Eurozone Rebound Written Off as New Lockdown Threatens Recovery, Brussels' Fund Fires Blanks

- Written by: James Skinner

Image © Adobe Images

The Eurozone economy rebounded much more strongly than was anticipated by economists in the third-quarter, Eurostat data revealed on Friday, but with the recovery at risk from renewed 'lockdown' and the EU's coronavirus recovery fund in danger of firing blanks, the data was overlooked by investors.

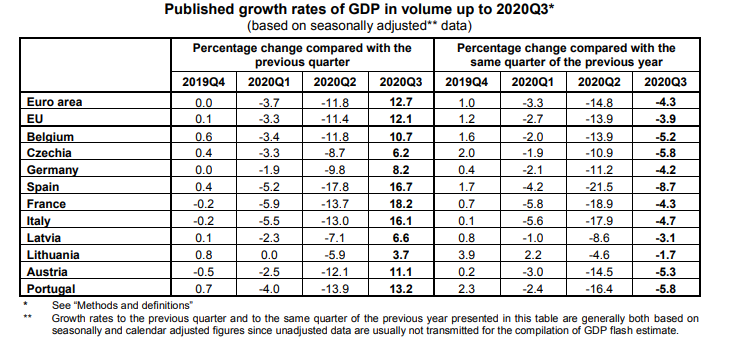

Eurozone GDP rose by 12.7% in the three months to the end of September, partially reversing the -11.8% contraction seen in the prior period and surpassing the consensus for a rebound of 9.5%, while leaving output just -4.1% below the level observed in the same period one year ago.

Outperformance resulted from strong gains in France, Spain and Italy, all countries hit the hardest by the first wave of coronavirus-related restrictions that washed over the continent in the first quarter.

"The whopping 8.2% qoq increase in German Q3 GDP was clearly above consensus and our own expectations, although we had highlighted the upside risks in recent weeks. GDP was still 4.1% lower than a year ago and 4.2% below Q4 last quarter pre-COVID-19," says Stefan Schneider, chief economist at Deutsche Bank. "The rebound was driven by the bounceback of those components which caused Q2’s 9.8% slump (revised from -9.7%)."

Source: Eurostat.

French GDP rose 18.2% last quarter when consensus had looked for only a 15% rebound out of the prior period's -13.7% trough. Spanish GDP rose 16.7% when economists were looking for only a 13.5% expansion.

"It won't last. As more restrictive measures are put in place due to Covid-19, a quarterly growth contraction now looks highly likely in the next quarter," says Paolo Pizzoli, a senior economist at ING, of Italy's numbers.

Italian output recovered 16.1%, paring a -12.8% decline when it had been expected to increase by just 11.1%. Separately, the Eurozone unemployment rate was revised higher from 8.1% to 8.3% and inflation was said by Eurostat to have remained at -0.3% in October.

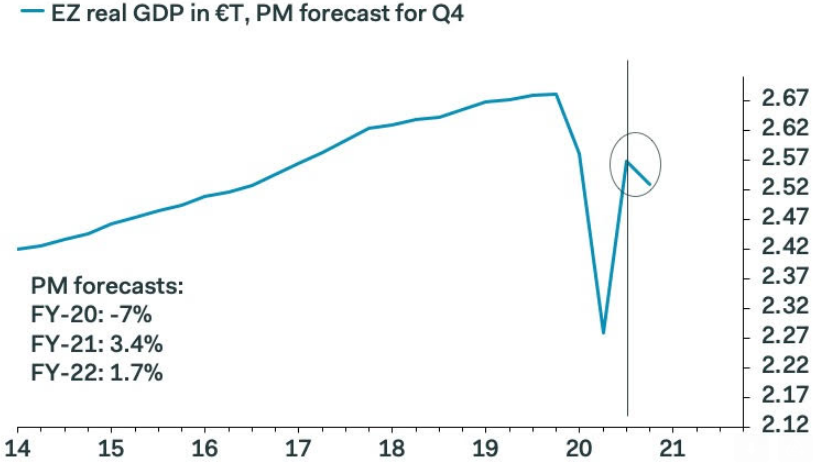

"The EZ economy came roaring back in Q3 as lockdowns ended, though a full recovery is still some way off," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "In the near term risks are shifting to the downside, which is what the ECB will respond to in December. The advance October inflation data also will nudge the central bank towards further easing."

Source: Pantheon Macroeconomics.

