GBP/AUD Week Ahead Forecast: Inflation Showdown

- Written by: Gary Howes

- GBPAUD mildly bullish

- 1.9330 a potential upside target

- Australian inflation is the week's main event

- A soft read could prompt AUD weakness

- UK PMI eyed on Tuesday

- Global risk sentiment of great importance too

Image © Adobe Stock

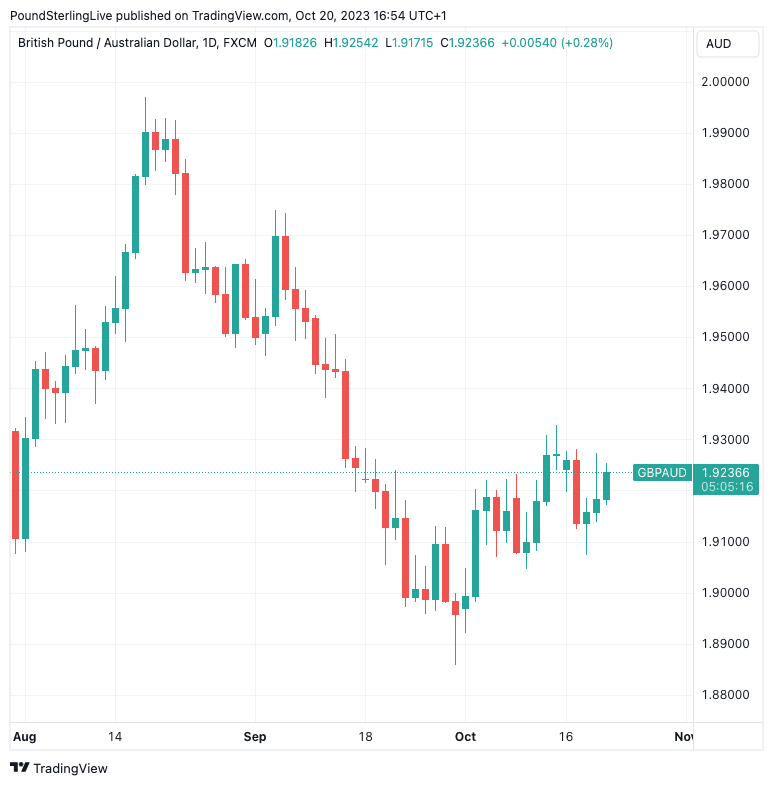

The Pound's October rebound against the Australian Dollar remains intact and we see risks for an extension higher over the coming days, particularly if Australia's all-important inflation print comes in soft. (Update: inflation beat expectations and lifted the odds of another RBA rate hike, in turn boosting AUD. Please see the coverage here).

The Pound to Australian Dollar exchange rate (GBPAUD) is located near 1.9220 at the start of a new week and remains subject to a short-term uptrend as it unwinds from the oversold conditions of late September when it scraped a low of 1.8857.

Short-term momentum readings remain constructive and 1.9330 could be tested again over the coming days, but this depends to a great degree on Australia's inflation numbers which will firm market expectations for the Reserve Bank of Australia's November decision.

Above: GBPAUD is mildly constructive in the short-term. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Australia reported some softer-than-expected jobs figures last week that prompted markets to row back on expectation, but analysts reckon there is still a shot of a rate hike if inflation burns hot.

Headline CPI inflation is released at 01:30 BST on Wednesday and is expected to print at 5.3% year-on-year in the third quarter, down on the 6.0% growth seen in the second quarter.

The trimmed mean CPI inflation number is worth watching as the RBA tends to lend some weight to it, here the expectation is for 1.1% quarter-on-quarter in the third quarter.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Should inflation beat expectations, then the odds of an RBA rate hike increase, which should, at the margin, underpin the Aussie Dollar and push GBPAUD lower again.

Last week's soft inflation report from New Zealand implies to economists at Crédit Agricole that Australia risks following suit in the coming week, good news for households and businesses, but not for those wanting a stronger AUD.

"The RBA has made explicit it has little tolerance for upside surprises in inflation, however, and the central bank forecasts headline inflation to plummet to 4.25% YoY by year-end from 6% YoY currently. So a reading close to 5% YoY is required next week to keep the RBA happily on hold at its November meeting," says a note from Crédit Agricole.

Last week revealed the Australian Dollar to be particularly prone to broader risk sentiment. Thursday's equity market selloff was reflected in a weaker Aussie Dollar thanks to its high sensitivity to global sentiment.

Above: Australia's employment growth rate is trending lower. ImageL ANZ.

This is particularly the case when the global mood is impacted by developments in China, which is Australia's premier trading partner. Last week's surprisingly upbeat Chinese GDP numbers boosted the Aussie, while news of further housing market weakness on Thursday weighed.

In terms of China, this week sees an empty release calendar, which should give a greater impetus to the domestic inflation figures. However, we would be wary of any ad hoc announcements by authorities aimed at stimulating the economy, viewing them as supportive of the Aussie currency.

Developments in the Middle East matter, too. Analysts note a rise in oil prices linked to any increased tensions relating to Iran could boost the Aussie.

This is because Australia is an energy exporter and the AUD therefore aligns positively with rising prices.

Developments in U.S. bond markets will also be considered. Rising U.S. bond yields have proven to be headwinds for equity markets and should they resume their march higher, AUD will come under pressure.

But should bond yields retreat from their highs, AUD can find some breathing room to advance.

In short, a strong week for stock markets could deny GBPAUD any further upside.

Image © Adobe Images

The British Pound found itself under pressure following the release of a tranche of domestic figures that pointed to a slowing economy, but the currency could find redemption should this week's PMI figures beat expectations.

"We still have... flash PMIs and labour market data to be published. As has been seen in past meetings, singular data points can have the power to influence a rate decision (even if they are then revised). The risks are certainly tilted towards a further hike from the Bank of England," says Ellie Henderson, an economist at Investec.

Should expectations for a further hike build, it could prove supportive of Pound Sterling.

Employment figures were due last week but were delayed by the ONS for technical reasons and are now set for release on Tuesday at 07:00 BST, and investors will be looking for signs of 'slack' in the labour market to back a growing expectation that the Bank of England has completed the rate hiking cycle.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The headline unemployment rate is expected to be unchanged at 4.3% in August. Meanwhile, the rolling three-month employment figure is expected to show a contraction of 195K workers.

Should the numbers beat expectations, the Pound could ascend against the Australian Dollar, but we would expect gains to be limited simply by observing the Pound's inability to rally on upbeat data (the inflation beat last week is a case in point).

The UK PMI survey comes at 09:30 on Tuesday and gives a timely snapshot of economic performance. The PMIs have been increasingly important to the currency market, which is now heavily invested in relative economic growth rates.

This means currencies with higher growth potential are favoured over those with a weaker outlook, as interest rates are likely to remain elevated for longer in the outperformers.

A services PMI of 49.5 is expected, with the manufacturing PMI anticipated at 44.6. The rule of thumb is that the Pound will move according to whichever side of expectation the data lands: higher on a beat, lower on a miss.

"If the forward-looking balances in recent activity surveys are anything to go by, October's flash S&P Global/CIPS PMI surveys are likely to signal a further contraction in private sector output," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes