UK Economic Forecast: Three Stages to the Covid-19 Slump and Recovery say Morgan Stanley

- UK economy could shrink 10% in 2020

- Unemployment to peak near 9%

- Deflation could morph into inflationary surprises in 1-2 years

Image © Adobe Stock

Economists at investment bank Morgan Stanley have said they see the coronoacrisis economic slump as being deeper than they originally anticipated, with only a partial bounce back occurring in 2021.

Declines in inflation to below 1.0% and a rapid jump in unemployment towards 10% in 2020 are also seen as likely at Morgan Stanley, who have updated clients with their UK economic forecasts just days before Prime Minister Boris Johnson is expected to reveal the UK's lockdown exit strategy.

Economists at the Wall Street-based bank say they see three distinct stages in their UK economic forecast:

1) suppression stage (1st half of 2020) with a lockdown of at least seven weeks under which the economy is likely only operating at 65-70% of its normal capacity;

2) containment (2nd half of 2020 and the first half of 2021), when lockdown measures will only be lifted gradually, resulting in a partial bounce-back, but still leaving GDP 5% below its 4Q19 level at the end of 1H21; and

3) a pre-Brexit stage (2nd half of 2021), when a medical solution to Covid-19 will most likely be available, but growth in the UK will be dampened by Brexit.

In all, economists say they expect UK GDP to contract by 9.6% year-on-year in 2020, followed by a 4.9% year-on-year partial bounce-back in 2021.

"We are now anticipating a bigger hit under lockdown and a slower recovery as lockdown is lifted, with cautious consumers and businesses," says Jacob Neil, Economist at Morgan Stanley.

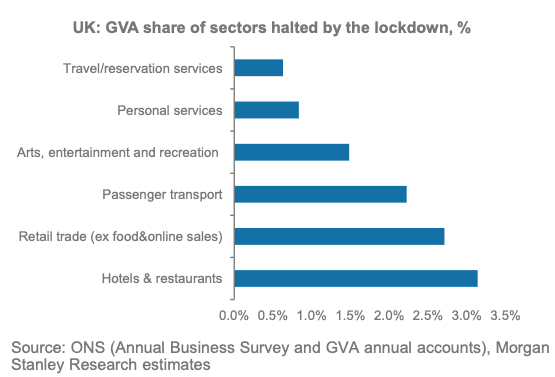

Above: Around 10% of the economy is effectively shut in a lockdown

At the end of 2021, Morgan Stanley's base case sees the level of GDP around 5% lower than it was in the fourth quarter of 2019, but under a bear case scenario the economy could actually be around 10% lower.

Unemployment is forecast to slump from 4% before the crisis to 9.7% in the second quarter of 2020, before coming down again.

Above: The ONS suggests 25% of firms have stopped trading

Concerning inflation, Morgan Stanely say the coronavirus shock will be deflationary for prices, "given restricted demand through social distancing and emergence of a higher level of slack and a large negative output gap," says Neil.

Owing to slumping oil prices and weak core inflation, Morgan Stanley see 2020 inflation at just +0.9% year-on-year which gives the Bank of England ample space to print money and buy up government debt under its quantitative easing programme.

However, the unprecedented fiscal response by the government that should see around £290BN pounds, or around 13% of economic output, pumped into the economy should support both the economy and inflation going forward.

Indeed, economists at Jefferies say that stimulus could well in upside surprises to inflation data over the next 1-2 years.

"Whatever happens to the profile of GDP in the next year or so, budget deficits are set to explode and with them debt issuance. If the BoE ends up buying much of this debt through an expanded QE programme then ultimately, in contrast to what was seen after the financial crisis, the money supply M4 could end up growing by 10% or more. Currently financial markets may be focused on all the many downside risks to the economy and how deflationary they will be. But, on a 1-2 year view we could be entering a world where inflation surprises on the upside," says David Owen, Economist at Jefferies.

The updated forecasts from Morgan Stanley come as Deloitte's regular survey of the CFOs of the UK's largest companies shows the largest drop in confidence on record, with companies adopting an unprecedented defensive stance.

In the face of the economic slump, corporates are now no longer focussing on growth but are said to be focussing on cost control, cash conservation, selling assets and debt reduction or deleveraging. Key to reigniting growth in the economy will be convincing companies to start expanding and taking risks once more, confirming that the psychological impact of the coronacrisis will linger and deliver a negative feedback loop into the economy.

CFOs nevertheless expect growth to begin to return in the coming months: 41% of CFOs expect the lockdown to start to ease in May and a further 41% expect it to begin in June. 76% of respondents say they expect demand for their own products and services to revive later this year.

Yet there is no expectation of a quick snapback in activity in the second half of the year.

Most CFOs do not expect demand for their products and services to return to pre-COVID-19 levels until 2021, with 53% warning that peak levels of activity will be only regained sometime after mid-2021.