Pound-Canadian Dollar Tide Turns in Favour of Loonie as BoC Overtakes BoE

- Written by: James Skinner

-CAD solidifying 2021 lead after overcoming GBP.

-As BoC seen overtaking BoE, Fed on policy path.

-USD/CAD sellers circle as steep downside looms.

Image © Adobe Images

The Canadian Dollar has overthrown Sterling as the best performing major currency of the year but with the Bank of Canada’s (BoC) policy set to evolve in a favourable direction sooner than elsewhere the Loonie is now a leading contender for a sustained period of outperformance.

Sterling has suffered a setback alongside a softening Euro this month and amid a turn for the worse in sentiment toward European currencies generally, leading the Pound-to-Canadian Dollar rate back beneath 1.74 and roughly its breakeven level for 2021 to trade as low as 1.72 this week.

Canada’s Dollar has picked up meanwhile, alongside the U.S. Dollar, oil and investors' contemplation of what an economic recovery might mean for Bank of Canada policy in the weeks ahead, helping to make it the outperformer in the 2021 currency market marathon thus far.

“We expect the currency to gain in the weeks ahead (outperform in the G10 space),” says Shaun Osborne, chief FX strategist at Scotiabank. “Beyond an earlier reduction in its pace of QE, we also expect the BoC to be among the first major central banks to begin raising rates."

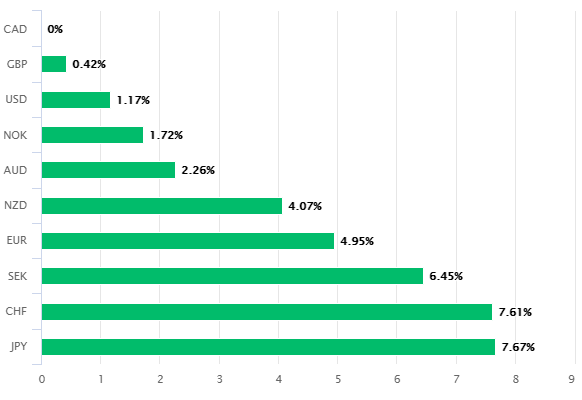

Above: Pound Sterling (left) and Canadian Dollar's (right) performance against major currencies in 2021.

This is after the BoC indicated clearly this week that it intends to begin packing up its crisis fighting toolbox as soon as next month and at what is a quicker pace than many had anticipated, which is positive for Canadian government bond yields and a prospective boon for the Loonie. Especially as this would be coming at a time when investors are on the lookout for divergence between central banks' inflation outlooks and policy stances.

"Even though liftoff may be a long way off, we think divergent policy stances will be an increasingly important factor for G10 FX investors," says Michael Cahill, a strategist at Goldman Sachs. "In our view, this approaching divergence can be mostly attributed to three factors: initial (pre-pandemic) conditions, the exit strategy process (ie, balance sheet measures), and some idiosyncratic factors potentially changing policymakers’ reaction functions."

The Canadian Dollar already offered investors a best of both worlds exposure to commodities that benefit from any global recovery as well as to an inevitable tailwind resulting from Canada’s close proximity to a stimulus pumped U.S. economy, but the Loonie's appeal now stands to be bolstered further.

Goldman Sachs' research has found that currencies tend to respond to central bank policy changes long in advance of them and that the largest currency responses to diverging rate paths are often found in the exchange rates that pit currencies of close neighbours like the U.S. and Canada against each other.

Above: Pound-to-Canadian Dollar rate with Fibonacci retracements of January rally.

Selling USD/CAD and USD/NOK are among the bank's top recommended trades for the months ahead and the most relevant for the theme of central bank divergences, recent signs of which could now enhance the Canadian Dollar's responses to economic data.

This is because when central banks' favour either higher rates or bond yields, investors tend to respond more to good and bad economic reports by pricing-in or out future policy changes. Meanwhile, pessimists whose preferences are for lower interest rates or bond yields would typically tend to overlook positive economic news, Goldman says, leading their currencies to eventually become less responsive to it.

