Canadian Dollar Advances after BoC Shifts into Higher Gear

- Written by: James Skinner

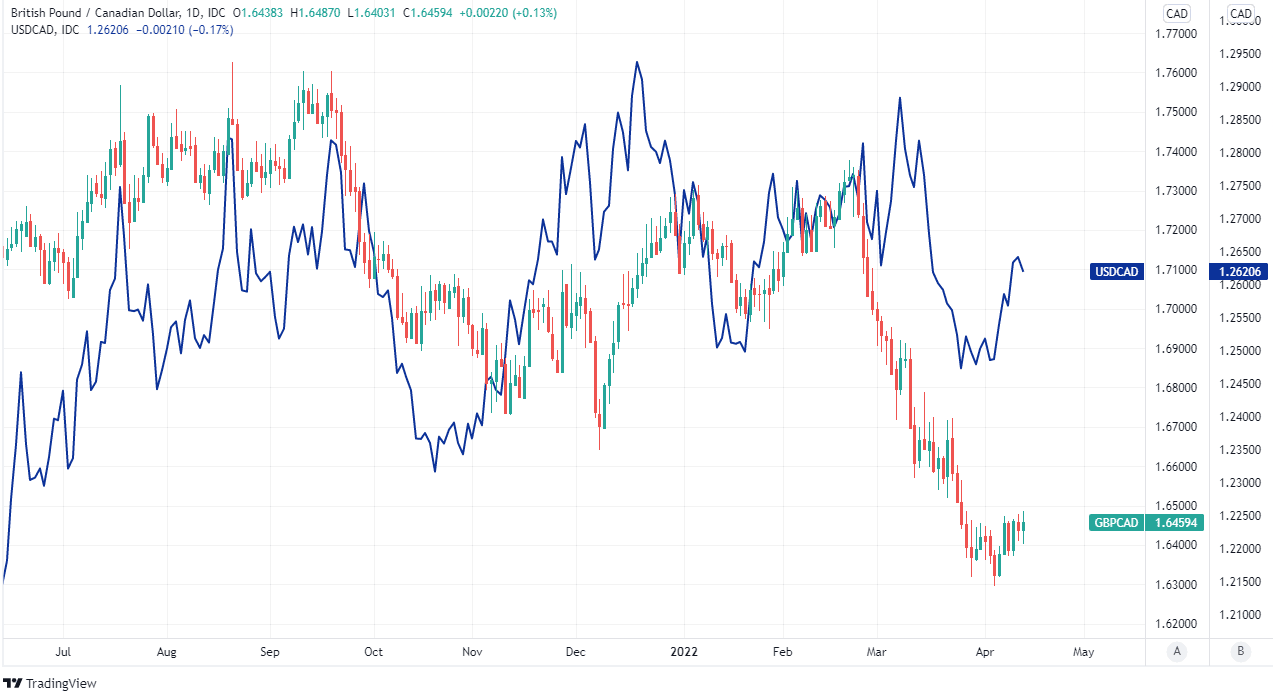

- USD/CAD & GBP/CAD advances stalled by BoC policy

- BoC takes large rate step, looks to shrink balance sheet

- Indicates further large rate increases possible up ahead

Image © Bank of Canada, Reproduced Under CC Licensing

The Canadian Dollar pared earlier losses against the U.S. Dollar while also briefly stalling a rally in GBP/CAD after the Bank of Canada (BoC) signalled that it could lift interest rates and tighten monetary policy at an accelerated pace in the months ahead.

Canada’s Dollar had been on the back foot against the U.S. Dollar, Sterling and other currencies but it staged a comeback against some on Wednesday after the BoC raised its cash rate by a larger-than-usual increment of 0.50%, taking the benchmark to 1% in the April policy decision.

The BoC also announced that it will now begin the process known as quantitative tightening whereby it divests government bonds held on its balance sheet by allowing them to mature at their natural pace without reinvestment of any proceeds received from the government.

Given the short average maturity of government bonds on the BoC’s balance sheet, Wednesday’s decision may lead the BoC to be among the first major central banks to fully reverse a pandemic-inspired quantitative easing programme and is an upside risk for Canadian bond yields.

