Pound-to-Canadian Dollar Rate 5-Day Forecast: Looking for the 'Bear Trend' to Restart

Image © Adobe Stock

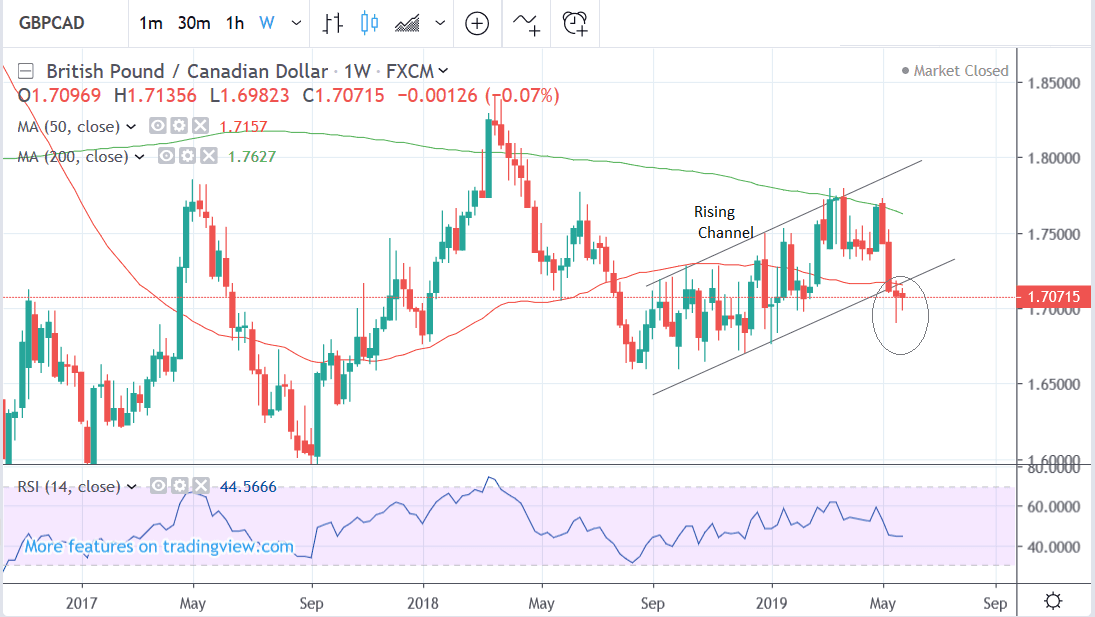

- GBP/CAD has broken out of a rising channel and should decline

- A break of the lows to result in a continuation lower

- Conservative Party leadership race to dominate Pound outlook

- Trade war developments key for CAD

The Pound endured a month of decline against the Canadian Dollar with the GBP/CAD exchange rate falling 3.4% during May.

Declines were however front-loaded into the first 20 days of the month as from May 21 the GBP/CAD entered a sideways pattern with a strong rally being recorded on the final day of the month.

The gains on May 31 mean the exchange rate opens the new week at 1.7150.

Further sideways trading is possible over coming days but we are on the alert for a bigger move lower owing to the GBP/CAD's decline during May which makes the the medium-term trend (multi-week) a negative one.

The pair recently broke cleanly out of a rising channel, which is a very bearish sign. When prices break out of a channel the general expectation is that they will fall as far as the height of the channel extrapolated lower by at least 61.8%. This suggests a minimum downside target of 1.6665. This may take some time to reach, however, and initially, we see a probable move down to 1.6760 instead.

After the initial channel break, the pair stopped and reversed at the end of last week and then rebounded. Occurring just after the channel breakdown this could be what analysts call a ‘throwback’, which is when the prices pull back just after a major line break, before resuming the trend in the direction of the breakout.

This suggests a bearish continuation lower will still eventually unfold, within a 1-3 week timeframe. A break below the 1.6900 lows would provide confirmation.

The weekly chart shows the longer-term picture and how prices have broken down out of a bigger rising channel.

We remain bears given the still intact bearish short-term trend, and the downside channel break.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Canadian Dollar: Trade Wars Getting Closer to Home

The Canadian Dollar recently lost ground in sympathy to Mexico after Donald Trump’s threat to increase tariffs on Mexican imports. It was feared the breakdown in the trade relationship between Mexico and the U.S. would impact on U.S.-Canadian trade via the U.S.-Mexico-Canada (USMCA) trade accord.

Looking ahead, any news flow relating to international trade talks, particularly relating to the USMCA - could impact the Canadian Dollar and market will be alert to tensions between Mexico and the U.S. ratcheting up.

Oil prices are another factor impacting on the Loonie after the steep 5.0% decline in crude last week weakened the currency. There appears to be no let-up and oil is in a new short-term downtrend. Further declines are likely to have a similar impact in the week ahead.

CAD is very sensitive to changes in monetary policy especially interest rates, which are set by the BOC, yet going forward - after last week’s meeting - the BOC is likely to leave interest rates alone and adopt a neutral stance resulting in less volatility for CAD.

