Australian Dollar Forecast to Fall 4.0% if Trump Wins by CBA

- U.S. vote heading for protracted delay

- U.S. Dollar rallies

- Australian Dollar drops, could go notably lower

- But should Biden prevail, AUD can go 2.0% higher

Image © Adobe Images

- GBP/AUD spot rate at time of publication: 1.8354

- Bank transfer rate (indicative guide): 1.7712-1.7840

- FX specialist providers (indicative guide): 1.7920-1.8189

- More information on FX specialist rates here

The Australian Dollar and other 'commodity currencies' lost ground against major peers such as the Pound, Euro and U.S. Dollar on signs U.S. politics were headed for acrimony amidst a tightly fought presidential election, and analysis from Commonwealth Bank of Australia suggests further losses are possible.

The Dollar was bid and the Aussie Dollar sold amidst heightened volatility after U.S. President Donald prematurely called himself the winner of the presidential election and signalled the potential for the election to enter a protracted legal battle.

The Australian Dollar relinquished earlier gains and went lower by over a percent after Trump told supporters, "we will win this, as far as I am concerned we already have"; he added he plans to go to the U.S. Supreme Court and wants all the voting to stop. "Frankly, we did win this election," he said.

The contested result is widely held by analysts to favour 'safe haven' currencies such as the U.S. Dollar, Yen and Franc but disadvantage emerging market currencies and the antipodean New Zealand and Australian Dollars.

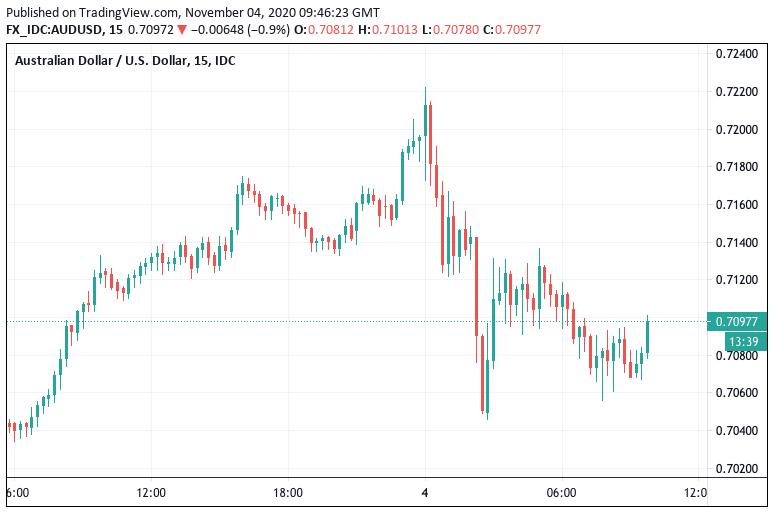

Above: AUD volatility against the USD over the past 24 hours.

"Within the G10 this implies underperformance of the antipodeans and CAD," says Marvin Barth, a foreign exchange strategist at Barclays. "An unclear election result jolts already high post-pandemic uncertainty amid a worsening global growth outlook, raising potential volatility and risk aversion. While the length and seriousness of the delay remain unknown, the outcome most feared by markets skews towards risk reduction."

Trump had done better than was predicted by pre-election polling and modelling, and with the race looking too tight to call the final result might not be known for days, which is looking like an increasingly likely scenario.

Trump knows postal ballots are likely to favour his opponent and he will likely therefore attempt to use the courts to try and discount as many ballots as possible, particularly where they are yet to be counted, including Michigan, Wisconsin and Pennsylvania.

If lawyers get involved, a conclusion to the election could potentially take weeks.

The Australian Dollar could therefore be in for a period of weakness.

The Pound-to-Australian Dollar exchange rate has advanced back to 1.8282 amidst the developments, confirming Sterling's position as a mid-table performer amidst the political turmoil. However, against the U.S. Dollar the Aussie's position was more precarious with the AUD/USD exchange rate sinking by 1.67% to reach 0.7073.

Above: GBP/AUD short-term volatility. Lock in current levels to protect your budget, or consider automatically booking your preferred exchange rate, find out more here.

Analysis from Commonwealth Bank of Australia (CBA) suggests a substantial decline in the Australian Dollar awaits if, after all the turmoil, Trump emerges as the winner.

CBA have modelled a scenario whereby Trump retains office, the Democrats retaining their majority in the House of Representatives and the Republicans keep their majority in the Senate.

"This is the scenario the market is currently pricing," says Joseph Capurso, a foreign exchange strategist at CBA in Sydney.

"Should President Trump win, we expect the USD to increase significantly by 4% over one to two months. We expect AUD/USD to fall by 4%. By contrast, the USD increased by 6% in 2016 following President Trump’s unexpected victory. As incumbent, President Trump’s campaign promises are likely to be less radical than in 2016," adds Capurso.

A second scenario being anticipated by CBA involves a narrow win for Biden but the Republicans maintain control of the Senate.

"We judge a Trump win is being priced by markets following the initial results. If results swing towards a Biden victory as mail‑in votes are counted, we expect currency markets will unwind initial moves. We expect USD can initially fall by around 1% and AUD/USD can jump around 2%," says Capurso.

"Outside of initial currency moves, we expect the USD to fall, and AUD/USD to lift, modestly by 2%‑3% over one to two months," adds the analyst.

A third scenario anticipated by CBA would see Biden becoming President, the Democrats keeping their majority in the House of Representatives and winning a majority in the Senate.

This 'blue wave' narrative was seen as the most likely outcome heading into the vote by those market participants who had been following the pre-election polling and modelling.

Under this scenario a generous and decisive fiscal support package would have been guaranteed, which was tipped by analysts to support stock market valuations and currencies with a high correlation with stocks, such as the Australian Dollar.

Market price action and subsequent developments suggest the 'blue wave' scenario is now out of favour.

"It will take a long time – possibly several weeks – to count every vote. The legal disputes about the votes will continue. Legal disputes about when to stop counting votes have been ongoing for several weeks. A recount of votes can occur in some swing states because of automatic triggers and legal disputes," says Capurso.