Pound-Rand Rate Rallies Back to 20.00 Barrier Aided by Domestic Disturbances and Rising Covid cases

- Written by: Gary Howes

- GBP/ZAR eyes test of 20.00

- ZAR undermined by protests, rising covid cases

- Global sentiment also unhelpful

- But Citi and HSBC see a stronger end to 2021

Image © Adobe Images

- GBP/ZAR reference rates at publication:

- Spot: 19.98

- Bank transfer rates (indicative guide): 19.28-19.42

- Transfer specialist rates (indicative): 19.80-19.84

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

Public disturbances, rising Covid-19 cases and a softer global investment backdrop all conspired to push the South African Rand lower at the start of the new week, however some analysts maintain that the outlook remains constructive for ZAR.

Public disturbances in South Africa's KwaZulu-Natal have been reported over the weekend and recent hours, with protesters unhappy about the jailing of former president Jacob Zuma looting businesses.

The developments don't pose a major economic risk in isolation, but one currency analyst says the optics could have more significant implications.

"Big test for the anti corruption fight in RSA as ex-President Zuma is jailed for 15 months for contempt. His supporters were not only marching but looting last night in Kwa-Zulu Natal Province. Not good but ultimately the government must prevail if it is going to convince inward investors that they mean business," says Humphrey Percy, SGM Foreign Exchange Ltd.

Zuma was handed a 15-month prison sentence for defying a Constitutional Court order to give evidence at an inquiry investigating high-level corruption during his nine years in office until 2018.

Police said six people had been killed and over 200 arrested in related protests and looting since last week.

According to newswires, violence and looting continued on Monday, with some disturbances being reported in the country's largest city Johannesburg

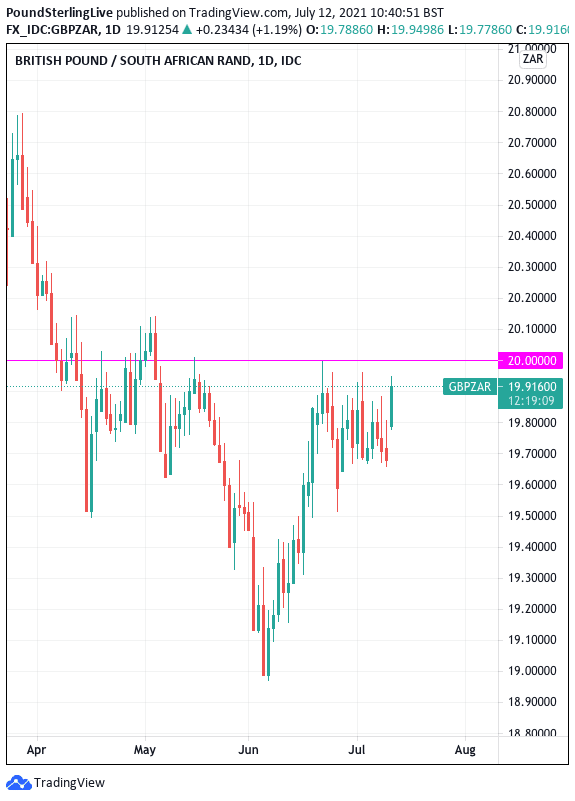

Associated Rand weakness at the start of the week has allowed for another impulse higher in the Pound-to-Rand exchange rate (GBP/ZAR), which is making its way back to the 20.00 level:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

As can be seen in the above, 20.00 poses a significant resistance barrier where rallies tend to fail.

Investors appear intent on selling the Pound and buying the Rand in the approach to 20.00 in anticipation of an ultimate failure at this technical barrier.

Therefore the Rand might find technical considerations ease some of the recent weakness.

Given the strength of resistance here, any break higher in GBP/ZAR will ultimately require a fundamental breakdown in sentiment towards the Rand, which had been a star performer heading into the mid-year period.

The domestic story could yet deliver such a fundamental breakdown as the surge in Covid-19 cases across the country continues, resulting in the imposition of restrictions by the government.

"ZAR leads underperformance as local repricing of Delta risks remains," says Rui Ding, analyst at Citi.

The rule of thumb when it comes to Covid economics is that the longer restrictions last the more damaging they become economically as irreversible structural breakdowns begin to occur.

The South African government on Sunday extended restrictions for another 14 days, maintaining rules that include a ban on gatherings, a curfew from 9 p.m. to 4 a.m. and a prohibition on the sale of alcohol.

"Our health system countrywide remains under pressure," President Cyril Ramaphosa said in a televised address to the nation.

"The ZAR’s appreciation trend appears to have halted. Tighter restrictions because of a new wave of COVID-19 cases," says Paul Mackel, Head of FX Research at HSBC.

For the Rand, "the Covid risk premium remains valid with Ramaphosa extending bans on alcohol sales and most public gatherings for two weeks on Sunday," says Ding.

It is not just South Africa that is seeing a surge in Covid-19 cases as the highly transmissible Delta variant is causing cases to rise in Europe and Asia.

This is in turn being reflected in softer global markets and commodity prices, with a spike of cases in southern China being blamed in part for slowing in economic activity in the world's second-largest economy.

The combination of softening investor sentiment and lower commodity prices are in turn a headwind for the Rand, which tends to benefit when investors are optimistic and the cost of South Africa's raw material exports are elevated.

Despite the recent setback to the Rand, some analysts remain optimistic on the currency's outlook.

Citi think that the latest risk-off episode has probably mostly run its course, as they expect:

i) the impact of the Delta variant on markets to be limited,

ii) the global recovery to remain in place, and

iii) central bank policy to be data-dependent and able to pivot if needed, but of course some risks remain.

HSBC's Mackel says in a monthly foreign exchange research briefing note that his team do not see strong fundamental reasons to be excessively pessimistic on the ZAR for the second part of the year.

"Recent leading indicators suggest limited damage to the economy stemming from the new restrictions, the trade balance surplus remains sizeable and the SARB is likely to start policy normalisation before year-end," says Mackel.

Another potential trigger to a Rand recovery could come in the form of investor expectations regarding the U.S. Federal Reserve, which has proved something of a handbrake to global growth of late.

The Fed appears intent on reducing the levels of support it provides the U.S. economy, which in turn has knock-on effects for the global economy.

In anticipation of a higher interest rate regime in the U.S. the yield paid on U.S. sovereign and corporate bonds has risen.

However, Derek Halpenny, head of research, global markets EMEA and international securities at MUFG, says this source of weakness for the Rand could soon come to pass.

"ZAR should begin to rebound following the heavy sell off as Fed rate hike fears begin to ease. The positive fundamentals that have led to ZAR strength for most of this year including favourable carry, improving terms of trade and improving investor risk sentiment remain in place,” says Halpenny.

"After such a sharp correction lower the ZAR now appears more attractively valued. Our base case scenario is for US rate hike fears to begin to calm down at the current juncture rather than continue to escalate," he adds.