Pound to South African Rand Week Ahead Forecast: Downside Risks Dominate

- Written by: James Skinner

- GBP/ZAR at risk from BoE & Fed policy decisions

- Downside risks for USD also a headwind for GBP

- BoE’s policy & outlook a possible further burden

Image © Adobe Images

The Pound to South African Rand exchange rate reversed its late April gains at the opening of a holiday-shortened week but could be at risk of slipping back toward last month's lows in the days ahead owing to a mixture of Bank of England (BoE) and Federal Reserve (Fed) monetary policy.

South Africa’s Rand and Sterling have both been volatile of late with each sustaining heavy losses at the hands of a strengthening Dollar during the fading light of April and in price action that lifted GBP/ZAR above 20.00 on Monday.

But the Pound to Rand rate reversed that gain on Tuesday, leading Sterling down to its lowest against the South African currency since April 21 and ahead of key policy decisions from the Fed on Wednesday and BoE on Thursday.

“So far this quarter, the rand averages R15.08/USD, weakening substantially over the second half of April as markets increasingly worried that the US would hike its interest rates significantly more than SA in Q2.22, and H2.22,” says Annabel Bishop, chief economist at Investec.

“Tomorrow night’s (SA time) FOMC meeting will be a key determinate for the domestic currency, with a 50bp hike in US interest rates factored in by the markets, although there are some worries of a 75bp hike instead, which have driven the rand particularly weaker recently,” Bishop said on Tuesday.

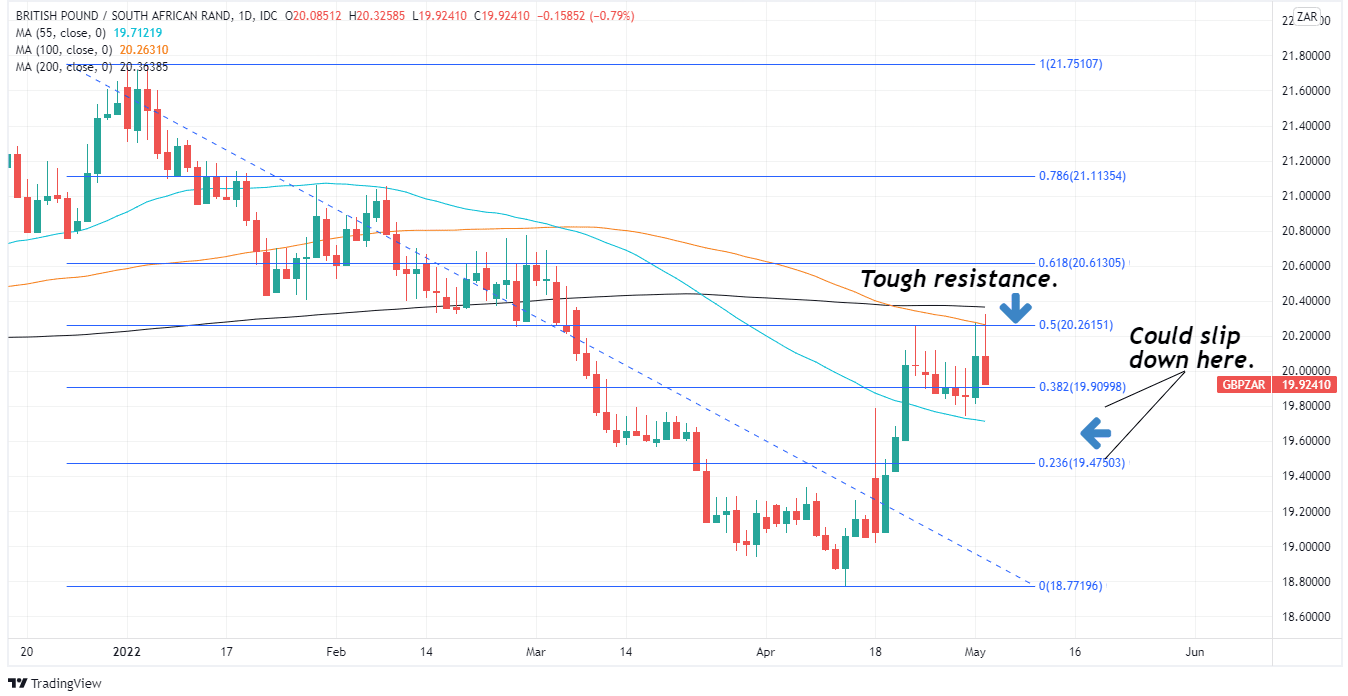

Above: GBP/ZAR shown at daily intervals with Fibonacci retracements of 2022 fall indicating likely areas of technical resistance for Sterling and support for the Rand. Includes selected moving-averages. Click image for closer inspection.

Above: GBP/ZAR shown at daily intervals with Fibonacci retracements of 2022 fall indicating likely areas of technical resistance for Sterling and support for the Rand. Includes selected moving-averages. Click image for closer inspection.

The Fed is widely expected to lift its interest rate by 50 basis points to one percent and to announce the beginning of a process intended to shrink the near $9 trillion worth of government and mortgage bond holdings held on its balance sheet, commonly referred to as quantitative tightening (QT).

