South African Rand Keeping GBP/ZAR’s Downward Bias Intact

- Written by: James Skinner

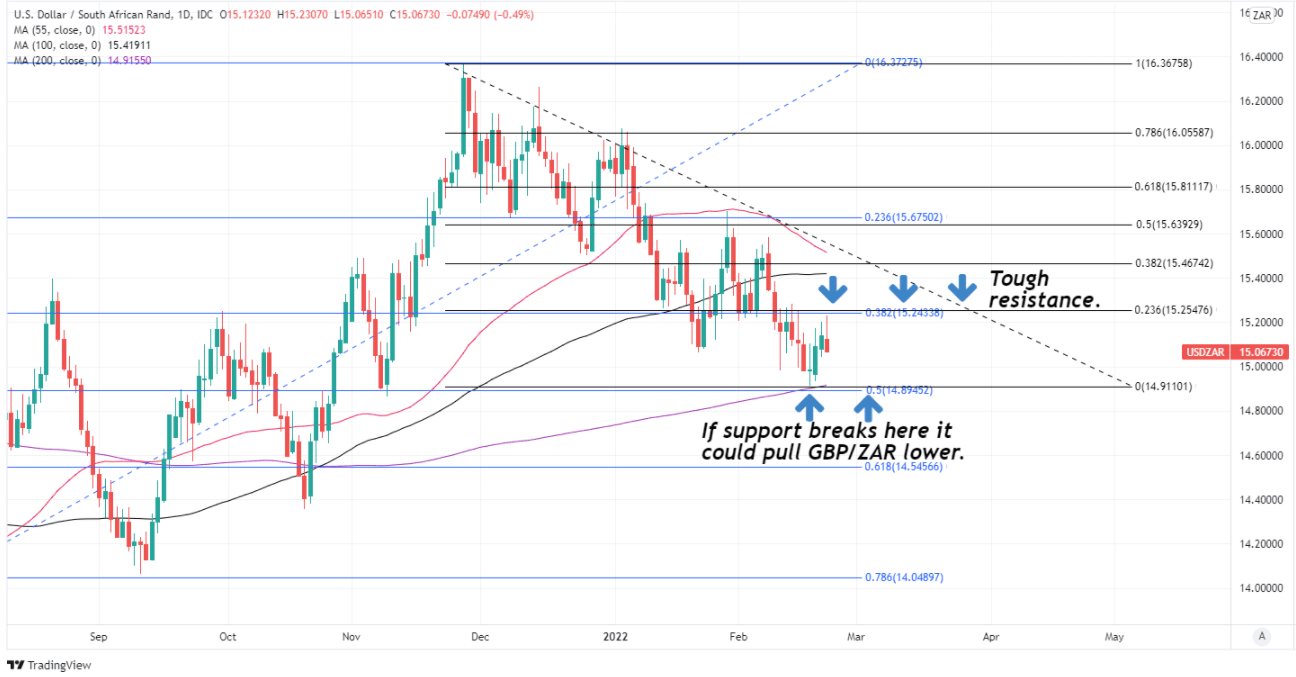

- GBP/ZAR under pressure & could be set to fall further

- Risks slide to 20.20 & below if USD/ZAR retests 14.89

- Commodities & SA debt yields posing risk to USD/ZAR

Image © Pound Sterling Live

South African Rand strength has kept downward biases in GBP/ZAR and USD/ZAR intact, although it could push the Dollar and Sterling further if this week’s national budget is warmly received by the market.

South Africa’s Rand stumbled early in the new week amid an ebb and flow of market concerns about the situation along the Russia-Ukraine border, which appeared to reach a crescendo Monday after President Vladmir Putin said that Russian soldiers would enter Ukraine’s breakaway regions.

Those losses had seen USD/ZAR and GBP/ZAR testing notable resistance levels on the charts but were quickly reversed on Tuesday as stock markets rose across the globe and international energy prices eased lower alongside major reserve currencies like the Dollar and Sterling among others.

“Last week, the rand made a number of attempts on the downside, but the 14,9000 short-term technical support level held firm,” says Walter de Wet, a fixed income and currency strategist at Nedbank, in reference to USD/ZAR. “Local focus this week will be on the Budget speech.”

Above: Pound to Rand rate shown at daily intervals.

- GBP/ZAR reference rates at publication:

Spot: 20.46 - High street bank rates (indicative): 19.75-19.89

- Payment specialist rates (indicative): 20.28-20.36

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The Rand’s Tuesday rebound was even larger than its Monday declines and indicates robust appetite for the South African unit ahead of this Wednesday’s national budget, which is likely to bring the market’s focus back onto the national debt and the outlook for the budget deficit.

Finance Minister Enoch Godongwana delivers his inaugural budget speech Wednesday and while the leadup to these events has typically been an apprehensive period for the Rand, this time has been different owing to 18-months or more of strong performance from commodity prices.

“South African rand bonds continue to attract investors with high yields, and should Minister Godongwana show a further lowering in debt and deficit projections (although substantial moves are unlikely), this would add to positive sentiment towards ZAR debt and the ZAR,” says Annabel Bishop, chief economist at Investec.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Profits from the mining sector have helped lift the tax take and may also have seen National Treasury spend less than was suggested as likely at the last budget, and all of which could potentially lead treasury to anticipate favourable progress on the budget deficit over the coming year.

That would potentially ease pressure on South Africa’s credit rating which has been a long-term burden on the Rand, and could be helpful for the currency during the remainder of the week ahead, especially if international markets remain unconcerned about developments in Ukraine.

“No credit rating upgrades are expected as a result of the budget, with debt projection needed to drop to those pre pandemic to change this, although Moody’s may possibly begin considering the removal of the negative outlook on a positive budget, if it occurs,” Investec’s Bishop wrote in a Monday research briefing.

Above: USD/ZAR shown at daily intervals.

A favourable budget could be likely to ensure the all-important USD/ZAR exchange rate retains a downside bias over the coming days, and this would in turn act as a burden for the closely connected Pound to Rand pair, which tends to closely reflect the relative performance of GBP/USD and USD/ZAR.

“It has tested the 200-DMA at 14.90/14.85 which is also the low of November. Daily MACD is within negative territory which denotes upside momentum is lacking,” says Kenneth Broux, a strategist at Societe Generale.

“In case the support at 14.90/14.85 gets violated, there would be a risk of a deeper decline towards projections of 14.45 and 14.10. A short-term bounce is expected; late January peak at 15.75 could cap the upside,” Broux and colleagues wrote in a Tuesday research note.

The Pound to Rand exchange rate would risk sliding back toward and perhaps even below its November 2021 levels around 20.2000 if the combination of this week’s events leads USD/ZAR to fall beneath 15.00 and back to last week’s lows around 14.89.

Any USD/ZAR decline below 14.89 would add to the downside potential of the Pound to Rand rate.