"We think FX investors should de-emphasize arguments that policy rates will mostly stay unchanged in coming years, and begin to focus once again on growing policy divergence. FX markets are anticipatory, so tend to react more to the full path of the curve, especially where policy expectations are on the move," Cahill writes in a recent research note. "Standard BEER models show the largest response to divergent rate paths in close neighbors, such as USD/CAD, NOK/SEK and AUD/NZD."

Above: Goldman Sachs' central bank policy tracker.

The BoC marked itself out as an early mover and effectively pulled ahead of the BoE on the pathway to monetary policy normalisation this week after BoC Deputy Governor Gravelle told the CFA Society Toronto on Tuesday that circumstances justifying the bank's extraordinary balance sheet no longer present the same threat.

“We will have a new full economic projection at our April policy decision. I want to be clear here: moderating the pace of purchases while adding to our holdings would simply mean that we are still adding stimulus through QE but at a slower pace. It would not mean we are removing stimulus. We would be easing our foot off the accelerator, not hitting the brakes," Gravelle said.

Gravelle also said it's now becoming appropriate to think about the "moral hazard" and the financial stability risks that could result from too long a period of ultra easy monetary policy, in an apparent reference to longstanding trends in stock markets and house prices. Policymakers elsewhere including in New Zealand and China have recently sought to curb these trends, though using differing approaches.

This is a pretty clear indication that the BoC's goalposts are shifting.

Source: Bank of Canada. Total assets (black line) with selected composition details.

"GoC bond purchases since last March represent a little over 35 percent of the total amount of GoC bonds that are outstanding—by far the highest among this group of central banks," Gravelle said. "When central banks provide liquidity, we have to do so in ways that don’t encourage market participants to take undue risks in normal times. Our actions must be targeted at specific issues and scaled back as those are resolved. That is why we gradually adjusted our facilities."

A gradual scaling down of the programme under which the BoC buys government bonds should be supportive of the Loonie and a burden for GBP/CAD given that with the exception of Norway’s Norges Bank, nobody else in the major economy club is expected to lift interest rates or otherwise put away their tools before 2023.

The BoC said earlier in March that its cash rate will remain at 0.25% until "until inflation objective is sustainably achieved," and that QE will continue "until the recovery is well underway," although this was at the same time as it scrapped January's forecast of an economic contraction for Canada this quarter. It now expects modest growth instead.

"Domestic yields are at an attractive level to keep foreign flows interested – even with the decline in crude prices over the past week," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets. "USD should perform over the coming quarter. The CAD is likely to outperform on the crosses – especially against other commodity currencies (short AUD/CAD is where it’s at). Cross plays are back in vogue. If you’re bulled up on an idiosyncratic story, express it via the crosses instead of against the USD."

Above: USD/CAD at daily intervals with U.S. Dollar Index (yellow), CAD/USD (purple) and GBP/USD (black).

Meanwhile and although the BoE has made clear that it's content with the outlook for the UK's economic recovery, which has been cultivated with the aid of one of the fastest vaccination programmes in the world, it has given no signals to suggest that a change or withdrawal of monetary support is pending.

"The expected timing of policy normalization should support CAD and NOK (both components of our USD short basket) while it may eventually hold back GBP," Goldman's Cahill says. "Markets are significantly pricing above our expectations for the BoE, which could be a headwind for Sterling ahead."

The BoE came across unfazed by recent increases in British bond yields when it cited the 2021 budget, fast vaccine rollout and resulting plan for a second quarter reopening of the economy for its tentative expectation of a sharp growth rebound this year and next. The Bank also implied satisfaction when earlier this month it said "If the outlook for inflation weakens, the Committee stands ready to take whatever additional action is necessary to achieve its remit."

But Bank Rate remains at 0.10% and the targeted stock of government and corporate bonds held on the balance sheet unchanged at £895bn, with no changes expected near-term, which means the Bank of Canada has now pulled ahead of the Bank of England in the policy normalisation process.

"The current unwind of risk trades has impacted GBP and Wednesday’s low inflation data also pushed back some of the potential of BoE becoming less dovish. Nevertheless, prospects for reducing restrictions remain and are in stark contrast to continental Europe," says Tim Riddell, a strategist at Westpac. "Fed officials have resoundingly underscored their dovish policy track."

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with USD/CD (purple).