GBP/CAD Week Ahead Forecast: Inflation Data Can Stall the Acent

- Written by: Gary Howes

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate has rallied to a new three-and-a-half-year high at 1.7720, but the odds of a pullback in the coming days are high with inflation figures due either side of the Atlantic.

Pound Sterling is far and away the top performing currency of 2024, with much of these gains coming in the past two weeks as investors consider a trifecta of developments: 1) improving domestic data, 2) a retreat in Bank of England rate cut expectations and, 3) improved political sentiment.

"The GBP currently has the strongest upward momentum amongst G10 currencies. The UK election result has created a more favourable backdrop for the GBP. The large majority for Labour should ensure a period of much-needed political stability in the UK," says Lee Hardman, an analyst at MUFG Bank Ltd.

Sterling's gains have been particularly evident against the Canadian Dollar, which has been weighed down by a Bank of Canada interest rate cut and the prospect of a second cut later in July.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The main risk facing the CAD is perhaps that the Bank continues with its monetary easing later this month," says Shaun Osborne, Chief FX Strategist at Scotiabank. "Markets have been rebuilding expectations that the BoC will follow up on June’s rate cut with another ease on the 24th after pricing retreated in late June."

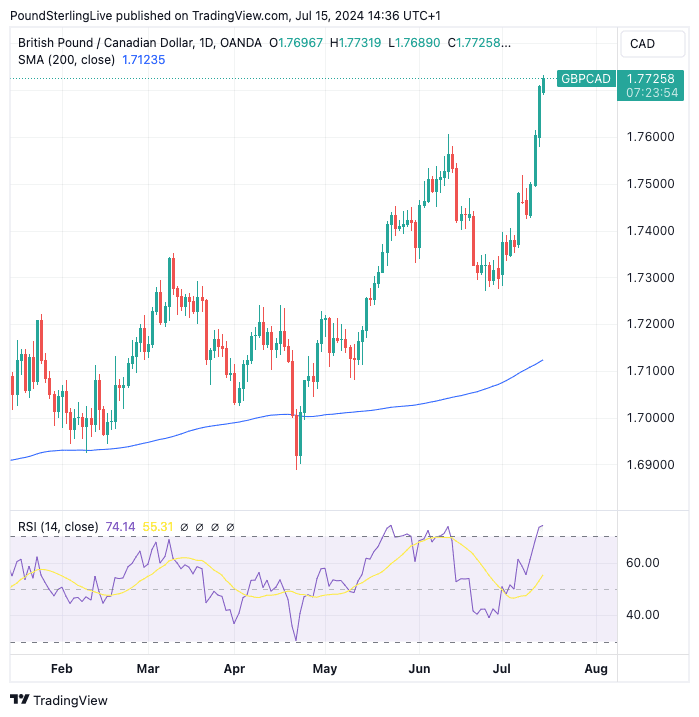

The net result is a bullish GBP/CAD technical setup. We note that the exchange rate is trading well above the key moving averages we consult when trying to establish a currency's path of least resistance. In fact, the Moving Averages are proving particularly unhelpful in the near term as we could see some relatively deep pullbacks before they are even tested!

Above: GBP/CAD at daily intervals. Track GBP/CAD with your custom alerts; find out more here.

What is catching our eyes is the Relative Strength Index. This momentum indicator has risen to 73 and is therefore sending a signal that GBP/CAD is overbought and due a corrective move lower.

It is important to note that this does not signal a deep retreat is at hand, an exchange rate merely needs to trade sideways for overbought conditions to unwind. Also note that in May and June the RSI was stuck at overbought for a particularly lengthy spell, which is quite unusual.

So the message is that we think further gains are possible over the coming days and weeks once a counter-trend pullback has taken some heat out of the market. A retreat to 1.76 would not come as a surprise within this context.

The trigger to such a decline would be Tuesday's Canadian CPI inflation release, where a stronger-than-expected number can offer the CAD some relief as this would push back against bets for a July interest rate cut at the Bank of Canada.

The consensus estimate suggests CPI will rise 0.1% in the month and 2.8% in the year (down from 2.9% in May). A print on either side will have a corresponding influence on CAD, with the scale of the move depending on the scale of the miss.

UK CPI is due the following day, and we think this could be a decent market-mover given the overbought conditions we are seeing in a host of Pound exchange rates.

Services inflation is expected to read at 5.6% and headline CPI inflation is forecast to read at 2.0%. Any undershoot would raise the odds of an August 01 rate cut and send an overbought Pound-Euro sharply lower.

Analysts at Oxford Economics reckon the headline CPI inflation print will land at 1.8%, an outcome that would represent a decent undershoot and prompt a selloff in the Pound.

"Considering the GBP has been the best performing G-10 currency QTD, we think it remains prone to a larger correction if CPI print comes in lower than expectations," says Daragh Maher, Head of FX Strategy at HSBC.

However, the sell-off in the Pound would be limited because the Bank of England will find it difficult to cut aggressively if the economy continues to perform robustly, something a number of economists said was likely following last week's GDP release.

Wage numbers are out on Thursday and could also have a significant impact on Sterling if they miss expectations.

The consensus is for average weekly earnings to have increased 5.8% over the year to June. Anything below here would result in GBP selling as it raises the odds that the Bank of England eases UK monetary policy with a 25 basis point rate cut in August.

GBP weakness will potentially be limited, however, given that an August 01 rate cut would come with ample warning that a further successive cut is by no means guaranteed.

The Bank will remain nervous regarding inflation rising again into year-end, and caution will be the watchword.

This state of affairs can mean one of the central pillars of GBP outperformance will remain intact.