannia," says Saul.

Money Metals, SD Bullion, JM Bullion and Apmex are amongst those reporting such an uptick in activity over the weekend that they were unable to process orders until Asian markets open because of unprecedented demand.

"In the last week, we have seen a dramatic shift in Silver demand from our customers. For example, the ratio of ounces sold per day was running about two times earlier in the week and closer to four times the average demand by the end of the week. Once markets closed on Friday, we saw demand hit as much as six times a typical business day and more than 12 times a normal weekend day. Combined with the extremely high demand levels, we are also seeing a surge in new customers. On Saturday alone, we added as many new customers as we usually add in a week," says Ken Lewis, CEO of Apmex.