Canadian Dollar Emulates BoC's Calm as Market Eyes April for QE Tapering

- Written by: James Skinner

Above: BoC Governor Macklem. Image © Bank of Canada, Reproduced Under CC Licensing

- GBP/CAD spot rate at time of writing: 1.7568

- Bank transfer rate (indicative guide): 1.6920-1.7043

- FX specialist providers (indicative guide): 1.7271-1.7411

- More information on FX specialist rates here

The Canadian Dollar gave a cool and calm response to the Bank of Canada (BoC) on Wednesday when it provided few if-any clues about how the world's largest quantitative easing programme (QE) will evolve in response to what is already a better-than-expected performance from Canada's economy.

Canada's Dollar clung to intraday gains over many others even as oil prices dipped and the U.S. Dollar rose, including after the BoC left its cash rate at 0.25% in line with market expectations and said little of its QE program.

"In the context of rising bond yields, the Bank of Canada had to walk a tightrope in its latest statement, and do so without the aid of a new set of projections. Policymakers acknowledged that their forecasts from January now look too conservative," says Royce Mendes, an economist at CIBC Capital Markets. "The short statement seems to have taken a do no harm approach, kicking the can down the road until April to make any changes to the conditional commitment or pace of bond purchases."

The BoC said only that its cash rate will remain steady until "until inflation objective is sustainably achieved," and that its QE will continue "until the recovery is well underway," although it did indicate that changes could be in the pipeline through its economic commentary.

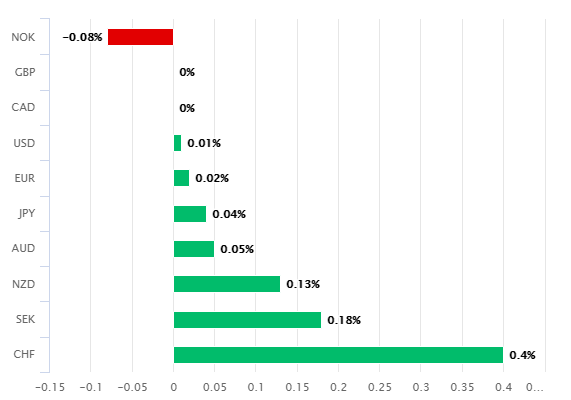

Above: Canadian Dollar performance against major currencies on Wednesday. Source: Pound Sterling Live.

The BoC reversed its January assessment that an outright contraction is likely to be Canada's economic lot for the first quarter, after various measures of housing market activity consistently surprised on the upside and following a period toward year-end 2020 where retail spending was also faster than envisaged.

In the January the bank had forecast the economy to grow at an annualised pace of 4% in 2021 and by nearly 5% next year, enabling it to more-than backfill the -5.5% decline in 2020 GDP, although it was likely to be longer before the job market recovered fully and the so-called 'output gap' was closed.

The latter is necessary for the BoC to be confident that the economy can sustainably deliver inflation that averages 2% each year, which is what central bankers the world over including at the BoC are tasked with.

"We see the Canadian economy returning to full capacity in 2022, sooner than the central bank has assumed. That leaves us expecting a rate hike in the second half of 2022 which markets are currently pricing in. Well before that first hike, we think the BoC will taper its QE program in April," says Josh Nye, an economist at RBC Capital Markets.

Source: BMO Capital Markets.

Central banks use interest rates and other monetary policy tools like quantitative easing in order to manage inflation over a multi-year horizon, normally with a view to keeping it steady at what are generally and in the developed world at least, 2% targets.

"The BoC is much closer to running out of bonds to buy than the Fed is. We suspect this will force the BoC to end QE before the Fed later this year," says Greg Anderson, CFA and global head of FX strategy at BMO Capital Markets.

The BoC has been buying "at least C$4bn per week" of Canadian government bonds since October, when it reduced purchases from "at least C$5bn per week" while guiding that it would buy more longer-dated bonds at the expense of its allocation to shorter-term maturities.

Few if-any had expected the BoC to rock the boat this Wednesday by suggesting that a shake up could be in the pipeline, although plenty of analysts, economists and other observers are increasingly conscious of the likelihood that it'll have no choice but to make at least some changes soon.

This is because the BoC has developed an increasingly large footprint in the bond market so that it now owns almost 40% of outstanding government debt and is on course to hold more than half of it before the early days of the final quarter, according to estimates from TD Securities.

Above: USD/CAD shown at weekly intervals with Pound-to-Canadian Dollar rate (black line).

The BoC's QE program is now the largest in the world despite that the bank had not used this particular policy tool at all before the pandemic.

"Assuming positive economic momentum continues, we continue to think that a reduction in the pace of QE to $3 billion/week is likely in the cards for this April meeting and potentially, a further relative terming out of purchases," says Taylor Schleich, vice president of economics and strategy at National Bank of Canada Financial Markets. "While there was no clear signal in today’s statement that an April taper was imminent, we’d note the Bank didn’t provide much of a hint before the October 2020 slowdown. Additionally, we may also be in for an update to forward guidance on the policy rate."

So large are the BoC's purcashes compared with the outstanding stock and new issuance coming to market that its program is unsustainable and will have to be cut back further, although this would almost inevitably mean higher government yields for at least some maturities and potentially a stronger Canadian Dollar.

But an explicit recognition that this may be in the cards was always unlikely on Wednesday and in no small part because of recent events in U.S. and international bond markets, where yields have risen at such a rate of knots they ended up toppling stock markets and lifting the U.S. Dollar during late February and early March.

That was an unwelcome turn of events for the Federal Reserve (Fed) and a good reason for the BoC to keep its cards close its chest on Wednesday, although many local firms anticipate the bank will announce another QE cutback and potentially new interest rate guidance on April 12.