Pound's Australian Dollar Recovery has More Work to do Before the Bearish Bias is Overturned

Image © Desiree Caplas, Adobe Stock

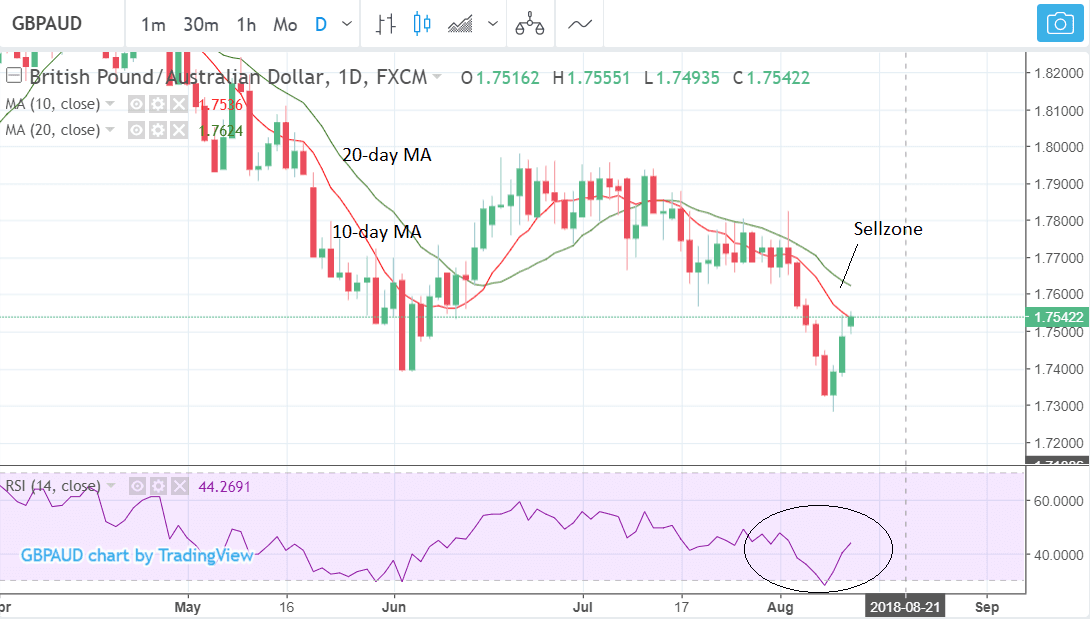

- GBP/AUD looks increasingly bearish after break below 50-week MA.

- Strong recovery currently underway, however

- Key for AUD this week is release of labour market data

The Pound-to-Australian Dollar exchange rate has bounced higher over the last three days after easing UK Brexit concerns supported a recovery in the Pound while dour global sentiment emanating from the Turkish financial crisis curbed demand for the Aussie.

Yet, from the perspective of the weekly charts, the Pound's recovery against the Australian Dollar is tenuous.

The recent break below the 50-week MA - a formidable obstacle - suggests a strong downside bias and a probable breakout from an established range, both signs which strongly recommended more downside.

Yet in the process of recovering the pair has formed a hammer candlestick which is a bullish reversal pattern signifying a turn higher is probably on the horizon.

Much depends on the outcome of this week's activity since the hammer relies on the subsequent period being bullish to confirm the exchange rate is going higher.

The daily chart shows the pair rising up steeply over the last three days. It has now entered a space between the 10 and 20 day MAs known as the sellzone because it is considered the optimum place to reload shorts after a pull-back and chase the downtrend lower again. If the pair forms a bearish reversal bar in the zone then it will probably be a sign the downtrend is resuming.

Any further upside is likely to be capped not far above the current market level at 1.7583 where the 50-week MA is situated.

The MA will probably cap gains as large MA's often present obstacles to the trend. They are widely used indicators and therefore subject to higher-than-normal levels of volatility.

Overall the break below the 50-week is significant and the short-term trend remains bearish. We forecast a continuation of this trend in the absence of stronger evidence of a reversal.

A break below the 1.7282 lows would provide confirmation of further downside to a target at 1.7000.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch Going Forward

The main factor impacting on the Australian Dollar in the week ahead will probably be global risk appetite which is heavily dependent on the outlook for world trade.

Fear of escalating trade wars and tit-for-tat tariffs, and the knock-on harmful effects on growth are currently weighing on the Aussie so any relief should support if, and vice-versa if the situation worsens.

The Aussie Dollar remains prone to global sentiment stresses, and with Turkey dominating the headlines we would argue the broader environment is not conducive to any sustained rally in the currency.

On the domestic front, NAB Business Confidence for July beat analyst expectations by coming in at 7, better than the 6 forecast.

Business confidence lifted and employment conditions strengthened, but business conditions moderated as did forward orders, suggesting something of a mixed bag for the economy.

However, the employment conditions index rebounded, up 5pts to an elevated +10, reversing falls over the past two months.

"The survey correctly foreshadowed the jobs boom of 2017. The survey suggests that the employment index is consistent with jobs growth near-term of around 23k/month, well above the 17k/month pace required to keep the unemployment rate steady (assuming an unchanged participation rate)," says Andrew Hanlan at Westpac.

Ahead, the most important release for the Australian Dollar is probably employment data out on Friday, August 13, at 2.30 B.S.T.

The data is expected to show a rise in employment of 15.3k in July and the unemployment rate to stay at 5.4%.

Improved data could support the Aussie but probably not much - only a really big surprise is likely to move markets.

The labour market impacts on the currency through increasing inflation expectations. When the labour market is tight workers can demand higher wages which tends to lead to higher spending and inflation.

Higher inflation leads to higher interest rates which attract greater inflows of foreign capital drawn by the promise of higher returns.

The Reserve Bank of Australia continues to hint they are not planning on raising interest rates until 2020 at the soonest, which is very far out compared to most competitors.

Stagnant inflation is to blame and only a real boost to the labour market and, more importantly to wages, could change that view.

Another key event in the coming week for the Aussie is a speech by RBA governor Lowe on Friday at 00.30 B.S.T., and then assistant governor Ellis afterwards at 08.30.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here