South African Rand's Budget Plan Cheered in Currency and Bond Markets

- Written by: James Skinner

"We think this budget will hold the line on stabilising the sovereign credit rating outlook, and is a net positive against a global backdrop where fiscal strain is in focus in other emerging markets" - Matrix Fund Managers.

© Lefteris Papaulakis, Adobe Images

The South African Rand rose broadly in mid-week trade while South African bond yields fell as financial markets cheered success and promises of further progress in the government's effort to improve the public finances despite a difficult economic climate.

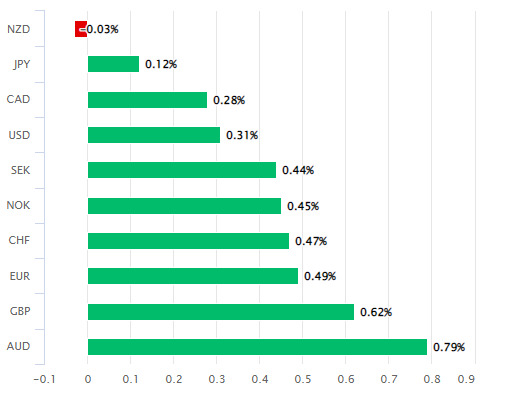

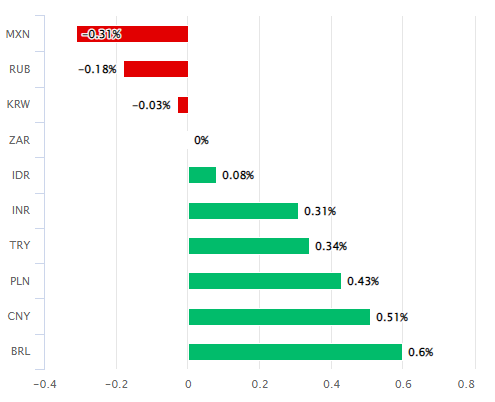

South Africa's Rand rose against all but four G20 counterparts while making gains in the bond market after the government said it has met 2022's target for the primary budget balance and expects to do so again this year.

"The fiscal consolidation strategy we adopted several years ago has (1) restrained growth mainly in consumption expenditure, and (2) allowed us to use part of higher-than-expected revenues to reduce the deficit," Finance Minister Enoch Godongwana told parliament.

"As a result, we are bringing the fiscal deficit down without resorting to tax increases or further cuts in the social wage and infrastructure. A primary fiscal surplus will be achieved in the current financial year, and this will be maintained over the medium term. This is a critical policy stance," he added.

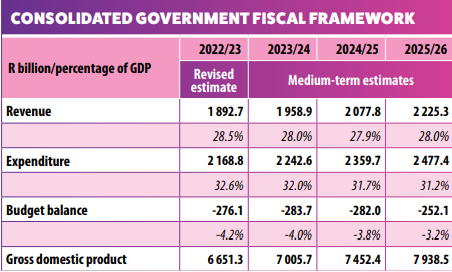

The consolidated budget deficit data below is different to the primary budget balance because the latter excludes spending on debt interest, which has risen in the last year, although National Treasury also exceeded expectations and forecasts for this deficit too.

South African Government, National Treasury.

Last year's budget update had warned of a consolidated budget deficit equal to 6% of GDP for 2022 while forecasting deficits of -4.8% and -4.2% for this year and next, although economic growth was stronger than expected last year while higher commodity prices also lifted tax revenues.

"Mainly due to this Eskom debt relief, government debt will stabilise at a higher level of 73.6 per cent of GDP and in 2025/26. This is three years later than anticipated," the finance minister said.

"There are risks to the fiscal outlook. These include a worsening of the economic outlook, a further weakening of the finances of state-owned companies, and an unaffordable public-service wage agreement. If these risks materialise, they will require us to make difficult budgeting trade-offs," the minister also warned on Wednesday.

The projected budget deficit levels are unambiguous positives for the public finances, government bond market and national currency but so too are newly-unveiled details of government plans for lightening the debt burden of troubled national electricity monopoly Eskom.

"We think this budget will hold the line on stabilising the sovereign credit rating outlook, and is a net positive against a global backdrop where fiscal strain is in focus in other emerging markets," says Carmen Nel, an economist and macro strategist at Matrix Fund Managers.

"As long as SA policy remains relatively conservative and transparent, we should be able to attract our fair share of portfolio inflows," she adds.

Above: South African Rand performance relative to G10 and G20 currencies on Wednesday. Source: Pound Sterling Live.

Frequent, widespread and severe equipment failures at Eskom have seen the country and economy cloaked in rolling power cuts for as many as 10 hours per day this last week, and there is risk of this extending for up to 14 hours per day.

But a bloated balance sheet and resulting limitations for Eskom's access to credit is one important set of reasons for why it's been unable to make much progress in restoring an adequate and reliable power generating capacity.

That has in turn made Eskom a concern for credit rating agencies, who've worried that further deterioration of Eskom finances would have spillover impacts on the public purse, although the debt plan announced on Wednesday might mitigate these concerns.

Some R337BN (£16 BN, $18.7 BN) of Eskom debt is already guaranteed by the government and R254 BN of this is now set to be taken directly onto the public balance sheet, the finance minister revealed on Wednesday.

This would free up space for fresh borrowing that could fund the necessary investments in equipment, plant and machinery.

A transcript of Finance Minister Godongwana's statement to parliament can be accessed here, and all of the relevant budget documents can be found here.