Chinese Trade Data and RBA Lowe’s Comments Suggest Shift in Stance At Australian Central Bank

Surprisingly strong Chinese trade figures have supported a more positive outlook for the Australian economy delivered in a speech by the Reserve Bank of Australia (RBA) governor at a recent economic forum.

The data helped defuse fears that China’s economy was sliding down, with negative implications for Australia, for whom China is its largest trade partner and biggest export market.

Chinese Imports showed a 16.7% rise in January, which was well above the 10.0% forecast and bodes well for Australian trade.

Exports rose by 7.9% from -6.2% previously resulting in an increase in the Trade surplus to 51.3bn from 40.7bn in December.

Lowe Talks up The Australian Economy

The Chinese data supports comments made by RBA governor Philip Lowe at the A50 Economic Forum in Sydney on Tuesday evening, which were viewed as potentially marking a change in stance from the RBA, given the inextricable trade relations between the two countries.

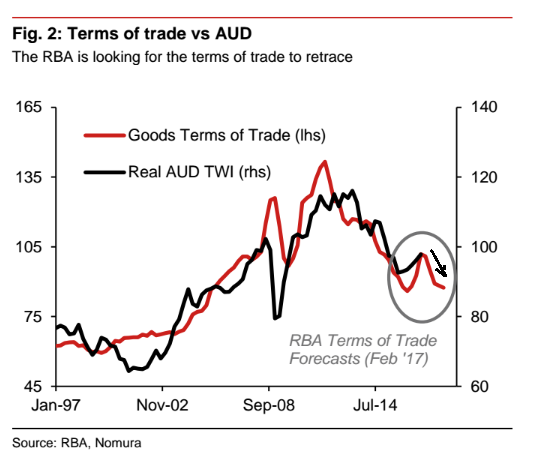

Lowe gave an especially upbeat assessment of the Australian economy at the forum, in which he saw growth rising by 3.0% annually over the next few years, inflation moving higher, and increasing exports supporting the terms of trade.

The terms of trade is the aggregate value of a nation’s exports divided by the aggregate value of its imports, multiplied by 100.

If it rises, it is good for a country’s economy as it shows increasing exports relative to imports, if it falls it shows falling exports relative to imports.

“Another headwind we have had over recent years – that is the decline in our terms of trade – has already stopped. Since earlier last year, a rise in global commodity prices has provided a boost to our national income. And the improvement in the global economy since late last year should also help us,” said Lowe.

At the same event, Lowe was also quoted by analysts at Nomura Bank as saying that the Australian Dollar was “not fundamentally too high,” which suggested he would be happy to see it appreciate.

This contrasts with comments in the February RBA statement, which suggested any further appreciation would (changed from previous “could”) “complicate the economic adjustment.”

It further suggests greater confidence in the outlook from the RBA.

Nomura Not Sure

Writing before the release of the upbeat Chinese data, Nomura’s Peter Dragicevich was more circumspect about the outlook for commodities and the Aussie economy compared to governor Lowe.

“Despite Governor Lowe’s comments about the present, the detail in the RBA’s February SoMP points to an implicit view that some of AUD’s strength will unwind over coming quarters. In line with our thinking, in the RBA’s baseline, the next major move in commodity prices will be down, not up,” said Nomura’s Peter Dragicevich.

The preferred valuation model used to determine the estimated fair value of the Australian Dollar is based on commodity prices and terms of trade.

Dragecivich notes how the model is forecasting weakness in commodity prices on the horizon which will probably pass through to the Aussie Dollar.

“Although the RBA does not provide a forecast for AUD, when mixed with the RBA’s real AUD TWI modeling framework, a decline in the terms of trade points to a lower implied real AUD TWI path over the course of 2017,” said the Nomura analyst.

They see the Aussie as likely to fall as the economy takes a breather due to lower commodity prices in 2017, which could have Lowe eating his words.

“Consequently, while RBA Governor Lowe is rather sanguine about AUD currently, a decline in Australian commodity prices and/or downward revisions to global or domestic growth that does not feed through to a lower AUD due to actions and policies in other economies could easily change his tune.”

Nevertheless, the picture has been further complicated by the sudden jump in Chinese data, suggesting demand may be stronger than assumed by Nomura or the fair value model based on commodities and Australian terms of trade.