South African Rand Rallies Like Rhino in China Shop on Hawkish SARB Surprise

- Written by: James Skinner

"The implied starting point for the rand forecast is R18.06 (23q2) to the US dollar, compared with R17.32 at the time of the previous meeting. Currency markets are expected to remain volatile" - South African Reserve Bank Governor Lesetja Kganyago.

Image © Adobe Images

The Rand rallied across the board in the penultimate session of the week after the South African Reserve Bank (SARB) raised its interest rate further than was expected and indicated that further increases would be likely if local inflation risks persist through the months ahead.

South Africa's Rand extended an earlier rally against a retreating Dollar while reversing earlier gains in GBP/ZAR and EUR/ZAR to leave the greenback, Sterling and the Euro nursing notable losses on Thursday in response an evident hardening of the SARB's hawkish resolve.

This was after three out of five members of the Monetary Policy Committee voted to lift the repo rate by half a percentage point to 7.75% on Thursday in what was a hawkish surprise for a market consensus that had been looking for only a quarter percent increase to 7.5%.

"The revised repurchase rate is now less accommodative and is more consistent with the current view of risks to inflation," Governor Lesetja Kganyago said.

"The aim of policy is to anchor inflation expectations more firmly around the mid-point of the target band and to increase confidence of attaining the inflation target sustainably over time," he added in a statement.

Above: GBP/ZAR shown at 15-minute intervals alongside USD/ZAR and EUR/ZAR. Click image for closer inspection.

Above: GBP/ZAR shown at 15-minute intervals alongside USD/ZAR and EUR/ZAR. Click image for closer inspection.

Thursday's increases was larger than expected and came after earlier released Statistics South Africa figures suggested that inflation rose from 6.9% to 7% in February, leading the SARB to raise its forecasts in anticipation of a lengthier battle to return inflation to the target.

Previously, inflation was expected to fall back to within the 3% to 6% target band by the end of this quarter but the new forecasts suggested on Thursday that this could now take until some time in the third quarter and that inflation is likely to average 6% for the year, up from 5.4% in the prior forecasts.

But while the main inflation is now seen higher than previously, underlying domestic inflation pressures are still viewed as well-contained by an already-fragile economy that has been further undermined by this year's increase in equipment failures at Eskom and the resulting power cuts.

"The rise in South Africa’s headline inflation rate has been shaped primarily by fuel, electricity and food price inflation," Governor Kganyago said on Thursday.

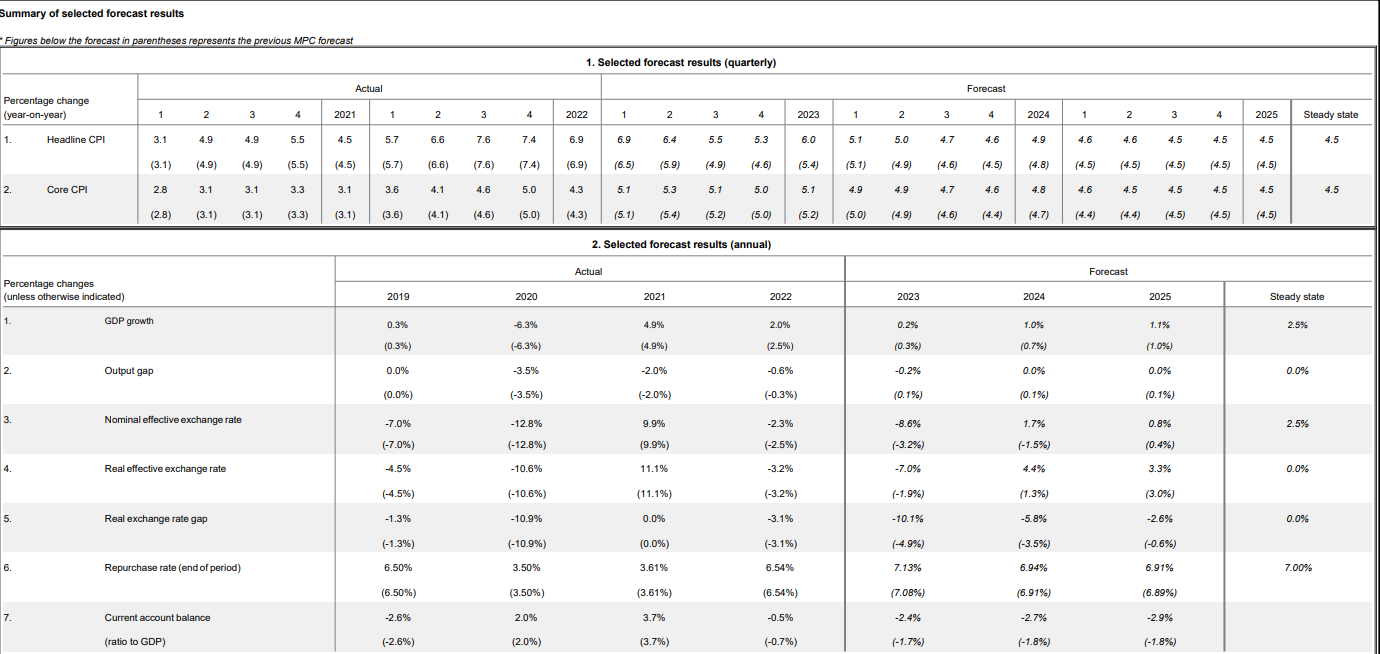

"Our forecast for core inflation is largely unchanged at 5.1% in 2023 (previously 5.2%) and 4.8% and 4.5% in 2024 and 2025," he also later added.

Above: South African Reserve Bank forecasts for March. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: South African Reserve Bank forecasts for March. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

With domestic price pressures still faint and much recent inflation being imported through food, fuel and electricity prices it's possible, if not somewhat likely, that Thursday's decision was designed to support the currency as much as it was intended to contain inflation expectations.

Previously, and in January's policy statement, Goveror Kganyago noted that a deteriorating outlook for the global economy had meant "the risk of currency weakness has increased" with possible implications for the inflation outlook.

Exchange rates can impact inflation by raising or reducing the prices of imported goods and services, and Thursday's monetary policy statement suggested that inflation risks would rise further if the USD/ZAR pair rises back above 18.06.

"Recent weeks have seen further sharp depreciation and then some reversal as sentiment shifted abruptly in the wake of policy decisions in some major advanced economies," Governor Kganyago said on Thursday.

"The implied starting point for the rand forecast is R18.06 (23q2) to the US dollar, compared with R17.32 at the time of the previous meeting. Currency markets are expected to remain volatile," he added.

Above: GBP/ZAR shown at daily intervals alongside USD/ZAR and EUR/ZAR. Click image for closer inspection.

Above: GBP/ZAR shown at daily intervals alongside USD/ZAR and EUR/ZAR. Click image for closer inspection.