Why the Australian, New Zealand and Canadian Dollars Have been Falling

A major recent feature of the markets has been the steep decline in commodity prices and a knock-on effect on commodity-linked currencies.

The sell-off has seen oil and iron ore fall by 7%, copper by roughly 5% and even precious metals like gold by around 3%.

The anchor-weighted drop in commodity prices has translated into similar loses for commodity currencies – the Australian Dollar, Canadian Dollar and to a lesser extent the New Zealand Dollar, which are the currencies of major commodity exporters.

Similar falls have been witnessed by emerging market commodity currencies especially those closely correlated to oil such as the Russian Rouble, the Brazilian Real and other oil currencies such as the Norwegian Krone.

The month of April alone saw the Canadian Dollar fall from 1.32 to 1.36 for one US Dollar and is currently trading at 1.3715.

The Australian Dollar has fallen from a March high of 0.7750 to its current 0.7320 and the Rouble dropped to 57.80 from 55.70 in April.

Oil Taking A Dive

One major reason for the sell-off is the fall in oil prices which has been caused by a resurgence of supply from America’s shale oil fields.

The shale wells temporary shut down when oil prices fell to 30 Dollars a barrel at the start of 2016 as it was not cost effective to produce them but after oil rebounded to the $60 mark at the start of 2017 the shale wells began reopening.

Cost efficiencies were also brought in which reduced the overall cost of shale oil extraction, further lowering the breakeven price and encouraging more operators online.

The result has been a surge in shale oil which has glutted the oil market again and led to the most recent sell-off back down to the 45s Dollars per barrel level.

OPEC in Focus

The next focus for markets will be on the OPEC meeting on May 25 around which there is much speculation as to what the cartel will try to do to limit the price of oil from falling any lower.

The meeting also marks the end of the current agreement OPEC agreement, in which all members and some non-members agreed to multilaterally lower global oil production by 1.2m barrels a day (1.9m including non-OPEC countries), which helped oil prices rebound from their previous low.

Will OPEC renew the agreement to limit supply in an attempt to raise prices again, will it tighten supply even further, or will it let the market follow its natural course lower in the hope that it will put the shale producers out of business again?

Rumours circulating indicate the likelihood of an extension of the current agreement which would probably be positive for oil prices.

“Looking ahead, we believe the recent drop is overdone. Just as the rise in prices triggered an increase in output, the fall below $50/barrel should provide a natural brake. In addition, reports suggest that OPEC and Russia are likely to extend their output cuts when the oil cartel reconvenes in a couple of weeks’ time,” said Adam Wilkins, chief economist at Lloyds Commercial Banking.

Wilkins further added that the price of oil is likely to stay supported by rising long-term demand linked to the global economic recovery.

If he is right them the downside witnessed in oil commodity currencies such as the Canadian Dollar, the Rouble and the Krone may be short-lived.

China Demand Peaked

Oil is not the only commodity suffering from price discounting at the moment – iron ore, copper and precious metals are all also showing price declines.

These are mainly due to a fall in demand from China which recently completed a major restocking drive which it undertook when commodity prices were at extreme lows about 18 months ago.

The sudden fall in demand after the end of China restocking and the now plump inventories which will not need to be restocked for some time has once more precipitated a sell-off.

Iron ore is the primary export of Australia, which sells most of its iron ore to China so the decline in demand has particularly hit the Australian Dollar which has declined in tandem with the price of the commodity.

Will it Last?

J P Morgan's Daniel P Hui is of the opinion that the commodity currency malaise will not last.

One reason it that the steep decline in commodities themselves does not seem to be driven by a deeper decline in actual global growth.

“It is still far from convincing that a precipitous slide in global activity is in the offing, signaled by falling commodities.

“Our economists, in fact, argue that this week's PMI data reaffirm expectations of a 2Q growth rebound,” says Hui.

Without a more fundamental driver, the current weakness is commodity markets may merely be temporary and due to what Hui describes as “technical” and “idiosyncratic” drivers.

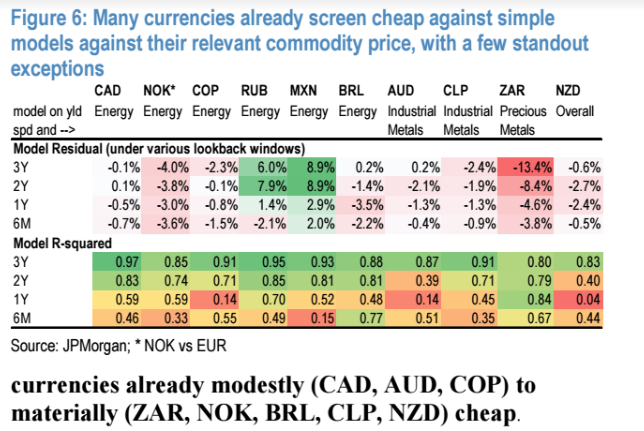

He further adds that the already quite undervalued status of most commodity currencies makes them more resistance to weakening any further.

“With commodity-benchmarked valuation already modestly to materially cheap, and mixed trends positioning, there is not a wide opportunity set for positioning short commodity FX, without a baseline of a more sinister turn in the broader global industrial cycle,” said the analyst.

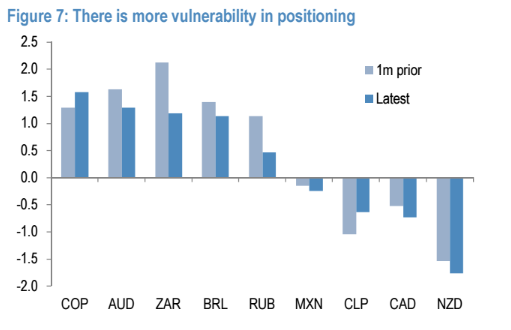

One slight short-term concern for commodity FX is its generally overweight positioning in the futures market which contrary to intuition actually traditionally points to the onset of weakness.

“The more vulnerable aspect of commodity FX may be positioning. Figure 5 below presents late-April positioning across key commodity currencies, as well as the prior month. Although almost all saw positioning reductions (except COP and CLP), most remain materially overweight (four > 1-sigma) on a 3-year z-score basis. Only CLP, CAD, and NZD are already materially underweight,” noted the J P Morgan analyst.

Dollar At Risk of Gain

If the commodity block of currencies continues to experience a crisis the US Dollar will be the winner according to Hui.

Up until now, he notes, the Dollar index has changed surprisingly little during the recent commodity FX sell-off because the gains made by the Dollar against commodity currencies were offset by a rebound in European currencies which have seen a fall in their political risk premiums.

Now that much of the political risk has been ‘worked out’, however - particularly after the French election - there may be nothing left to counterbalance the weakness in commodity currencies if it continues – which could then lead to a rise in the Dollar.

“But the recent trend of higher EUR-commodity FX as the core FX market phenomena may not be sustainable should the recent move in the commodity complex turn more sinister; in which case dynamics would likely turn more broadly USD positive,” concluded Hui who advocates buying the Dollar versus the Yen as a method of profiting form a potential Dollar upturn.