“The Bank of Canada brought out the big guns in its fight against inflation, but for those fearing the worst, it’s noteworthy that it still sees room for the economy to put in two reasonably healthy years for growth as it does that,” says Avery Shenfeld, chief economist at CIBC Capital Markets.

Above: GBP/CAD shown at 15-minute intervals alongside USD/CAD.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

While financial markets had priced-in a high probability of such an outsized step already, the Canadian Dollar climbed following the decision in an indication that some aspect of it may still have taken parts of the market by surprise.

“Growth is strong and the economy is moving into excess demand. Labour markets are tight, and wage growth is back to its pre-pandemic pace and rising. Businesses increasingly report they are having difficulty meeting demand, and are able to pass on higher input costs by increasing prices,” the BoC's statement said.

“There is an increasing risk that expectations of elevated inflation could become entrenched. The Bank will use its monetary policy tools to return inflation to target and keep inflation expectations well-anchored. With the economy moving into excess demand and inflation persisting well above target, the Governing Council judges that interest rates will need to rise further,” the bank also said.

Wednesday’s increase reverses half of the cash rate cut from 1.75% that was announced over the course of March 2020 after the global spread and economic disruption of the coronavirus became evident.

(Set your FX rate alert, here).

"With inflation surging (we think next week’s March CPI report will be in the 6% range, another 30-year high), the unemployment rate falling rapidly (now at its lowest since at least 1976) and businesses noting widespread capacity and price pressures, the BoC wants to move toward a more neutral policy stance in short order," says Josh Nye, a senior economist at RBC Capital Markets.

"That goal post shifted slightly today, with the bank revising its estimate of the neutral rate higher by 25 bps to a 2-3% range. Our forecast assumes more standard, 25 bp hikes going forward—until the overnight rate hits 2% in October—though we think another 50 bp increase will be an option on the table in June," Nye said following a review of the BoC's April Monetary Policy Report.

The latest rate step comes as inflation sits at 5.7%, nearly three times the BoC's two percent target, and as the bank warns of higher prices ahead due to the strengthening Canadian economy and side effects from the Russian invasion of Ukraine like elevated energy prices.

The BoC lifted its inflation forecasts on Wednesday and now looks for it to average 4.5% in 2022 before ebbing to only 2.4% next year, which would leave prices growing at a rate that is still above the BoC’s target and may be an indication that the bank will eventually have to raise the cash rate further than it has so far assumed as necessary.

Above: GBP/CAD shown at 4-hour intervals alongside USD/CAD. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

“The higher neutral rate was the most intriguing development in today's decision and introduces new upward risks to terminal rate forecasts. We continue to look for a 2.50% terminal rate, with another 50bp hike expected in June,” says Andrew Kelvin, chief Canada strategist at TD Securities.

This potentially has supportive implications for the Canadian Dollar in the weeks and months ahead, making it a possible headwind for the Pound to Canadian Dollar exchange rate and potentially also the USD/CAD pair.

GBP/CAD is potentially more disadvanataged than USD/CAD, however, given the balancing act currently underway at the Bank of England (BoE), which has recently begun interrogating uncertainty about the full extent to which Bank Rate may need to rise this year if UK inflation is to be subdued.

The BoE's recent vocalisation of that uncertainty has placed a question mark over the merits of the market's expectation for Bank Rate to rise from 0.75% to 2% or more by year-end, and has seen Sterling come under pressure from a range of currencies including the Canadian Dollar in recent weeks.

“It's currently hard to play the monpol divergence between the Fed/BoC, so most of the CAD action sits on the crosses,” says Mark McCormick, global head of FX strategy at TD Securities.

“There's probably some room to play USDCAD (higher) on terminal rate pricing in the months ahead. That would simply reinforce the current 1.24-1.28 range, though, where we continue to like fading extremes rather than expecting a breakout,” he also said on Wednesday.

Above: GBP/CAD shown at daily intervals alongside USD/CAD. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes