Australian Dollar Back Under Pressure Following RBA Minutes, Chinese Data and Slide in Consumer Confidence

- Written by: Gary Howes

- AUD falls against most peers

- RBA minutes suggest low likelihood of another hike

- Chinese data shows economy losing steam

- Aussie consumer confidence back to Covid-era lows

Image © Adobe Images

The Australian Dollar is under pressure following new communication from the Reserve Bank of Australia, disappointing consumer confidence figures and Chinese data which suggests economic growth in Australia's largest trading partner continues to disappoint.

China reported industrial production grew 5.6% in the year to April, up from 3.9% in March, but this was a significant undershoot against economist expectations for a reading of 10.9%.

Fixed asset investment - a key driver of industrial commodity demand which is particularly relevant to Australia - rose 4.7% in the year to April, undershooting expectations for a rise to 5.5%.

Also disappointing were retail sales which were higher at 18.4% year-on-year (a figure flattered by the fact many major cities were locked down a year ago), an undershoot on expectations for 21%.

"China's April data largely missed expectations which increased concerns that its economic recovery momentum has failed to sustain," says Ho Woei Chen, Economist at United Overseas Bank (UOB).

"The AUD is down against most G10 currencies as Chinese data disappointed overnight," says Noah Buffam, an analyst at CIBC Capital Markets.

Domestic developments were also largely unsupportive with the RBA proving it remains a reluctant hiker despite surprising investors by raising interest rates at the start of May.

Minutes covering the May 02 meeting showed RBA board members saw a finely-balanced argument for hiking interest rates, suggesting the hike was a case of providing insurance against any upside surprise in inflation down the line.

"The RBA May minutes were also released and showed a cautious Bank that hiked to try to mitigate some of the upside risks from leaving inflation above target for 4 years," says Buffam.

The market judged that the hike therefore merely brings forward the hike that investors had expected at a later date from the RBA, therefore the peak in Australian interest rates is unlikely to shift higher from here.

"RBA minutes showed the decision to hike rates earlier this month was a close call, have knocked the AUD back a bit," says Kit Juckes, Head of FX Research at Société Générale.

The Pound to Australian Dollar exchange rate (GBPAUD) rose a quarter of a per cent on the day in the hours following the release of the minutes to 1.8740 as the pair continued to retrace the losses suffered earlier in May.

The Australian to U.S. Dollar exchange rate (AUD/USD) meanwhile retreated a third of a per cent to 0.6676. "The AUD/USD remains within its 3-month trading range of 0.6565 and 0.6806," says Buffman.

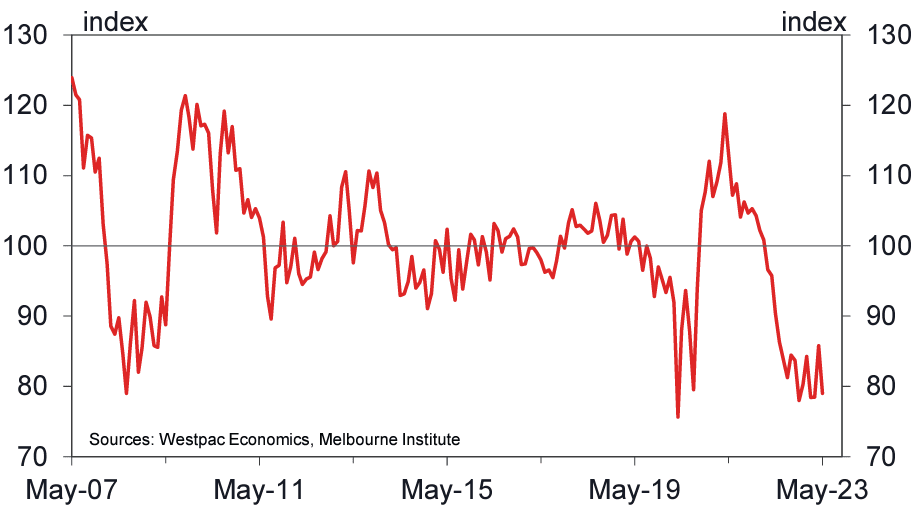

Raising the bar to further rate hikes at the RBA was the release of Westpac consumer confidence data that showed an unexpectedly large decline in sentiment.

The index came in -7.9% month-on-month to 79, having been boosted by nearly 10% m/m in April, taking it back to pandemic-era lows.

"The RBA's rate hike had had its intended effect of pushing households back into being conservative in their consumption decisions," says David Forrester, Senior FX Strategist at Crédit Agricole.

Details of the report revealed family finances were down 10% m/m and the outlook for the economy a year ahead declined by 9.5% m/m.

"While the budget provided some relief from higher electricity bills and increased the dole, the consumer confidence data suggest it will not lead to another burst in household consumption," says Forrester.

The Australian Dollar remains one of the laggards of 2023, falling against all its G10 peers apart from the Yen and Krone.

A dovish RBA and lacklustre Chinese economic rebound have been key factors behind the Aussie's relative underperformance, something that might be exacerbated by an increasingly dour consumer.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes