Lloyds Constructive on Australian Dollar Outlook, Others Disagree

The outlook for commodity prices may be the key factor influencing the direction of the Australian Dollar, according to the views of leading FX analysts.

The Aussie Dollar has reached the 0.7600 level against the US Dollar after rising over 3.0% in the last six weeks, from a four- month low of 0.7350 made in early May.

“This has been driven by a combination of resilient domestic data and a supportive external backdrop,” say analysts at Lloyds Bank Commercial Banking in a recent report. “Australian unemployment fell to 5.7% and retail sales for April outperformed expectations, with inflation rising by 2.1%."

These changing economic conditions appear to be reflected in the more neutral stance adopted by the Reserve Bank of Australia (RBA) at their June rate meeting where they decided to keep interest rates at 1.50%.

Although generally upbeat about the economy, the central bank did also cite muted wage growth as an ongoing concern, with falling real wages a threat to household consumption.

Moreover, with core inflation still subdued there seems little reason for the RBA to raise interest rates.

As such, the market currently expects the RBA to keep rates unchanged through to the end of 2018.

This contrasts with the outlook for US monetary policy which continues to be hawkish after the Federal Reserve (Fed) continued their tightening cycle at their June meeting by raising interest rates another 0.25%.

The Fed also kept its expectations of future rates, illustrated in its dot plot diagram, the same, implying they would continue raising rates over the next few years.

Normally such a wide divergence between the outlook for interest rates in two currency jurisdictions would support the currency with the rising interest rates because investors tend to transfer funds too where they can get a higher return.

But Lloyds are not as bearish AUD/USD as the differentials would suggest, saying, “in spite of the interest rate divergence, we remain constructive on the Australian Dollar, due largely to the external environment.”

By “external environment” they seem to mean commodity prices and the global economy.

They are positive about commodity prices which they still see as ‘stabilising’.

They also expect China will rebound, and a generally “positive risk environment” – presumably global - should continue to be supportive of the currency.”

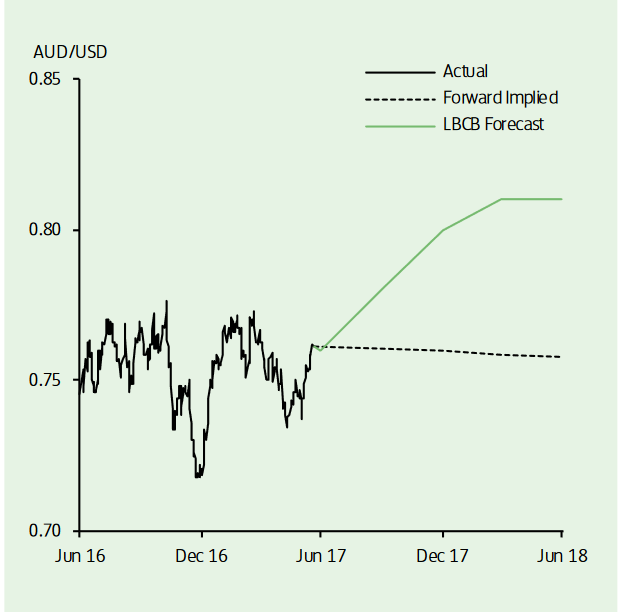

Above: Forecasts for the Australian Dollar from Lloyds Bank.

Commodity Prices to Stay Weak say Morgan Stanley

However, the outlook for commodity prices - and hence the Australian Dollar - is up for debate. Analysts at Morgan Stanley have a contrasting bearish opinion of the Aussie.

They recommended selling AUD/USD earlier in the year and although they got it wrong they remain bearish.

AUD/USD’s unforeseen rally was more due to a fall in the Dollar than due to a more optimistic outlook for the Australian economy.

“The fall in US treasury yields and perception of weaker US inflation expectations caused the USD to weaken vs the AUD and stopped us out of this trade,” said Morgan Stanley’s head of research Hans Redeker.

“The AUD framework is still bearish but the USD side of the pair has become more volatile,” he goes on to say.

Weaker Australian banks are seen as a weak spot for the economy.

Unsustainably high levels of personal debt, including mortgage lending, combined with a new banking levy leave banks exposed.

MS also mention weakness in the housing sector although they do not expand.

They see continued weak iron ore prices as creating the potential for further AUD weakness.

“We will look for opportunities to sell the AUD again,” they conclude.

Citi forecast Iron Ore falling to $45.00 per tonne

That iron prices will fall further and lead to more weakness in the Aussie Dollar is a key conclusion according to analysts at Citibank.

They forecast iron ore to fall to 45 Dollars a barrel eventually (it is currently at 63).

Iron ore has already fallen 40% from its peak but they see a reduction in demand from China, which has already just completed a restocking drive, as a major factor limiting the price.

Increased supply also appears to be a factor due to the expansion of projects by top miner Vale in Brazil and the Roy Hill mine in Australia.

Clearly, if Citi are right in their forecasts the Australian Dollar will probably suffer in coming months.