EU to Suffer Largest Economic Hit from 2nd Lockdown: TS Lombard

Image © Adobe Images

The UK, Germany and Netherlands are the latest countries to announce a tightening of restrictions, aimed at halting the spread of the second wave of covid-19 infections.

Across the Atlantic, New York's mayor has warned a full lockdown looms.

What will the economic impact of this new phase in the pandemic look like?

Analysts at TS Lombard - an independent research provider - have put forward their initial economic forecasts in an effort to try and quantify the impact on the U.S and EU economies.

"A virulent second wave of the Covid-19 pandemic is underway," says Davide Oneglia, Economist at TS Lombard, who adds the European economy will be hit hardest as a result.

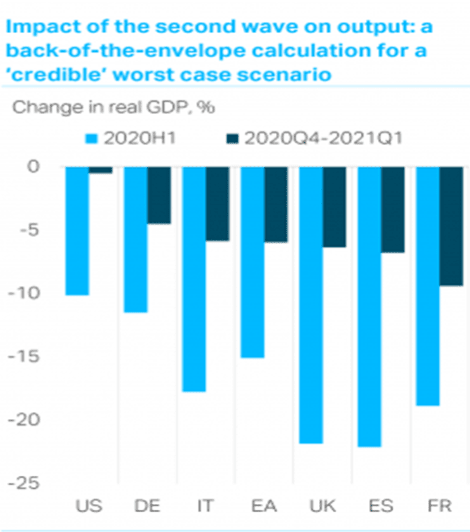

TS Lombard have done a "back-of-the-envelope calculation" to estimate relative declines in domestic demand in what they believe to be a 'credible' worst-case scenario.

Using the first half of 2020 as a template, they assess the potential damage of the policy response to a second wave in the fourth quarter of 2020 and the first quarter of 2021.

"Europe is hurt the most with GDP falling by 30%-50% of the decline in 2020 H1 while the US could stagnate," says Oneglia.

Their estimates are based on information about current activity embedded in Google Mobility Reports relative to the first half of 2020.

Adjustments are made to account for the extent of the rebound in the third quarter of 2020 and expected restrictions.

However, these calculations don't account for the resilience of manufacturing and trade activity versus the first half of 2020, a superior handling of the pandemic in north-east Asia, and the differences in policy responses in the two phases.

"Hospitalisations are key drivers of new restrictions and of activity via voluntary social distancing. Hospitalisation rates follow the new cases with a lag. New cases are starting to top in Europe. France leads, as earlier and tougher restrictions stem contagion. But in the US a ‘third wave’ of infections is still in full swing and hospitalisations are increasing too," says Oneglia.

cost-of-lockdowns-ts-lombard-2.png

Looking at the United States, TS Lombard observe that the surge in US hospitalisations since mid-September is concentrated in states that were largely spared by the first wave in spring and didn’t experience a second wave in summer (the Dakotas, Nebraska, Montana, Illinois...).

"Mobility indices in states with higher hospitalisation rates are slowing more than those where hospitalisations are still under control (e.g. CA, NY). However, loose restrictions limit the slowdown in activity, for now," says Oneglia.

The second wave has meanwhile forced European governments to dial up restrictions, but not all the way to April’s levels.

TS Lombard observe stringency indices suggest current measures in UK and Germany are looser than in June; France is the strictest.

It is not clear whether the research was done ahead of the significant tightening of restrictions announced for Germany on December 14, and that of London announced on the same day.

The Netherlands also announced a severe tightening of restrictions.

"Orders to stay home, restaurant, public venues and shop closures are taking their toll on economic activity. Mobility for recreation is hurt the most; a slower return to the office limits the pullback in work-related mobility," says Oneglia.