Despite the widespread and stronger-than-anticipated rebound in GDP, the data was overlooked by the Euro and other financial markets as the continent's major economies again stood on the verge of closure in the name of coronavirus containment this Friday.

"The numbers in Western Europe continue to deteriorate rapidly, with cases, hospitalizations and deaths rising across all major countries. The restrictions announced in recent days in France and Germany ought to bend the case curve, but it will take a couple weeks to show up in the data," says Ian Shepherdson, Pantheon's chief economist.

Europe's largest economy and the export powerhouse that is Germany will enter a new but partial form of 'lockdown' on Tuesday, 02 November where "institutions and facilities classified as recreational" including restaurants, bars, clubs, theatres, concert halls, museums, cinemas, sports grounds, swimming pools, leisure parks and others must all close. All affected businesses have been instructed to remain closed at least until the end of the month."

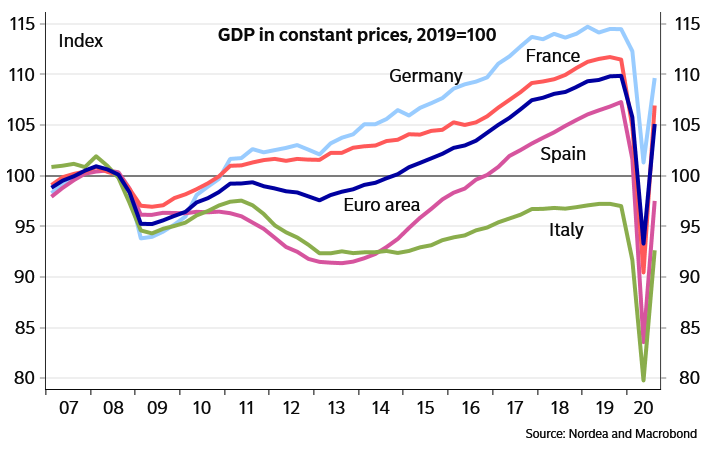

"The number of covid-19 cases and the recently announced lockdowns in many countries, and especially in Germany and France, are likely to take the growth rate back to the negative territory in the last quarter of 2020," says Tuuli Koivu, an economist at Nordea Markets. "While for the whole year 2020 our growth forecast of -8% is still valid although a bit negative, there are clear downside risks to the +5% growth forecast for 2021 that both we and the ECB have."

Source: Nordea Markets.

"A strong surge in activity in the third quarter in Germany will be followed by another dip in the final months of the year," says Carsten Brzeski, global head of macro at ING. "This 'Lockdown 2.0’ still tries to spare industry but given that many parts of the service sector will now be closed for at least four weeks, there is a risk that despite new government support of some 10bn euros, unemployment and insolvencies will increase. Add to this second or third round effects (think of suppliers but also the pure psychological impact of a lack of perspective) and probably more lockdowns in other European countries and a double-dip looks unavoidable."

Restrictions have been tightened elsewhere in Europe too with President Emmanuel Macron also announcing on Wednesday that France will return to ‘lockdown’ for at least the November month. That means the Eurozone’s two largest economies have now joined its third and fourth largest, Spain and Italy, in taking themselves partially offline at a crucial point for the bloc’s economic recovery. All were the stars of Friday's Eurozone recovery show.

"Even though EU-leaders reached political agreement on the long-term budget and the Recovery Fund in July, the final shapes are not yet carved in stone. Multiple subjects of debate amongst the European Commission, European Council and European Parliament could cause serious delays to the implementation of the Recovery Fund," says Floortje Merten, an economist at ABN Amro. "In addition, now that multiple member states have signalled that they are not (yet) interested in the take-up of loans, the economic impact of the Recovery Fund may be lower than previously anticipated."

Source: Worldometers.

The FT reported on Thursday that the initial tranche of payments from the EU's much-vaunted recovery fund could now be delayed, after it was credited with not only enhancing the EU name in the debt market but also with offering the continental economy a shot at 2021 competition with the U.S.

The fund was expected to become operational with the EU's new seven-year budget in January 2021, setting the ball rolling on an already-lengthy process through which member states could apply for a slice of the €750bn of grants and low interest loans offered by the fund. Any delay would add to headwinds faced by the economy in 2021.

"Governments remain in negotiations with the European Parliament about the details of the recovery fund, raising concerns that the first payments will not be issued in the first half of 2021, as planned," says Sharon Zollner, chief economist at ANZ. The challenges facing Europe’s economy mount along with COVID cases. The challenges were made all the clearer following yesterday’s announcements that France and Germany are returning to partial lockdowns."