Pound / Rand Exchange Rate Hits One-Year Best, 19.00’s Possible Suggest Technical Studies

The Pound-to-Rand exchange rate can still rise higher suggest our latest technical studies while we watch central banks for fundamental guidance.

GBP/ZAR rate briefly rose to 18.00 and touched a one year high this week as markets continued to price in expectations of a Bank of England rate rise.

The exchange rate is moving steeply higher as Pound strength is contrasted with a largely static Rand that is yet to find any reason to take a direction in either direction.

The South African Rand could be especially sensitive to the outcome of the Federal Reserve Rate meeting on Wednesday, especially given the heightened sensitivity the currency has to moves in US yields.

(South Africa government debt pays high yields; this attracts inflows of global capital as investors hunt yield which in turn bids the Rand higher. But rising yield in the US stems this flow as investors see less incentive to invest in riskier assets, of which ZAR is considered to be).

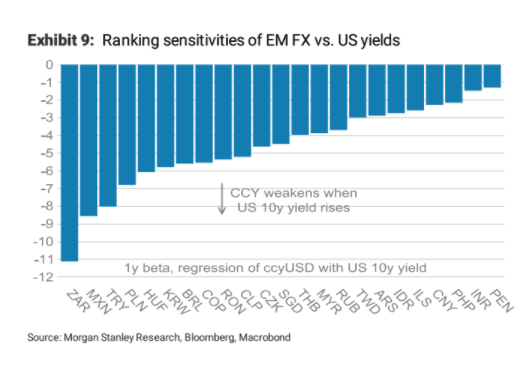

Indeed, recent research conducted by Morgan Stanley shows of all major US Dollar counterparts the Rand shows the greatest negative correlation with US 10-year yields, which are extremely sensitive to Fed rate hike expectations.

If the Fed shifts to a more cautious and dovish stance, as most analysts still seem to expect (regardless of the inflation print), then yields will fall and the Rand will likely rise given the negative correlation, and we may see a Rand recovery towards the back end of the week.

“The week started off with an increased likelihood of a Fed rate hike in December, the probability of that shot up to 60% after languishing in the low 30% for the past month or so. This increase was most likely driven by the fact that inflation looked better last week. This could be a bit of a buy the rumour sell the fact scenario, and we can see "risk-currencies" weaken leading up to the interest rate decision,” says a note from Johannesburg-based Treasury One.

Also keep an eye on Thursday’s SARB decision. Consensus is for a 0.25% cut but some suspect the SARB might bottle the move in light of the rise in recent oil prices.

“The increase in price could force the MPC to sit on their hands as the oil price could affect the inflation forecasts. Two weeks ago it was almost a dead certainty that the SARB would cut, but recent developments could sway the decision to no cut,” say Treasury One.

On the margin, leaving rates unchanged would be positive for ZAR as it defends the country’s high yields on bonds.

Technical Outlook Suggests Much More Gain

The GBP/ZAR exchange rate has broken out above a triangle pattern which has finished forming on the weekly chart.

It has well surpassed our previous target at 17.40 and continues its very bullish trend higher.

The triangle formed after the pair bottomed at the March 2017, 15.4300 lows – the fact it has completed five constituent waves (a-e) and has broken sharply higher is evidence it has finished forming and broken out higher.

The triangle looks very much like a reversal pattern and indicates the long-term downtrend may be reversing.

GBP/ZAR has also broken above a major long-term trendline in another bullish sign for the pair.

This increases the chances of a continuation higher and we expect the current strong up-move to extend, assuming confirmation from a break above the 18.0400 highs.

Such a break would probably lead to an extension higher to the next target at 18.6200 just below the 200-week moving average, as moving averages present tough obstacles to trending markets and there is a chance the pair could stall at the MA.

The true target for the breakout is much higher than the 200-week MA.

The normal method of calculating the target out of a triangle is to take the height of the pattern (navy line labelled ‘X’) and extrapolate it from the breakout point higher.

A minimum target can be found at a golden mean of the height of the triangle extrapolated higher – or 61.8% of the move - which gives a ‘minimum’ target at 19.2100 (navy line labelled ‘Y’).

A clear move above the moving average, such as would be confirmed by a break above 18.6750 would probably confirm a continuation up to the next target at 19.2100.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.