Australian Dollar: Lowe Targets 2.5% Cash Rate

- Written by: Gary Howes

Image © Crawford Forum, Reproduced Under CC Licensing.

Reserve Bank of Australia Governor Philip Lowe confirmed interest rates would likely double from current levels meaning they could top out below where investors are currently expecting, potentially undermining the Australian Dollar.

In a speech delivered midweek Lowe said the RBA would continue to hike the cash rate in order to return inflation back to the 2-3% range, hoping to ensure such hikes don't come at the expense of the economy.

But in response to a question Lowe said the RBA estimates the neutral rate as being around 2.5%.

The admission is unusual in that most central bankers have become loathe to place any targets on where they see interest rates heading, given the uncertainty posed by inflation.

"How quickly we need to get there and indeed whether we need to get there will be determined by the inflation outlook," he said.

The neutral rate is that which means interest rates are no longer stimulatory, but neither are they contractionary, and is therefore considered a sweet spot for a central bank in that policy is neither inflationary nor deflationary.

It also gives a clear path as to where Australia's basic interest rate is going from the current 1.35%.

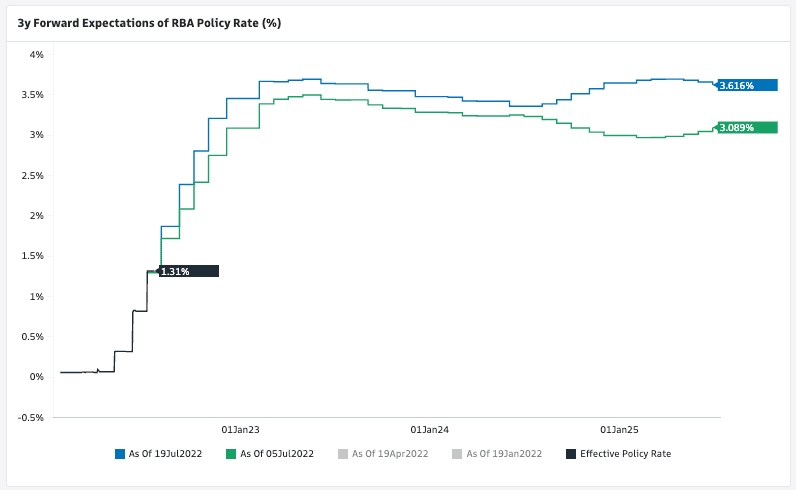

Currently money market pricing shows investors are placing the peak in the RBA's rate at 3.68% by June 2023, which suggests the RBA and the markets are misaligned.

Above: Market implied expectations for the RBA's cash rate. Image courtesy of Goldman Sachs.

If Lowe delivers on his guidance and the RBA raises rates steadily to somewhere close to 2.5%, and then stops, the market will have to readjust expectations lower.

The Australian Dollar's current value is to a great degree a function of the market's expectations for where interest rates are heading, therefore a readjustment lower in rate expectations could well mean a readjustment lower in the Australian Dollar.

Lowe's guidance therefore highlights one of the key downside risks facing the Aussie Dollar going forward.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

But, the Australian Dollar is a pro-cyclical currency that would benefit if the global economy finds its feet again and economic growth rates start to pick up.

Australia also has a strong commodity base that would mean its terms of trade remain positive for some time yet given the ongoing war in Ukraine, offering a fundamental support for its currency.

Much of the currency's outlook also rests with China whose has stuttered under the weight of the zero-Covid policy, but expect a sharp rebound for Australia's most important trading partner if zero-Covid is quietly eased.

An improvement in global market sentiment and economic growth prospects would therefore almost certainly outweigh any concerns on the outlook for RBA interest rates and mean the Aussie Dollar would likely appreciate.

Another consideration for the Australian Dollar is what other central banks are doing; if they continue to hike but the RBA sits in the slow lane as it targets 2.5% as per Lowe's suggestions then the currency could suffer.

But if other central banks ease back on their hiking agenda as inflation rates start to rapidly cool then other currencies will face a similar readjustment in expectations too.

So while on at face value Lowe's guidance is at odds with the market and suggests downside risks to the Aussie, there are numerous moving parts that are on balance supportive.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes