GBP/CAD Forecast for the Next Five Days: Strong Momentum, but Could be Nearing Overbought Conditions

The Pound to Canadian Dollar exchange rate (GBP/CAD) remains subject to a very strong uptrend which is, however, now looking a little overbought.

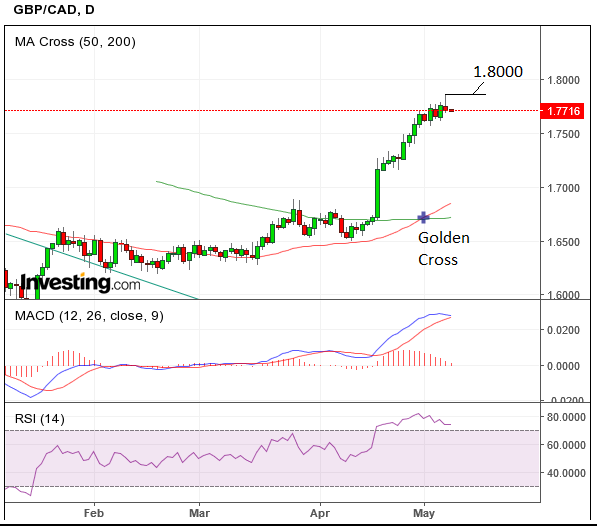

Our studies confirm the RSI indicator on the currency pair's chart is in the overbought zone above 70 which signifies traders should not add to their long positions.

However, such a reading can be problematic in that it can often signify momentum is incredibly strong.

Furthermore, the 50-day moving average (MA) has crossed above the 200-day MA in a very rare bullish sign for the pair called a “Golden Cross”.

We see a strong chance of a correction on the horizon before the exchange rate goes higher, although the uptrend remains intact.

A break above the 1.7857 highs would lead to a move up to our next target for the pair at 1.8000, which is the target calculated from a pattern at the lows.

Data for the Canadian Dollar

The Canadian Dollar has weakened as a result of a general fall in commodity prices which last week alone saw oil and iron ore fall by 7.0%, Copper by 5.0% and Gold by 3.0%.

This ongoing story is likely to be instructive over coming days and weeks, so watch the news-wires and your data sources for developments on this story.

There is no tier 1 data out of Canada in the week ahead but there is quite a lot of housing data, which should help clarify how well the housing market has been doing amidst recent subprime jitters.

Housing Starts in April, out at 13.15 on Monday, May 8, are expected to come out at 217.5k from 253.7k previously.

The New House Price Index is out at 13.30 GMT on Thursday, May 11, and is forecast to show a 0.3% rise in March from 0.4% previously.

Data, Events for the Pound this Week

From a hard data perspective, the main release for the Pound is the Bank of England (BOE) rate meeting and the BOE May inflation report at 12.00 GMT on Thursday, May 11.

No change in policy is forecast because of the ‘purdah’ preventing the authorities from making major announcements and changes to policies in the run up to the general election.

The BOE may downgrade growth expectations and raise inflation (notwithstanding the recent fall in oil), but according to analysts at Canadian lender TD Securities, the governor is expected to, “steer things back to neutral during the presser.”

Barclays expect the communication to be slightly hawkish, in an effort to boost the Pound and keep inflation at bay. Like TD they also see the bank likely to forecast inflation to rise and GDP to fall, although only during 2017, as falling oil prices will bite in 2018, slowing inflation in the longer-term.

“As for the communication, we believe the Committee will be eager to repeat its slightly hawkish message from the February inflation report, keeping the focus on inflation, and banking on the support provided to sterling to mitigate risks of excessively high and sticky inflation. Changes in forecasts will be consistent with such a move sideways as we expect GDP growth to be revised slightly lower but inflation slightly higher.

Other important data released this week includes the RICS House Price Balance (Apr) at 00.01 on Thursday, May 11, Industrial and Manufacturing Production at 09.30 on the same day and the Trade Balance in March, also at 9.30.