The UK Services Sector Struggled in August but Economic Rebound Still Seen in Third-quarter

- Written by: James Skinner

© IRStone, Adobe Stock

- UK services sector struggles in August amid rising 'no deal' Brexit fears.

- Three of UK's largest sectors slowed in third quarter due to uncertainty.

- Economy at risk of 'technical recession' this quarter after Q2 slowdown.

- But economist says consumer and government spending to save day.

The UK's largest economic sector was left treading water in August amid heightened uncertainty over the outcome of the Brexit process, the latest IHS Markit Services PMI showed Wednesday, delivering a further blow an economy that was already under threat from a possible 'technical recession' that some forecasters still say will be avoided.

The IHS Markit Services PMI fell to 50.6 in August, from 51.4 previously, when markets had looked for a reading of 51.0 Wednesday's result continues the trend of underperforming PMI numbers for the month of August and has done little to dispel fears about the underlying health of the economy. IHS surveys of the manufacturing, construction and services industries have now all disappointed market expectations for last month.

Companies reported lower overall activity levels last month as well as a slower pace of new order inflows and job creation as boardrooms across the country were blighted by indecision following a change of government that has been widely billed as making a 'no deal' Brexit more likely. Moreover, confidence about the business outlook fell for a third consecutive month and to its lowest level since the immediate aftermath of the Brexit referendum in 2016.

PMI surveys measure changes in industry activity by asking respondents to rate conditions for new orders, production, hiring intentions, prices and inventories. A number above 50.0 indicates industry expansion while a number below 50 is suggestive of contraction. The survey results often correlate with official measures of output, although they can often be wide of the mark too.

"While the focus has been on the Brexit drama in Parliament there is growing evidence that the economy is slowing. Indeed, the small drop back in the services PMI in August raises fears that the weakness in manufacturing and construction sectors is maybe starting to feed through into the services sector," says Thomas Pugh at Capital Economics. "Admittedly, the hard data has held up better than the surveys for much of the first half of the year. And that is likely to be the case again in Q3."

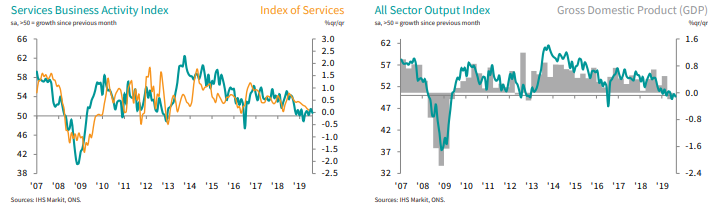

Above: IHS Markit graphs showing services activity and all-sector PMI correlation with GDP growth.

August's surveys tell the story of an economy that is now well and truly on its back foot with all main industries slowing steadily in the third quarter, after GDP growth already contracted by 0.2% in the second quarter. And if another quarterly contraction comes in the three months to the end of September, the UK will find itself in a recession, but economists say the surveys don't capture all of the UK economic picture.

"Taken at face value, the PMI suggests that the dominant services sector of the economy is treading water," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "The chances of a second consecutive drop in GDP, however, are remote, given that inventories will shift from dragging on GDP growth in Q2 to boosting it in Q3. In addition, the PMIs are excessively influenced by business sentiment and have given a misleadingly weak steer during the past 12 months."

Tombs is not alone in looking for the UK economy to rebound in the current quarter because Pugh is forecasting growth of 0.4% based upon the expectation that Brexit preparations in the manufacturing sector and strong consumer spending will be enough to save the day, although he does now say that risks to that forecast are tilted toward the downside following Wednesday's report.

The economy contracted in the second quarter after the manufacturing sector ground to a standstill in April, as firms sold off stocks that were built up to abnormal levels ahead of the original March 29 Brexit day in order to insure against disruption at the ports. The halt in April production across vast swathes of the industrial sector drove a reversal in the broader economy, which shrank after having grown by 0.5% in the early months of the year.

Above: Pantheon Macroeconomics graph showing correlation of PMI with real GDP growth.

Tombs cites Office for National Statistics accounts data for thinking that inventory levels returned to normal among manufacturers in the final months of the recent quarter, and forecasts that firms will want to rebuild abnormally large piles of inventories before the current October 31 deadline. He says they're likely doing this during the current quarter and that such activity has simply not been picked up by IHS Markit.

"They might even seek to hoard more goods now than in March, given that the new Prime Minister is more willing than his predecessor to opt for a no-deal Brexit," Tombs says, in a note to clients Tuesday. "The gloomy message of all these surveys needs to be taken with a large pinch of salt, given their track record of overstating the impact of political uncertainty on economic activity. The PMIs also need to be down-weighted, because they exclude the retail and government sectors, which are outperforming."

Wednesday's survey comes amid heightened fears that a general election is near after Prime Minister Boris Johnson tabled a motion under the Fixed Term Parliaments Act to poll MPs in pursuit of the two thirds majority required for an early election. It is a de facto confidence vote that comes amid open political warfare between the main parties in Westminster over the UK's pending EU exit.

Johnson has staked his premiership on a pledge to take the UK out of the EU on October 31 regardless of whether formal arrangements have been agreed, which could mean a 'no deal' Brexit plays out in less than 60 days time. However, most other parties in parliament have long said they won't countenance a 'no deal' Brexit, despite already voting to make it the default outcome if talks with the EU fail in the way that they so-far have done.

Above: Pantheon Macroeconomics graph showing changes in manufacturer inventories.

Opposition and some now-ousted Conservative Party MPs have tabled draft legislation that seeks to force the government to request from the EU an extension of the Article 50 negotiating period, with the draft bill also requiring the Prime Minister to accept any length of extension put forward by Brussels.

They were succesful in taking control of the parliamentary agenda in order to put the vote forward, prompting Johnson's push for an election, but there is significant uncertainty over whether they will succeed because of a filibuster attempt in the House of Lords, the UK's upper chamber, and the open question of whether the government would be able and willing to prevent any succesful bill from becoming law.

Nonetheless, the whole process is making a potentially damaging election more likely, even though the opposition is currently shying away from going back to the ballot box after having called for a nation ballot every week since suffering a narrow loss in the June 2017 vote. And it's done this so-far without providing any certainty about whether a 'no deal' Brexit will actually be prevented, which is what businesses and financial markets want to see.

If a UK government does not request an extension of the Article 50 window before October 31 and a version of the EU Withdrawal Agreement has not been ratified then the UK will leave the EU in a 'no deal' Brexit, which means defaulting to doing business with the EU on World Trade Organiztion terms. Those rules already govern UK trade with much of the rest of the world, and the nation has a goods and services surplus with the world outside of the EU rather than an economically damaging deficit.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement