HSBC sees "No Fundamental Reason" for Further South African Rand Weakness

- USD/ZAR nears bottom of 15.70-to-16.36 range

- Move below 15.70 could test USD buyers’ nerves

- But downside limited as Fed eyes early rate rises

- And subdued SA inflation keeps SARB going slow

- Latest HSBC estimates suggest ZAR fairly valued

Image © Adobe Images

A hat-trick of daily gains have helped make the South African currency the top performer among major developed and emerging markets for the week.

South Africa’s Rand rallied throughout the latter half of the week, pushing the USD/ZAR rate back toward the bottom of its December range between 15.70 and and 16.36 while in the process pulling the Pound to Rand rate back down toward 21.00.

The Rand had appeared on course to revisit November’s 2021 lows but Wednesday’s Federal Reserve policy decision was followed by three successive days of gains.

“The emergence of the Omicron variant amid broad-based USD strength has weighed on the ZAR. The new variant brings higher economic uncertainties and the Fed tightening is potentially ZAR-adverse. However, we believe that recent ZAR weakness has already reflected these risks,” says Murat Toprak, a CEEMEA FX strategist at HSBC.

“Our valuation metrics suggest that the ZAR is still aligned with its fundamentals. A smaller current account surplus has been partly reflected by the recent significant move up in USD-ZAR. Therefore, we do not see fundamental reason for further ZAR weakness,” Toprak said following a review of HSBC’s Rand forecasts this week.

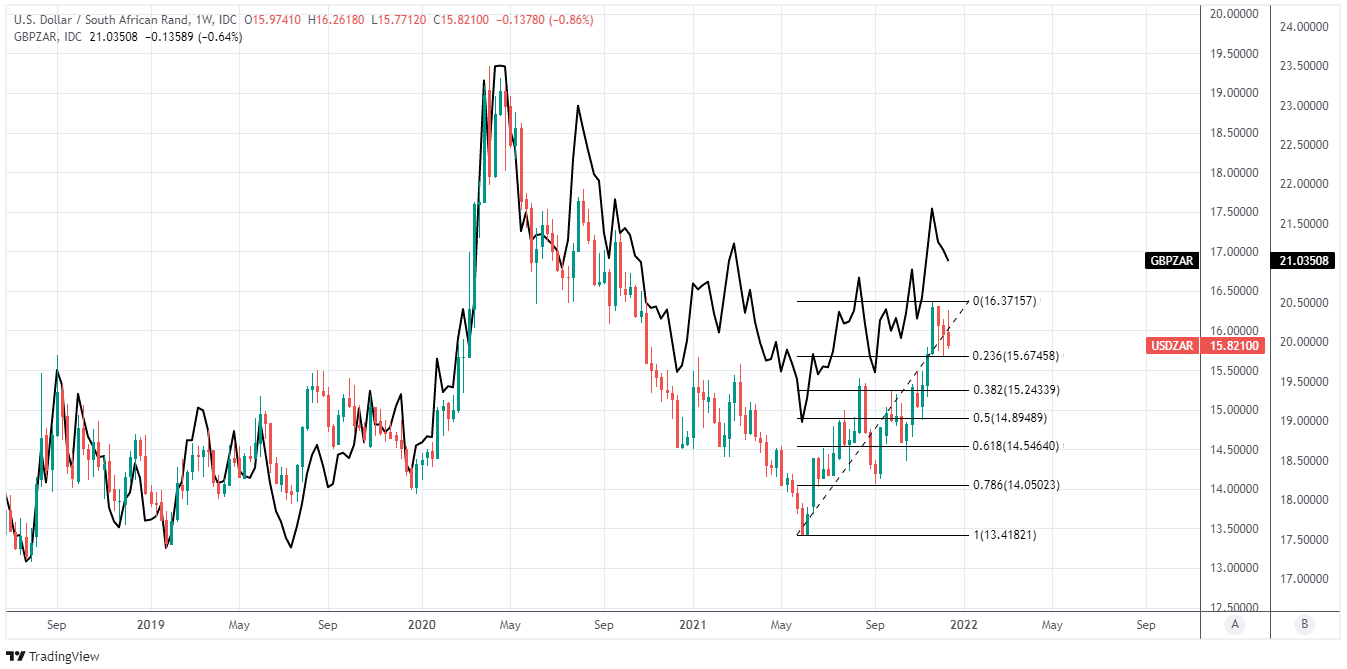

Above: USD/ZAR shown at weekly intervals alongside GBP/ZAR and with Fibonacci retracements of June’s rally indicating likely areas of support.

- GBP/ZAR reference rates at publication:

Spot: 21.05 - High street bank rates (indicative): 20.31-20.46

- Payment specialist rates (indicative): 20.86-20.95

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The nascent bounce back by the Rand was sustained in the wake of Thursday’s data revealing that South African inflation pressures remained mild in November, with the core inflation rate left sitting a mere 30 basis points away from the floor of the three-to-six percent target band.

