German and Eurozone Economic Outlooks Improve in August, ZEW Survey Shows

- Written by: James Skinner

Image © Adobe Images

- EUR/USD spot rate at time of writing: 1.1782

- Bank transfer rate (indicative guide): 1.1371-1.1453

- FX specialist providers (indicative guide): 1.1606-1.1677

- More information on FX specialist rates here

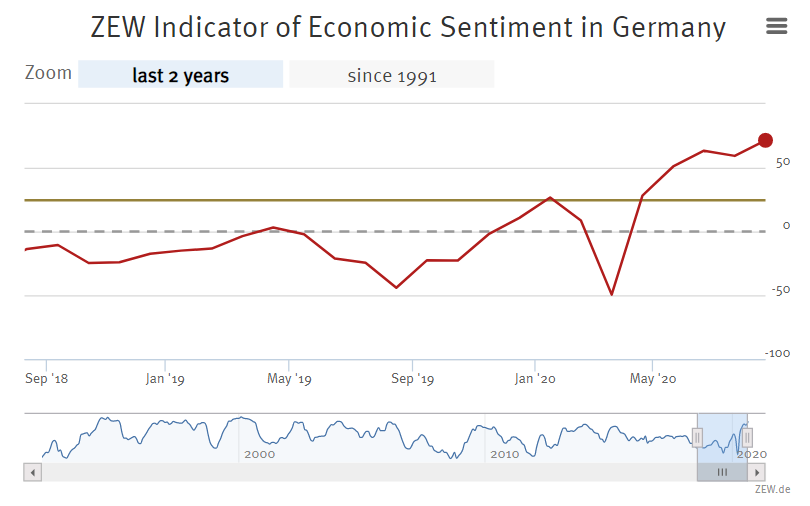

German and Eurozone recovery prospects improved in August, according to the Leibniz Centre for European Economic Research's latest ZEW survey of institutional investors, the fifth month of explosive gains for the barometer of sentiment toward the bloc and its outlook for the next six months.

Investors became more upbeat in their outlook for the next six months in August, lifting the ZEW indicator of economic sentiment from 59.3 to 71.5 for Germany when economists had looked for a fall to 57.0. However, institutions were more reserved in their appraisal of the current economic situation.

ZEW's index measuring optimism about the current economic situation actually declined by 0.4 points to -81.3 during a period that saw European capitals including Berline grow concerned about the prospect of a second wave of coronavirus infections in some countries on the continent.

Above: ZEW Index of economic sentiment for Germany.

“According to the assessments of the individual sectors, experts expect to see a general recovery, especially in the domestic sectors. However, the still very poor earnings expectations for the banking sector and insurers regarding the coming six months give cause for concern,” says Professor Achim Wambach, president of the ZEW institute.

For the Eurozone the ZEW index rose from 59.6 to 64.0 when economists looked for a modest decline to end a multi-month run of strong gains for the barometer of sentiment toward the single currency bloc's economy.

Similar to with Germany, the ZEW measure of optimism about the current economic situation also declined, though this time by -1.1 points to -89.8.

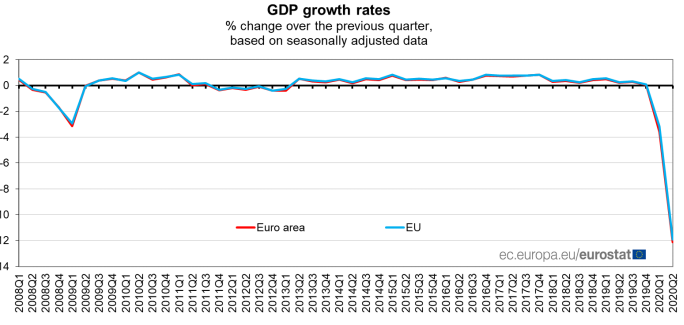

Above: Eurostate graph showing initial estimate of second quarter Eurozone GDP contraction.

Both German and Eurozone economies saw historic contractions in the second quarter but a range official data, including factory orders and industrial production for Germany as well as retail sales for the Eurozone, have indicated that recoveries got underway toward the end of that quarter.

"The is a solid, and surprising, headline, given the dip in Sentix expectations yesterday. Granted, there is no iron-clad rule that the two surveys should move in unison, but the key expectations gauges usually do. In any case, the fall in the Sentix was trivial, so today’s ZEW headline indicate that investors remain upbeat about the future, even if equities have lost momentum somewhat," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Destatis said on July 31 that Europe's largest economy shrank by -10.1% last quarter while Eurostat said the single currency area's economy shrank by -12.1% owing to widespread government mandated shutdowns of activity.

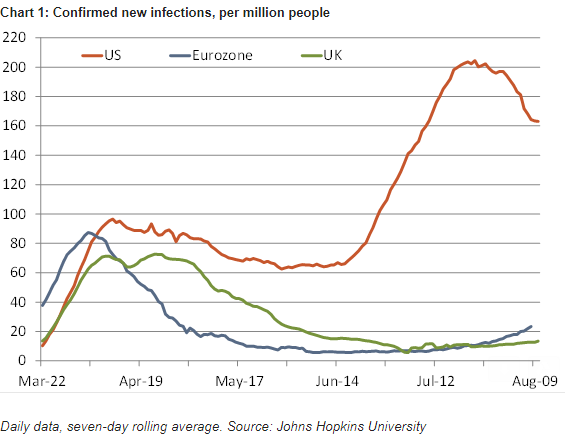

Above: Berenberg graph showing trend in new coronavirus infection numbers for UK. US and Europe.

But with restrictions having been eased from May in some cases and June in many others, economists have been looking for clues about the speed and breadth of an anticipated economic recovery.

Much depends however, on the evolving coronavirus situation in Europe given that increasing numbers are contending with second waves. Spain overtook the UK on Tuesday to become Europe's coronavirus capital after more than 1,000 new infections were disclosed by the government. However, France, the Netherlands and Belgium have all also seen notable increases that could yet hamper the third quarter economic recovery.

"From a much lower level than in the US, infection rates are increasing across much of Europe," says Holger Schieding, chief economist at Berenberg. "As in the US, the average age of the newly infected is significantly lower than it was in spring. In Germany, the share of people under 50 years in new infections has risen to 73% in late July/early August, up from 48% at the height of the pandemic in late March/early April according to Germany’s official virus watchdog, the Robert-Koch-Institute (RKI). More partying among young people, families and friends as well as increased travel activity in the summer tourist season are contributing to the rise in infections."