Pound-to-Rand Rate's Forecast for the Week Ahead

The GBP/ZAR exchange rate is likely to continue falling and our technical studies eye 14.50 as a potential target.

The South African Rand's appreciation against Sterling remains is set to continue and and we expect further GBP/ZAR declines in the medium-term as the pair falls to the next target at 14.5000 (current rate 16.8500).

The monthly chart - which gives us an overview of longer-term trends - shows that the pair has been in a long-term decline, ever since it peaked at 25.78 in January 2016.

From our perspective, this downtrend looks incomplete and we foresee another leg unfolding which should take the exchange rate down a further step to at least just above the level of the 200-month moving average at 14.50.

Although GBP/ZAR recovered during most of 2017, rising from the 15.45 lows to the 19.08 highs, it has rolled over and sold off heavily in December on the back of a fundamental shift in political power in South Africa.

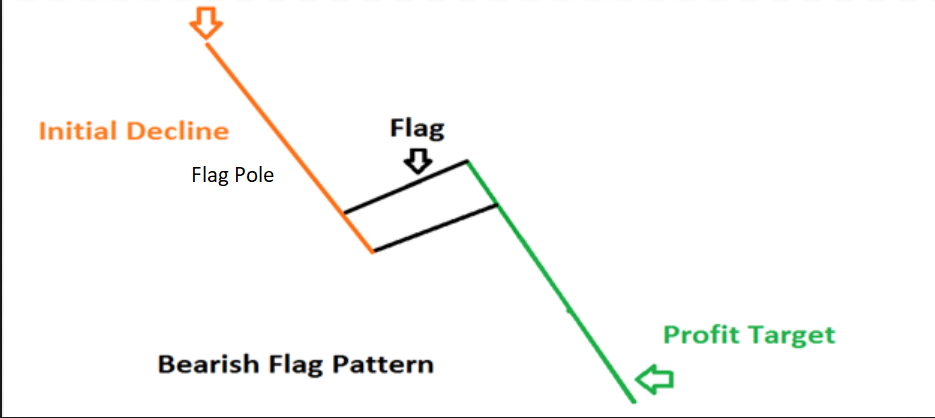

On the weekly chart, we can see the move down in more detail and it strongly resembles a bearish flag pattern, which also strongly suggests more downside on the horizon.

A break below the 16.40 lows would trigger more downside which would probably lead to a target at 15.50 and the March 2017 lows.

On the daily chart, we can see the flag pattern in more detail. The move down from 19.00 to 16.50 looks like the 'flagpole' and the consolidation since the start of 2018, the flag square.

The length of the flagpole provides a guide for estimating the length of the follow-through lower.

Even after the 15.50 lows are achieved there may be yet more downside beyond that on the horizon as the exchange rate falls to the longer-term downside target of 14.50.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events for the South African Rand

The Rand remains very much tethered to the fortunes to which it is inversely correlated, thus the Dollar's current weakness translates into Rand strength.

"Rand movements will primarily remain a function of EUR/USD, but within that broad theme it should remain an outperformer," says Rand Merchant Bank (RMB) Analyst John Cairns.

The political changes which ushered in the new ANC leadership in December appear to be filtering through after South Africa's National Prosecuting Authority (NPA) said it was probing seven corruption cases.

According to Cairns, this should help shore up confidence and provide a backdrop of support for the currency.

In addition, "December’s trade data could spur optimism as it often surprises to the upside," says Cairns of the trade balance released at 12.00 GMT on Wednesday, January 31.

Of Thursday’s vehicle sales data, which is released at 11.30, Cairns says, it should, "provide us with the first indication of economic activity post the ANC Conference, although it is probably too early to see the effects of surging confidence. "

Data and Events for the Pound

The main data release in the week ahead for the Pound is survey data for Manufacturing and Construction in January, in the form of Markit IHS's purchasing manager indices (PMIs).

These are normally a reliable forward indicator of activity and trends within the broader economy and economists use them to predict growth. Markets will be looking for confirmation that the better-than-forecast economic momentum enjoyed by the UK economy in the final quarter of 2017, confirmed in last week's GDP data, has extended into the new year.

Manufacturing PMI is out at 9.30 GMT on Thursday, February 1 and is expected to rise to 56.5 from 56.3 previously.

Global investment bank TD Securities say economists are being too optimistic about Manufacturing and the index will fall to 55.9 instead of rising to 56.5; an outcome that would certainly weigh on the Pound we believe.

"We’re looking for a modest pullback in the manufacturing PMI after last month’s larger nearly 2pt decline, with the index falling from 56.3 to 55.9 in January. We expect to see some of the weakness in the flash Eurozone print reflected in the UK outcome," say TD Securities in a briefing to clients ahead of the new week.

Construction PMI is out at the same time on the following day and is forecast to fall to 52.0 from 52.2 in December. Note that the sector is in recession, according to official GDP data, so some recovery will be keenly anticipated. However, construction is a small component of the UK economy and the impact on Sterling will likely be small if any. Nevertheless, clues on longer-term prospects for the economy will be key for overall sentiment.

One further event of interest to Pound-watchers in the week ahead is Bank of England (BOE) governor Mark Carney's testimony to the Lord's Economic Affairs Committee at which he will have the opportunity to comment on the state of the economy and monetary policy before the 'black-out' period prior to the next official BoE rate meeting.

Markets are keen to ascertain whether or not the Bank of England will raise interest rates in 2018, in a follow up to 2017's rate rise. Markets are anticipating this is the case, but a bullish assessment by Carney could certainly be the catalyst to a higher Sterling in the coming week we believe.

Carney's appearance in Davos last week was striking in that he hinted that he is taking a more optimistic stance on the UK economy, seeing growth picking up sharply towards the end of the year as the UK "consciously recouples" with the accelerating global economy.

He will certainly be queried on this, and the answers will be closely followed by currency traders.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.