“Looking ahead, we expect the Bank of Canada to remain on the sidelines. Recent data has been pointing to improving momentum, but the outlook remains clouded with uncertainty. For instance, one fly in the ointment in today’s report is an inventory build, which together with that in Q4, will likely result in a drag on GDP growth going forward. More importantly, escalating trade tensions are likely the biggest headwind heading into the second half of the year, a risk highlighted by the Bank of Canada this week,” says TD Securities, a Toronto-based Investment bank.

The main hard data releases for the Canadian Dollar on the horizon are the trade balance out on June 6 and employment out on June 7, though neither are likely to move the Canadian Dollar on the day and are only useful as background markers.

TD Securities looks for the international trade deficit to narrow modestly to $2.9bn in April on a combination of weaker import activity and stronger energy exports, partially offset by a pullback in non-energy exports, the deficit stood at $3.2bn in March.

Analysts are pessimistic about the outlook for employment data, however, saying they see the unemployment rate probably rising to 5.8% in May from slower economic growth.

TD Securities looks for the labour market to disappoint in May with employment falling by 5k which should push the unemployment rate to 5.8%, while wages should soften to 2.5% y/y on a sizeable base-effect from May 2018.

"We have previously argued that recent labour market strength is unwarranted by the economic backdrop and last month’s blockbuster print has not changed our view,” says TD Securities.

The Pound: Politics and PMI Data Dominate

The main focus for the Pound over the coming week will continue to be political, as the ruling Conservative Party prepares to choose its next leader and the country's next Prime Minister.

Key for Sterling will be the future leader's stance on Brexit.

The current favourite, Boris Johnson is a known 'Brexiteer', and recently said that if he were PM, he would take the UK out of the EU on October 31 “with or without a deal”.

Johnson is more popular amongst the Conservative party membership than amongst Conservative party MPs, and there is the chance the parliamentary party won't even select him to form party of the final pair of candidates that are voted on by the party's membership.

The contest is composed of several rounds. The first is held in Parliament and only involves Conservative MPs in the vote to decide a shortlist of two who are then put to a broader vote amongst party members. If Johnson can get into the final shortlist he will probably be next leader.

"The No Deal Brexit option will likely be the defining feature of the Tory leadership contest, as opposed to a leverage tool to be used primarily to extract better conditions in negotiations with the EU. This possibility becomes more urgently negative for GBP and for UK assets if one expects, as our economists do, that Boris Johnson may be inclined as a newly minted PM to call for new elections, aiming to create a parliamentary arithmetic that does not preclude a No Deal outcome," says Shahab Jalinoos, a currency strategist with Credit Suisse.

Jeremy Hunt is the favourite amongst the party membership at present, and he opposes a 'no deal' Brexit.

Regardless, whichever candidate espouses the toughest line on Brexit and potential future negotiations with Europe will likely win the final vote held by the party's membership.

The EU said it has not changed its stance on Brexit after May’s resignation, and that “our position on the withdrawal agreement — there is no change to that,” according to EU spokesperson Mina Andreeva.

This has increased downside pressure on Sterling because if the EU is unwilling to negotiate a better deal, and the next leader is a Brexiteer, it increases the chances of a 'no deal' Brexit in October.

Further complicating the outlook for Sterling is the possibility that in the event the UK were about to leave without a deal Parliament does have the power to vote down the government in a vote of no-confidence. The chancellor Philip Hammond, for one, has already said he is so against a ‘no-deal’ that he would vote against his own party if such an eventuality happened, in order to put “the national interest before party interests”.

If the government were voted down in a vote of no-confidence there would probably be a general election with an uncertain outcome. Article 50 would probably have to be revoked in the interim with considerable consequences for the chances of a Brexit ever being revived.

The outlook is decidedly murky, and therefore it is difficult to see Sterling enjoying any upside potential until this raft of issues are decided and certainty is returned to the political outlook.

On the economic data front, the main release on the horizon for Sterling are the IHS Markit PMI surveys.

The Manufacturing PMI survey is forecast to show a fall to 52.1 from 53.0 in May. This is still above the threshold for expansion of 50 but shows slowing activity. The results are released on Monday, June 3 at 08.55 BST.

PMI’s are widely acknowledged to be reliable forward indicators of growth and so a lower-than-expected reading would probably result in a decline in the Pound and vice versa for a higher-than-expected result or rise.

Construction PMI is out on Tuesday, and forecast to remain unchanged at 50.5.

Services sector PMI is out on Wednesday 5, at 9.30 BST and it is forecast to show a rise to 50.6 from 50.4.

This is the release most likely to have an impact on Sterling as the services sector accounts for over 80% of UK economic activity and therefore offers a better gauge on where the overall economy is headed.

Besides PMIs, there is potential for volatility from the testimony of Mark Carney and other Bank of England officials as they are questioned by the Treasury select committee on Monday, however, he and his colleagues are likely to defer an opinion on interest rates until there is greater clarity on Brexit.

Halifax house prices are out on Friday at 13.30 and expected to show a slowdown in house prices in May, with a 4.5% rise compared to a year ago (down from 5.0% in April) and 0.1% monthly rise compared to 1.1% in the previous month.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement