Canadian Dollar Appreciation Likely to Continue says MUFG

- CAD is top performer of past month

- MUFG says outperformance underpinned by BoC

- BoC to unwind aggressive monetary support in coming months

- GBP/CAD spot rate at time of writing: 1.7347

- Bank transfer rate (indicative guide): 1.6737-1.6858

- FX specialist providers (indicative guide): 1.6969-1.7200

- More information on FX specialist rates, here

- Set an exchange rate alert, here

The Canadian Dollar is forecast to continue its "solid performance" according to analysis from MUFG, the global financial services provider and investment bank.

"CAD to remain well supported," says Derek Halpenny, Head of Research, Global Markets EMEA and International Securities at MUFG.

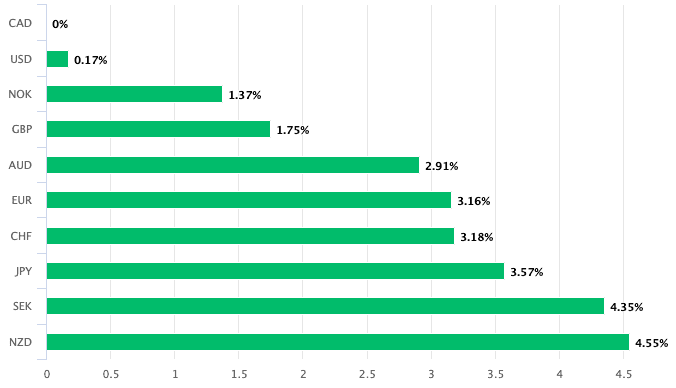

The Canadian Dollar is the best performing major currency of the past month, having risen by 3.16% against the Euro and 1.75% against the Pound. However, a 0.17% advance against the U.S. Dollar confirms it is competing with its North American cousin for the top spot.

North American outperformance does appear to be a theme for currency markets as the first quarter of 2021 comes to a close, but for analysts at MUFG it is the Bank of Canada (BoC) that could widen the Canadian currency's edge over its southern neighbour over coming months.

A closer look at the performance table shows that the Norwegian Krone is not far off behind the Canadian Dollar which is significant given that both currencies are noted for their linkage to oil prices, which have been rising over recent months:

The Canadian Dollar is referred to as as a 'commodity currency' owing to the country's hefty oil export sector which is a major source of foreign currency earnings and therefore a fundamental support of the Canadian currency.

The same is true for the Norwegian Krone.

However, MUFG say that the two currencies don't appear to be following oil market trends as has been the case in the past and are if anything relatively unfazed by a recent dip in oil prices.

They say their research leads them to the view that what is really of importance for the two currencies are the stances of their respective central banks: the Norges Bank could well raise interest rates in 2021, while the BoC could start tightening monetary conditions via other methods over coming months.

The rule of thumb in foreign exchange is that tighter monetary policy at a central bank tends to support the currency it issues.

The Norges Bank said in mid-March that interest rate hikes could begin in the fourth quarter with two additional hikes in 2022.

Last week the BoC indicated it was laying out a framework for removing some of the stimulus it had created during the covid crisis and would look to start shrinking its balance sheet once more.

The Coivd crisis saw the BoC expand the balance sheet by over 20% of GDP to hit a record CAD 575BN earlier this month.

Above: The size and composition of the BoC's balance sheet.

Deputy Governor Toni Gravelle said in a speech last week that the emergency liquidity programmes would cease as scheduled given conditions have normalised.

Halpenny says repo holdings stand at CAD 141BN and are set to play the biggest role in balance sheet shrinkage initially, but reducing government bond purchases from the current CAD 4BN per week is also high on the agenda.

Granvelle highlighted that purchases in Canada relative to market size were much bigger than other G10 central banks.

The BoC now holds about 35% of total outstanding bonds and would risk distortion on levels approaching 50%.

"Our QE program that supports our monetary policy actions is continuing to add to the Bank’s balance sheet. As new information on the strength of the recovery arrives, Governing Council will continue discussions about gradually adjusting the pace of our QE-related purchases," said Granvelle.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

"This is clearly setting the scene for tapering to be announced at the meeting on 21st April," says Halpenny.

"Getting to net zero purchases (maybe by year-end) would be determined by the economy and we see no reason not to assume further tapering as the year unfolds meaning the BoC maintains a clear lead on reversing policy," he adds.

MUFG tell clients a rate hike at the BoC is still some distance off but the lead in tapering will inevitably ensure a lead on rate hikes priced into the curve also.

"This could have implications for financial market conditions that the BoC will need to monitor closely. While USD/CAD is only marginally lower, the overall USD gain means CAD on a TWI basis, excluding USD, is already 4% higher and at the highest level since 2013," says Halpenny.

MUFG say their view on the BoC's planned reduction of stimulus support is similar to consensus and if U.S. Dollar sentiment turns less favourable later this year, which they expect, USD/CAD could decline more notably than expected.

The U.S. Dollar-to-Canadian Dollar exchange rate is currently quoted at 1.2629, the Pound-to-Canadian Dollar exchange rate is quoted at 1.7355.