South African Rand Rally and Outlook Bolstered by Hawkish SARB

- Written by: James Skinner

- ZAR builds further gains after SARB raises cash rate

- Statement reveals upside risks to SARB rate outlook

- Two of five on MPC voted for 0.50% March rate rise

- ”Gradual normalisation through to 2024,” seen likely

Image © SARB

The South African Rand built further on earlier gains over the Dollar, Pound and other currencies after the South African Reserve Bank (SARB) revealed that it came close to surpassing market expectations for its cash rate to be lifted to 4.5% in March.

South Africa’s Rand had already notched up strong gains over most other currencies on Thursday but rallied further in the wake of the March monetary policy decision and press conference from the South African Reserve Bank.

The SARB lifted the Repo Rate in line with market expectations on the day, taking it up from 4% to 4.25%, although the Monetary Policy Committee’s (MPC) statement revealed that two of the five policymakers on the SARB’s MPC had voted for an even larger increase to 4.50%.

“Global financial conditions are more volatile at present and, with higher than expected inflation, has pushed major central banks to start the normalisation of global policy rates. On balance, and with some exceptions, capital flow volatility is expected to remain high for riskier assets such as emerging market debt and currencies,” Governor Lesetja Kganyago said in a press conference following the decision.

The minority vote for a larger increase in the SARB’s policy interest rate came as the bank lifted its forecasts for inflation, which is now expected to rise above the upper end of the three-to-six percent target band in the months ahead.

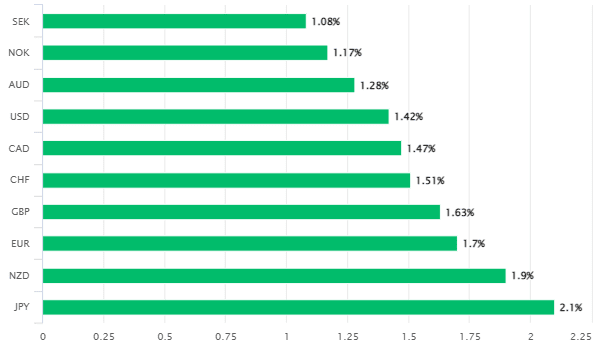

Above: South African Rand performance against G10 currencies on Thursday. Source: Pound Sterling Live.

- GBP/ZAR reference rates at publication:

Spot: 19.20 - High street bank rates (indicative): 18.53-18.66

- Payment specialist rates (indicative): 19.07-19.10

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“Headline inflation has increased well above the midpoint of the inflation target band and is forecast to breach the target range in the second quarter. Headline inflation then returns to the midpoint in the second quarter of 2023 taking into account the policy rate trajectory indicated by the bank’s quarterly projection model,” Governor Kganyago also said on Thursday.

Sharp increases in oil, gas and other commodity prices have lifted inflation across the globe including in South Africa during recent months and widely expected to raise it further before long, although there are other factors that could also add to the uplift and especially in the emerging market sphere.

“The interest rate rise follows other central banks across Africa, as they try to keep up with the more hawkish outlook by the FED. USD/ZAR is trading lower as a result, breaking the 14.68 level,” says Omar El-Gazzar, an FX dealer at Crown Agents Bank

The SARB indicated in Thursday’s update that it would look past the inflationary impact of rising commodity prices and focus instead upon the risk of too high inflation becoming entrenched by “second round effects” like rising wage packets and corporate price setting practices.

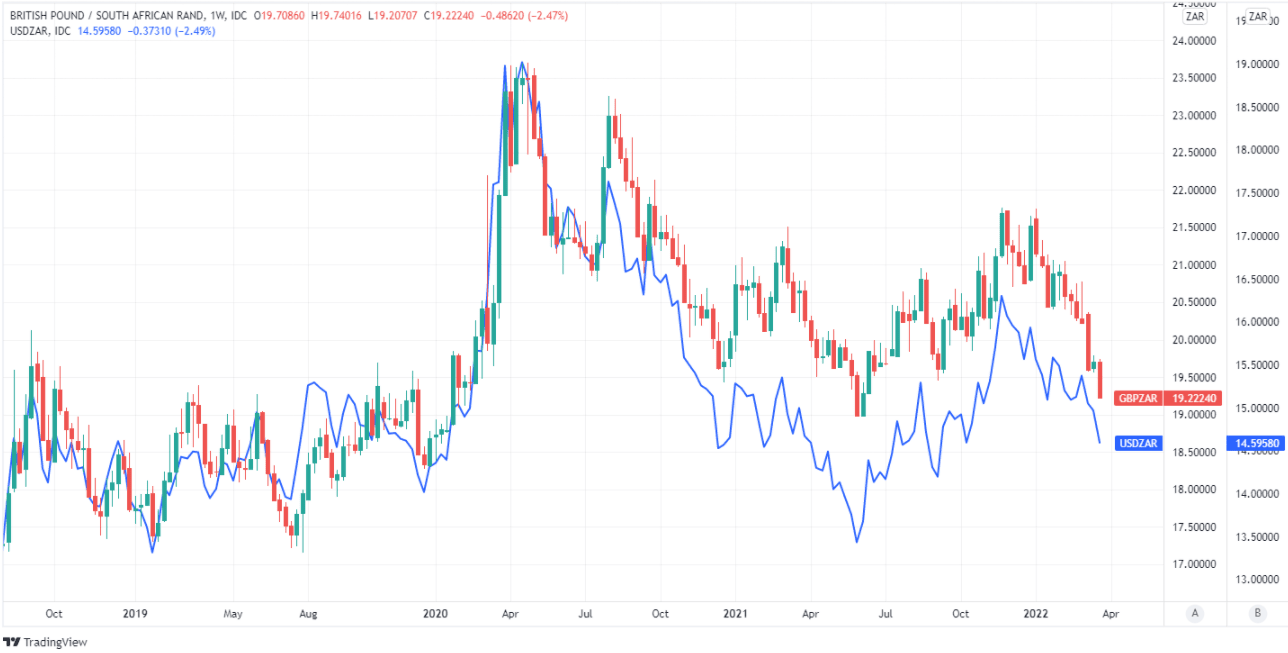

GBP/ZAR and USD/ZAR shown at daily intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The absence of strong demand-side inflation challenges the policy response of the central bank. Being aggressive could choke off the minimal demand that exists. Locally, producers have absorbed most costs without fully passing them on to consumer prices, which explains the dichotomy of PPI averaging 10% while consumer prices have remained below 6%,” says Tatonga Rusike, an economist at BofA Global Research.

Nonetheless, the bank’s quarterly projection model continued to indicate in March that “gradual normalisation through to 2024” of the interest rate, which was cut from 6.25% in March 2020, would be necessary to ensure that inflation returns to the SARB’s target over the medium-term.

In addition Thursday’s minority vote for a larger 50 basis point increase in the cash rate indicated clearly that, if anything, the balance of risks is tilted toward the upside for borrowing costs during the months ahead, which is supportive of the outlook for the Rand.

“We see further hikes of 25bp in May and September. Policy rate at end of 2022 at 4.75%. In 2023 our baseline is 75bp taking the policy rate to 5.5%. In 2024, we expect 50bps taking the policy rate to 6%. While the SARB model projects a terminal rate of close to 6.5% in 2024, we think it's unlikely. Our view is a terminal rate of 6%,” BofA’s Rusike wrote in a Monday research briefing.

GBP/ZAR and USD/ZAR shown at weekly intervals.