“Core inflation rose marginally but remained relatively subdued at 3.3% y/y, reflecting the effects of muted domestic demand side pressures,” says Lara Hodes, an economist at Investec.

This is one reason why the South African Reserve Bank (SARB) has been slow to lift its interest rate and could continue to lag behind as other central banks in developed and emerging markets normalise their monetary policies.

The SARB lifted its cash rate from last year’s low of 3.5% to 3.75% in November and said its quarterly projection model was advocating an additional interest rate rise before year-end followed by one 25 basis point increase to the cash rate in each quarter of 2022, 2023 and 2024.

“The central bank continues to be prudent as it started a timely rate hike cycle, in our view. The SARB does not need to be aggressive (HSBC economics sees the policy rate at 5.00% at the end of 2022 vs 3.75% currently) as inflation is likely to remain within the target range of 3-6%. This is an important difference with other countries in CEEMEA where inflation is well above central banks’ targets,” HSBC’s Toprak says.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Rand’s tentative recovery also comes amid a mixed performance from the Dollar even after Wednesday’s decision by the Fed to wind down its quantitative easing programme at a faster pace and to make ready to raise interest rates as soon as the second quarter of 2022.

The Fed’s latest forecasts implied that it could raise interest rates as many as three times next year, taking the Federal Funds rate to between 0.75% and 1%, although financial markets have stopped short of pricing-in this scale of adjustment.

That’s one more potential constraint on the Rand in its recovery off late November’s lows, which has already run into Dollar buyers around the 15.70 level once previously in December.

That coincides with the 23.8% Fibonacci retracement of USD/ZAR’s five-month uptrend dating back to June and the time when the Fed first began to signal that its monetary policy stance was beginning to shift in a less supportive direction.

“The 15.70 – 16.36 area is the trading range. Our bias remains to buy $ on dips. On the franchise front we have seen $ selling by leveraged names,” says Yuliya Kryzhanovska, a trader at Credit Suisse, in a Wednesday trading desk commentary.

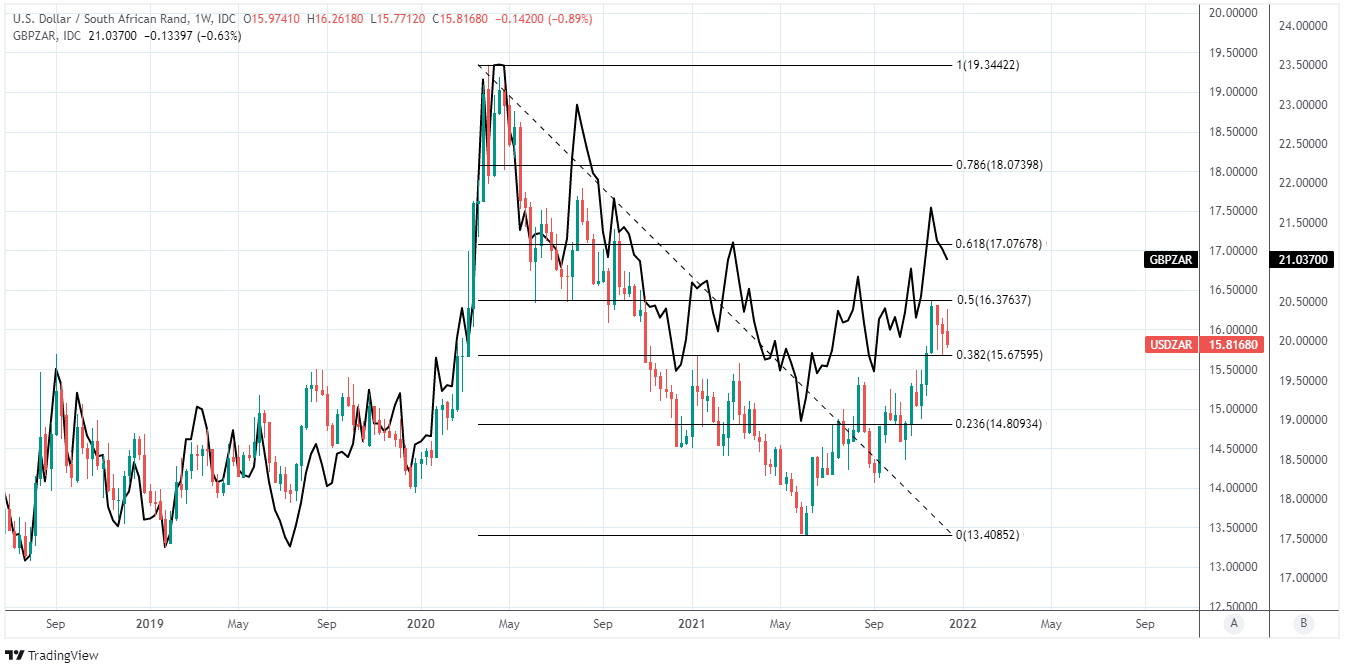

Above: USD/ZAR shown at weekly intervals alongside GBP/ZAR and with Fibonacci retracements of 2020 fall indicating likely areas of resistance.