“The US dollar has seen marked strength, which has changed the EUR/USD forecast, and has also impacted the USD/ZAR projections, allowing for an average of R15.40/USD for the rand this quarter, although it is at risk of further weakness,” Investec’s Bishop says.

“That is, the rand remains at risk of a weaker interest rate hike cycle in South Africa than in the US, with the domestic currency seeing severe depreciation in the past when the differential between US and SA interest rates has been significantly narrowed,” she also said on Tuesday.

This is all after a step-change in the bank’s monetary policy stance during March and April, which has seen Fed policymakers suggesting in chorus that “one or more” larger-than-usual 50 basis point increases in the Fed Funds rate could be necessary in months ahead to rein in U.S. inflation.

Above: South African Rand forecasts: Source: Investec. Click image for closer inspection.

“This week, there is also no important data from South Africa. Analysts are waiting to determine if the recent weakness in the ZAR continues, or if we see a moment of reprieve,” says Tim Powell, a director of forex at Sable International.

The resulting escalation of market expectations and subsequent uplift in U.S. bond yields has driven the Dollar sharply higher while toppling developed and emerging market currencies alike as if they were dominoes in recent weeks.

However, there is a risk of the Fed deferring the announcement on QT this Wednesday while it’s also possible, if not highly likely, that the latest economic forecasts from the BoE could sap market enthusiasm for Sterling with the both together implying further downside risks for GBP/ZAR and USD/ZAR this week.

"Give that so much is priced in, it is reasonable to question whether a ‘sell on the fact’ reaction could emerge this week for the USD, particularly if US economic releases disappoint. Included in this week’s data offering is the key US labour data for April,” says Jane Foley, head of FX strategy at Rabobank.

“That said, while the USD could be susceptible to a pull-back near-term, we are increasing seeing a build-up of risks that could keep the USD stronger for longer over the medium-term,” Foley said on Tuesday.

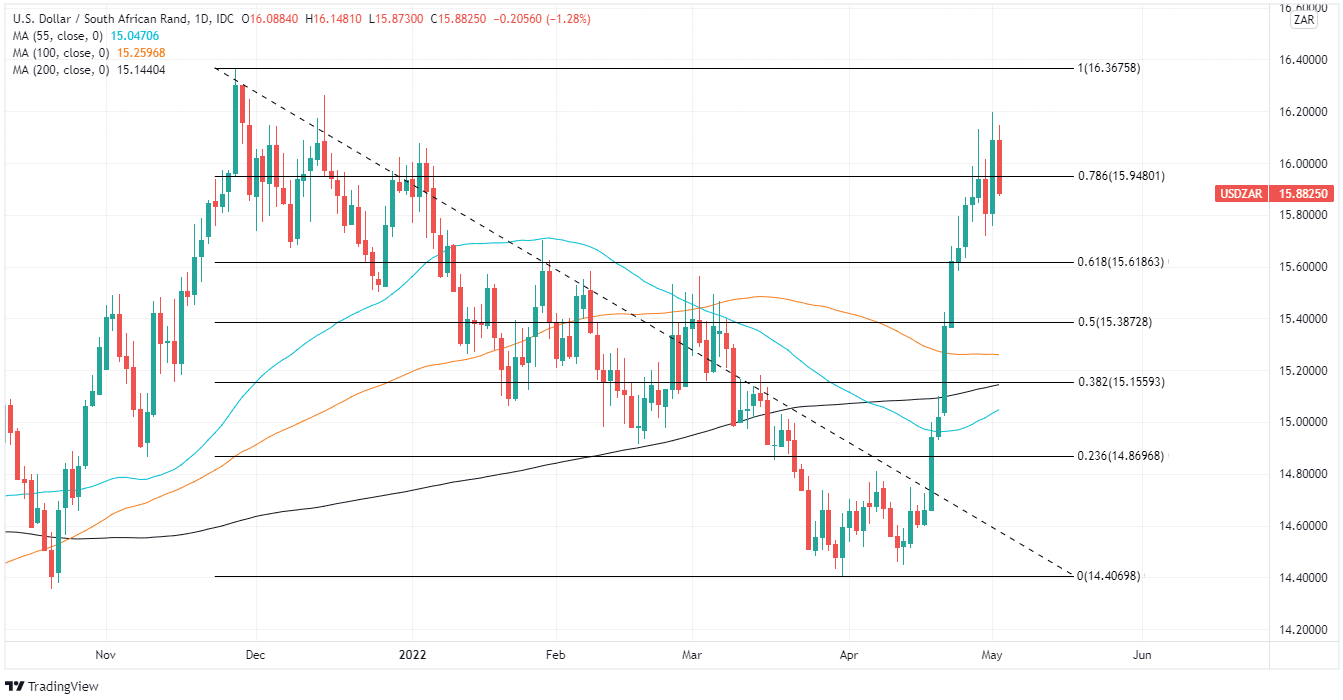

Above: USD/ZAR at daily intervals with Fibonacci retracements of November 2021 fall indicating possible areas of technical resistance for the Dollar support for the Rand. Includes selected moving-averages. Click image for closer inspection.

Above: USD/ZAR at daily intervals with Fibonacci retracements of November 2021 fall indicating possible areas of technical resistance for the Dollar support for the Rand. Includes selected moving-averages. Click image for closer inspection.