Outperforming South African Rand Benefits from SARB's Inflation Pushback

- Written by: James Skinner

"The SARB is set to continue to front-load policy tightening, which would imply that the neutral rate of 7.00% (as per the Bank’s model) could be reached much sooner than implied by the bank’s own forecast," - Matrix Fund Managers.

Image © Adobe Images

The South African Rand outperformed all comparable currencies ahead of the weekend and a barely a day after the South African Reserve Bank (SARB) sought to tamp down domestic inflation expectations and fend off currency depreciation with its largest interest rate rise for two decades.

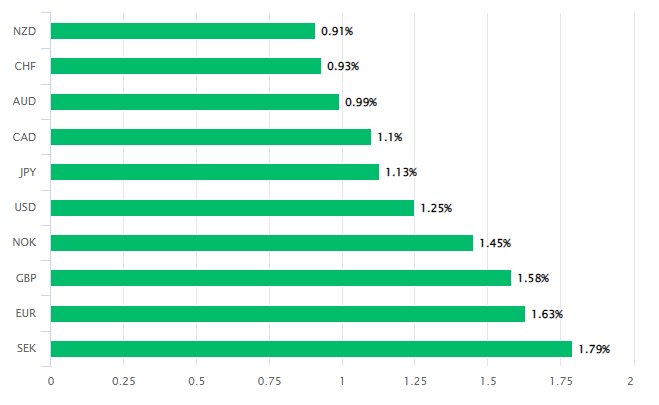

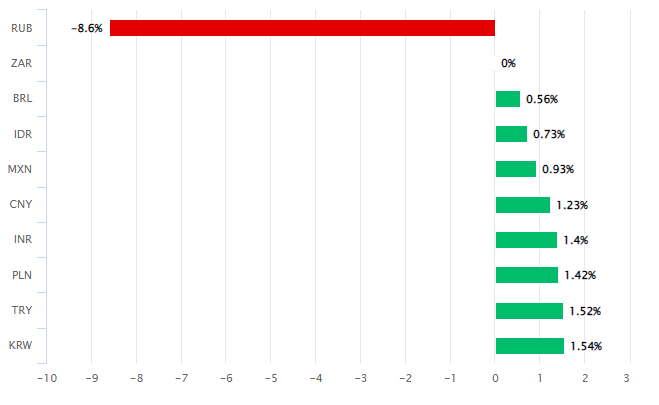

The Rand rose against all G20 currencies traded on the open market this Friday with its strongest gains coming from European counterparts as well as the Korean Won, Indian Rupee and Turkish Lira, many of which receded by more than one percent when measured against the South African currency.

"While we had expected the SARB to be more sensitive to the fragile domestic growth backdrop, the bank is firmly focused on inflation and ensuring its credibility remains intact," says Carmen Nel, an economist and macro strategist at Matrix Fund Managers.

Above: South African Rand relative to G10 currencies on Friday. Source: Pound Sterling Live.

The Rand’s strong Friday performance came hard on the heels of a South African Reserve Bank decision to raise its cash rate by 0.75% to 5.5% in a larger monetary policy step than had been expected by many economists and large parts of the financial markets.

Governor Lesetja Kganyago cited recent currency depreciation as well as increases in food and fuel prices as among the reasons for why labour costs and societal expectations of future inflation rates have risen, and it was these latter factors that catalysed the SARB’s Thursday decision

“The highly volatile oil price, a major commodity import, together with the weak domestic currency remains a key upside risk to the inflation outcome, through its effect on fuel prices. The SARB now anticipates fuel price inflation for 2022 at 38.9% (up from 31.2%),” says Lara Hodes, an economist at Investec.

Above: South African Rand relative to other G20 currencies on Friday. Source: Pound Sterling Live.

The SARB said little on Thursday about the latest prescription offered by its Quarterly Projection Model for the cash rate, which had previously advocated a “gradual” return of the interest rate toward more normal levels.

But parts of Governor Kganyago’s policy suggested that the odds have recently moved in favour of further increases in the cash rate and some market professionals see the SARB as likely to “front-load” or bring forward policy steps that might otherwise have been left until 2023 or later.

"Given that the inflation peak in the rest of the world is not yet in the base, the SARB is set to continue to front-load policy tightening, which would imply that the neutral rate of 7.00% (as per the Bank’s model) could be reached much sooner than implied by the bank’s own forecast," Matrix's Nel says.

Above: Pound to Rand exchange rate shown at hourly intervals alongside USD/ZAR.

“This would still be below the 8.00% – 8.50% level implied by the forward rate agreements (FRAs), which are assigning a substantial risk premium in light of the highly uncertain outlook,” she added in relation to the “neutral rate” estimate.

Matrix Fund Managers’ Nel said on Thursday that much about the pace at which the SARB lifts interest rates will likely depend on the policy actions taken by the Federal Reserve (Fed), which has set itself on course to lift U.S. interest rates to a “moderately restrictive” level by year-end.

Fed policy is a significant influence on all currencies although it may also be relevant that Thursday’s decision at the SARB also came in the wake of the first European Central Bank interest rate rise for more than a decade.

Above: Pound to Rand exchange rate shown at daily intervals alongside USD/ZAR.

Above: Pound to Rand exchange rate shown at daily intervals alongside USD/ZAR.

“Given a large and persistent projected breach of the SARB's 3-6% target range, we now expect policy rates to rise to a peak of +6.50% with the speed of the tightening largely dictated by Rand dynamics,” says Kevin Daly, co-head of CEEMEA economics at Goldman Sachs.

“We think that the SARB is unlikely to react to weak growth in the face of heightened inflation and currency risks,” Daly also said on Thursday.

Meanwhile, Friday’s rally by the Rand took place in a market characterised by widespread declines for U.S. Dollar exchange rates and underperformance from European currencies following the latest S&P Global PMI surveys of the continent’s manufacturing and services sectors.

Europe’s manufacturing and services sector indices slumped further for the month of July and to levels that would typically be consistent with recession.