SA Rand Caps Sterling’s Advance, More Robust ZAR Seen this Week

- Written by: Gary Howes

Commentators are tipping the South African Rand to enjoy a more robust week of trade in global FX markets over the course of the coming week.

The call comes as the volatility surrounding the recent no-confidence vote in President Jacob Zuma fades.

The Rand rose on news that the vote would be held in secret with markets betting that this was the best shot the country had of removing its market-unfriendly leader.

The gains were however reversed once the result of the vote became known; Zuma survives.

The agenda quickly moved to Moody’s - markets were concerned the ratings agency might be looking to review their ratings on South African debt.

“On Friday night Moody’s released a statement stating that they won’t do a rating review on South Africa rather saying that nothing fundamentally has changed in South Africa to warrant a rating review. This confirmation by Moody’s could serve to stabilise the Rand this week, and we could look for a week of sideways trading, barring any political events,” says a note from Treasury One, the foreign exchange brokerage.

Treasury One reckon this could be a Rand positive week as markets return to normal and investors start looking at Emerging Markets again.

Keep an eye on the US stock markets and South African bond market to gauge whether investors are seeking risk again.

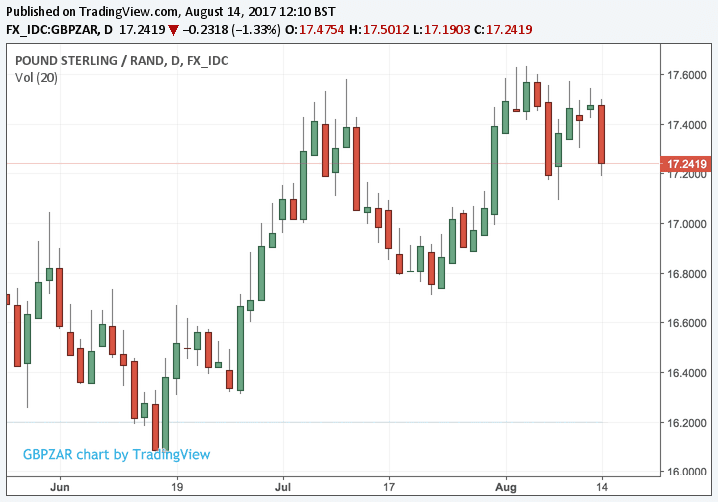

Looking at the Pound to Rand exchange rate, 1 GBP buys R17.23 on the open market, down from early August highs of 17.60.

This is however substantially better than the ~16.00 you could pick up back in June.

So the trend in GBP/ZAR does still remain up but we would point out that the trend is losing momentum with 17.60 looking like a difficult nut to crack.

We see the potential for any Rand strength to run GBP/ZAR back down to 16.80 where more substantive buying interest might be found.