South African Rand Outperforms as Dollar-Bulls Take a Breather

- GBP/ZAR is trading down at circa 17.15 after the Rand was propelled higher by US Dollar weakness

- Global factors including the fluctuations of the USD are considered main influencers of the Rand

- Longer-term outlook still favourable to Dollar and therefore Rand-negative however.

© kasto, Adobe Stock

The Pound is over half a percent down against the South African Rand with most of the damage appears to have been done by the South African unit which is seen enjoying a bout of relief now that the Dollar has pared some of its recent gains.

The consensus is that the Rand gains stemmed from global factors - mainly a weakening Dollar following the Federal Reserve's May policy meeting.

The Rand is highly negatively correlated to the US Dollar, which means when the Dollar weakens the Rand rises, as seems to be the case now.

"Just to remind those that hang the local unit’s performance on domestic factors: roughly 60% of rand movements are driven by global factors — the value of the US dollar and commodity prices," says Isahh Mhlanga, an analyst with RMB. "Significant gains since December were not just a reward for a great turnaround in SA’s fortunes but that is was due to US dollar weakness."

The Dollar has been in recovery mode over recent weeks, apparently spurred on by a rise in the yield being paid on US government debt which is in turn being driven by the pursuit of higher base interest rates at the US Fed.

Markets have increased their expectations for an interest rate hike in June, according to market measures of the probability with the prospect of a fourth rate rise this year now looking increasingly possible.

"Everything considered, the statement was not as hawkish as we had expected it to be, but it was not dovish either," says Mhlanga, yet at the same time the market reaction revealed a hawkish bias (in favour of expecting higher rates) "The probability of a June hike on the fed funds futures has jumped to 95% from 90% the day before," he adds.

Regardless of the varying interpretations, the Dollar weakened immediately after the meeting, which had the effect of strengthening the Rand.

"The dollar dipped yesterday after the Fed policy meeting, giving back to the rand and other emerging market currencies. We have maintained that, with no significant local events on the horizon, the rand and the bond markets will be susceptible to global market movements," says Zaakirah Ismail FIC strategist at Standard Bank.

This helped the Rand across the board, including against the Pound which it is trading at 17.15 on the interbank market currently.

But what of the future impact of global factors on the Rand, including the US Dollar?

Whilst every analyst and their dog have a theory about the US Dollar and why it is going up or down, several of the most recent analysts view argue for more upside for USD - something which would put a swift end to the Rand's current revival.

François Dupuis, vice-president and chief economist at Desjardin is in little doubt that the Fed will raise interest rates once again in June, suggesting a bullish outlook for USD.

"A new key rate increase in the United States should be ordered in June," says Dupuis, adding, "The big question is whether the Federal Reserve will order a total of three or four 0.25% increases in 2018. For the moment, we are sticking with our scenario of three increases, but both assumptions are nearly equally probable."

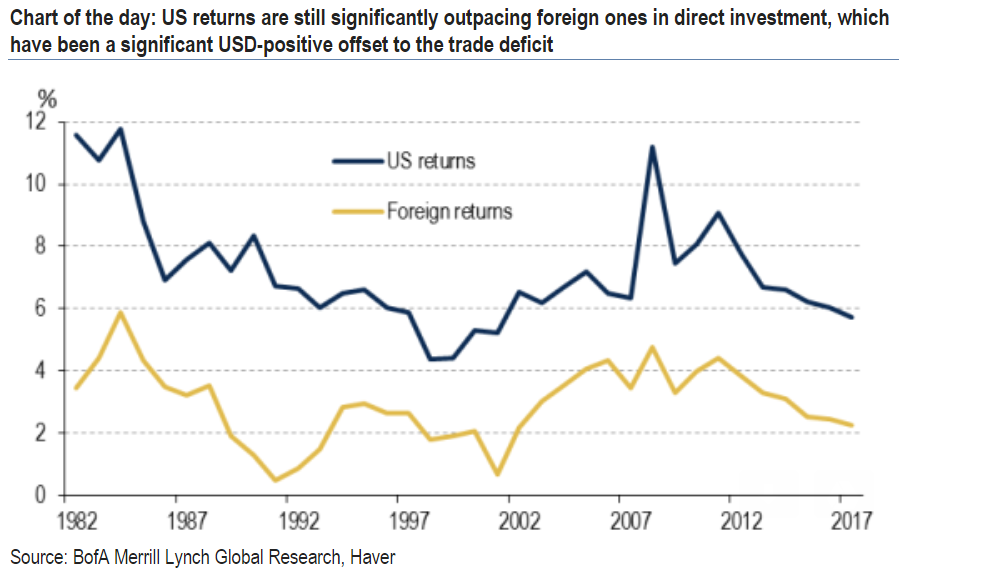

Ever wondered why the Dollar keeps going higher even though the country is running a budget and current account deficit?

According to John Shin, FX analyst at Bank of America Merill Lynch, it is because of foreign direct investment (FDI) inflows. These are profits US investors earn from the investments they have made abroad. When repatriated they increase demand for Dollars and help offset the deficits in other areas such as goods trade. The US runs a net surplus in FDI as shown on the chart below.

The FDI surplus is the basis for Shin's basically Dollar positive forecast both in the short and long-term.

"The US has maintained a surplus in investment income also in part due to holdings more heavily weighted in riskier assets. This income supports stability in the US current account deficit, which also supports a modestly USD-positive environment," says the analyst.

Therefore it could be that this pullback by the Dollar is temporary, and ZAR can expect to feel the heat agains soon.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.