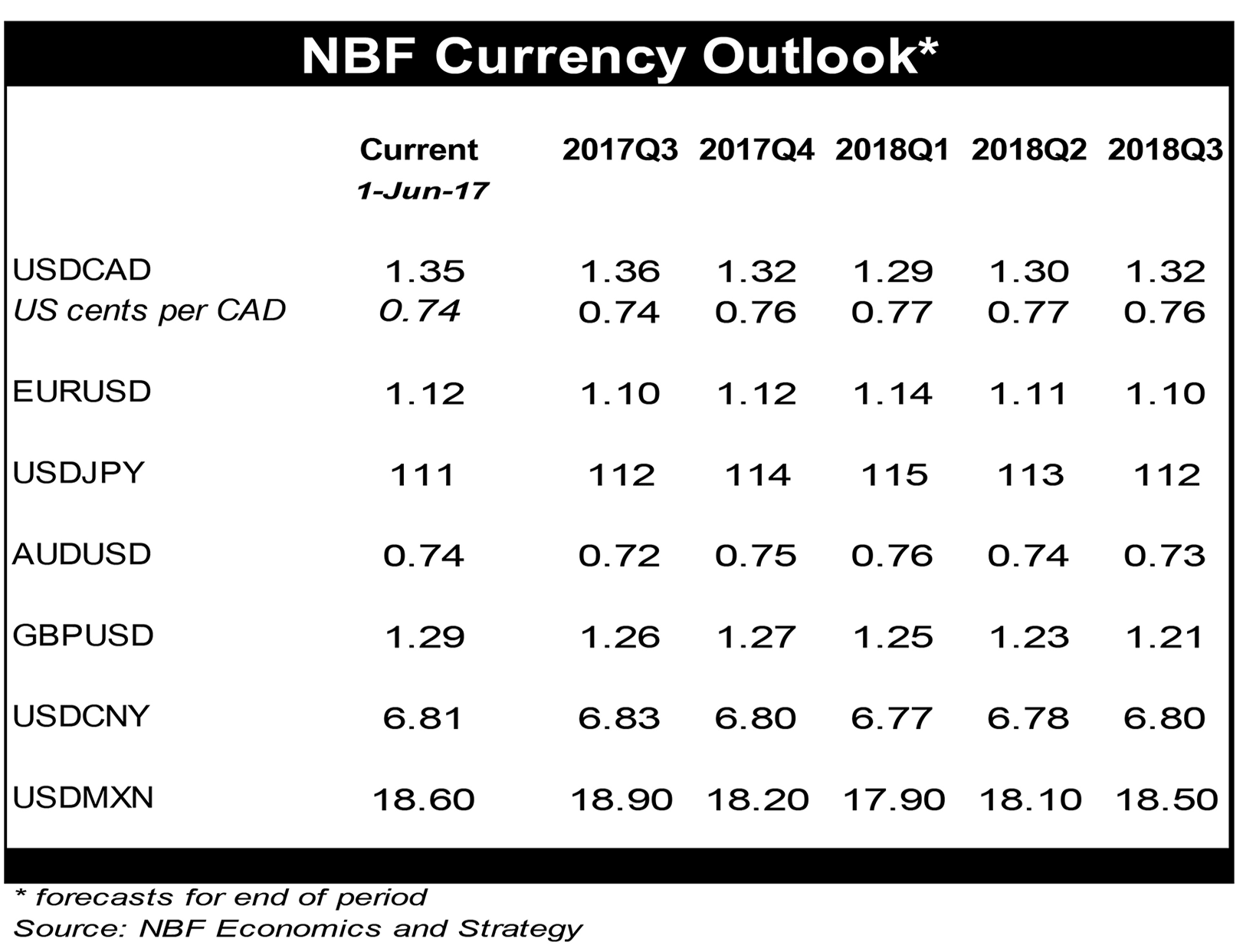

Latest Canadian Dollar Forecasts from NBC: Staying Positive Medium-Term

National Bank of Canada have told clients they remain positive on the Canadian Dollar’s prospects over the medium-term period.

However, the short-term could see further weakness in the currency as economic growth is forecast to soften following the bumper performance witnessed in the first quarter of 2017.

The Canadian Dollar recovered through May against a number of global currencies largely supported by the Bank of Canada which dropped its negative stance towards the country’s economic outlook.

However, the currency is still well below the top twenty major global currencies when 2017 is taken into account as can be seen in our comparative analysis tool.

“The loonie’s strength came from unexpected sources. The Bank of Canada, which for months had been highlighting the negatives in the Canadian economy and hoping that would hammer the loonie, suddenly decided to ditch much of its dovish language,” says Krishen Rangasamy at National Bank of Canada’s Financial Markets division.

What caused the central bank to change its tone?

The overheating housing market was likely a factor.

However, a more durable appreciation has been capped by the failure of oil prices to gain upside traction.

Oil exports constitute a major component of Canada’s export basket and therefore is important for the currency’s value.

OPEC’s programme of cuts to production during the first quarter of 2017 were offset by increased production outside of the cartel, failing to make a significant dent in the

overall supply glut.

And the most recent attempt by OPEC to limit production appears to have been not ambitious enough if the oil price’s recent action is anything to go by.

Prices have therefore failed to go higher.

What Does the Outlook Hold?

Looking ahead, Rangasamy says that it will be hard for foreign exchange markets to justify pessimism on a sustainable basis, particularly if the economy stays on track.

But short-term, there are some risks that will weigh:

1) U.S.-Canada trade flows must remain largely unaffected by NAFTA renegotiations for CAD to not fall.

2) The federally-approved Trans Mountain pipeline gets built in British Columbia.

“Those assumptions will be tested over the coming months amidst an increasingly mercantilist-sounding Trump administration in the U.S. and the NDP/Green party alliance in British Columbia which aims to topple the province’s current government and oppose the construction of the pipeline,” says Rangasamy.

3) The large current account deficit which Rangasamy describes as “a Damocles Sword hanging over the loonie.”

Canada is not exporting as much as is importing, this leaves it reliant on foreign investor capital inflows. If these inflows were to dry the CAD would have to adjust by falling.

Longer-Term: Stronger CAD

The longer-term picture is however seen as being more optimistic.

“True, the loonie remains vulnerable in light of persistent current account deficits which are being financed by unstable short term flows. But interest rate spreads with the U.S. are about to become more favourable to the Canadian currency,” says Rangasamy.

The Bank of Canada’s decision to ditch its dovish language signalled to markets an upcoming change in monetary policy stance.

The USD could bounce back over the near term if the Federal Reserve raises interest rates two more times this year.

“But the outlook for the greenback afterwards isn’t rosy considering that the expected shrinkage of the Fed’s balance sheet could reduce the need for rate hikes over the next several years,” says Rangasamy.