Australian Dollar a Surprise Winner on Trump Victory

- Written by: Gary Howes

The Australian Dollar has surprised analysts by advancing on confirmation Donald Trump has won the U.S. election.

Trump has won the White House and the Republicans will control Congress, giving the red sweep outcome that analysts considered an extreme 'upcase' for the U.S. Dollar.

The new administration will levy significant tariffs of up to 60% on China, which is Australia's most important trading partner.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The combination of USD strength and fresh headwinds to China made the Australian Dollar a potential sell candidate on a red sweep outcome.

But the Aussie is doing well at the time of writing: AUD is down by less than other currencies are against at 0.6577.

There could be a degree of 'sell the expectation, buy the fact' behaviour underway in the market, as most currencies are recouping initial losses against the Greenback in the European trading session as the election result is assured.

Perhaps the biggest loser in the selloff stands to be the biggest winner in any relief-syle snap-back.

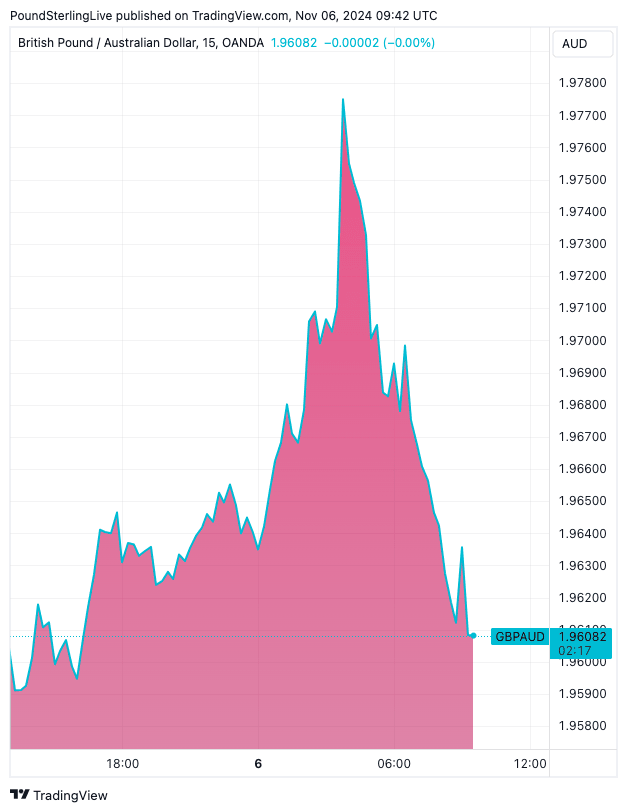

The AUD has recovered initial losses against the EUR and GBP: GBP/AUD went as high as 1.9782 but has faded to a daily loss at 1.9614. The EUR/AUD exchange rate is down 0.70% on the day at 1.6358.

Analysts were largely aligned on the view that the Aussie Dollar would slide if Trump won.

"The Antipodean currencies are highly exposed to the US election," said a note from Crédit Agricole. "The AUD and NZD have high exposures to UST yields, but unlike the JPY, are negatively exposed to any risk-off trading and weaker equities in the event of a Trump election victory."

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

However, stock markets are rallying quite significantly through the European session, with U.S. futures pointing to solid gains across the Atlantic.

This is because investors see Trump's policies of lower taxes and supply-side reforms as being supportive of the U.S. economic outlook.

The 'risk on' sentiment that follows the vote results is traditionally a supportive environment for the high beta Aussie Dollar.

For now, it looks as though this stock market euphoria will be in the driving seat, which can keep AUD supported until such a time that markets start to fret over what Trump means for China's outlook.