South African Rand Resilience Keeps GBP/ZAR On Back Foot Below 19.90

- Written by: James Skinner

- GBP/ZAR little changed even as USD seeks to rebound

- ZAR resilience may keep a lid on USD/ZAR & GBP/ZAR

- As trade surplus, yields & SARB’s wiggle room underpin

Image © Adobe Images

- GBP/ZAR reference rates at publication:

- Spot: 19.79

- Bank transfer rates (indicative guide): 19.10-19.24

- Transfer specialist rates (indicative): 19.61-19.65

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The South African currency holds its ground against many of the major currencies in an extended show of resilience that could keep GBP/ZAR beneath 19.90 and on its back foot.

The Rand has risen against all of the major currencies except the U.S. Dollar and Japanese Yen in the last week, while retaining gains over all except the Canadian Dollar for the 2021 year-to-date owing to an ongoing run of outperformance that took many in the market by surprise.

“Although now finding itself in the midst of a third wave of Covid-19, economic activity has surprised to the upside during H1 in South Africa. Industrial sector production has been particularly encouraging as both manufacturing and mining were able to post positive quarterly growth rates in Q1, while financial services also accelerated,” says Pieter du Preez, an economist at NKC African Economics.

“As such, we revised our economic growth forecast higher to 4.3% in 2021. Our baseline assumed a third wave; however, the severity of the third wave will matter going forward,” du Preez says.

The Rand’s outperformance has multiple drivers that are often a matter of debate among analysts and economists, but has so far enabled the currency to resist a weeks-long attempt at recovery by the U.S. Dollar even after coronavirus-inspired restrictions on activity were tightened this week.

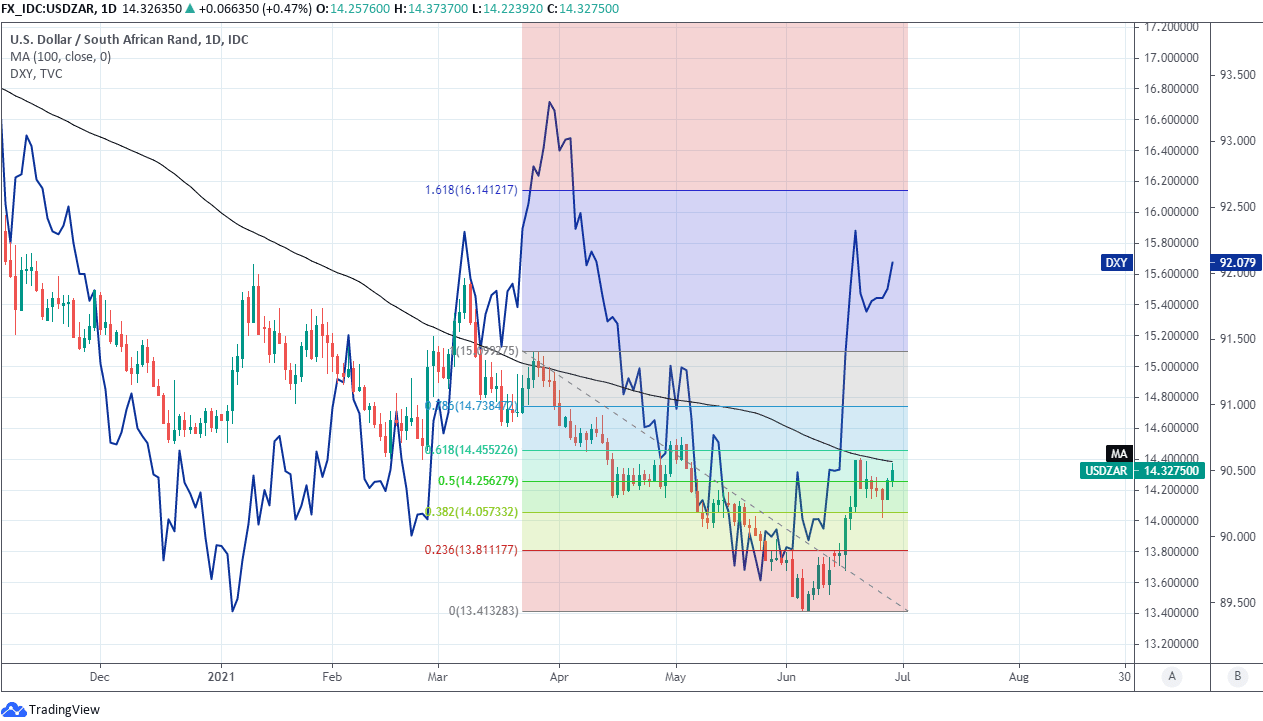

Above: GBP/ZAR appears to lag recovery of U.S. Dollar Index (blue), while showing reluctance to cross 38.2% Fibonacci retracement of its March decline at 19.9394, above which sits the 100-day moving-average.

“The rand has held above R14.00/USD, failing to strengthen further on ongoing market concerns over the firming of US rate hike plans and the rapid increase in the third wave in SA,” Bishop says,” says Annabel Bishop, chief economist at Investec.

With the exception of the Brazilian Real, the Rand was also still higher against all its largest developing economy counterparts for 2021 on Tuesday, even after President Cyril Ramaphosa announced Sunday that South Africa would be moving up the ‘lockdown’ ladder.

“Interprovincial travel is limited, and alcohol sales banned, which will negatively impact the hospitality, tourism and restaurant sector, with many businesses not recovered from last year’s lockdown. However, the third wave in Gauteng needs to be brought under control,” Bishop says.

New level four restrictions on activity and social contact are mild compared with those seen in other parts of the world although economists and analysts will nonetheless watch closely for signs of impact on the fragile economic recovery that was beginning to flourish in South Africa.

South Africa’s economy is a direct beneficiary of double-digit percentage increases in commodity prices, as these have helped to convert a cumbersome pre-pandemic deficit in traded goods and services into a surplus, which may have played a role in lifting the Rand during recent months.

Above: USD/ZAR appears to lag recovery of U.S. Dollar Index (blue), while showing reluctance to cross the 100-day moving average at 14.3846, which sits beneath the 61.8% Fibonacci retracement of the second quarter’s decline.

“The biggest driver behind the robust trade numbers was elevated mining commodity prices,” says NKC’s du Preez. “Inflation rose markedly to 4.4% y-o-y in April. This acceleration in price pressures came as no surprise given the increase in international oil prices over the past couple of months. Consumer price index (CPI) inflation will continue to rise over the short term.”

Elevated commodity prices have helped convert deficits to surpluses in some parts of the national accounts and lifted model-derived estimates of ‘fair value’ for the Rand, but they’ve not been without cost as the higher price of oil has seen inflation rise to 5.2% in the month of May and left it above the midpoint of the 3%-to-6% range targeted by the South African Reserve Bank (SARB).

It remains to be seen if South African inflation will rise any further given uncertainties about major economy central bank policies including those of the Federal Reserve, which could ultimately see commodity prices slowing, and it’s a matter of open debate as to how the SARB might respond to higher price pressures in the event that they end up threatening the upper bounds of its target range.

But if movements in oil prices are overlooked then South African inflation was actually sitting at 3.1% and around the bottom of the SARB’s target range last month, as was reflected by Statistics South Africa’s core consumer price index in May, while any suggestions from the SARB that it’s contemplating an interest rate response would amount to what is effectively another feather in the cap of the Rand.

“While we still expect no interest rate hikes in South Africa this year, the SARB has started talking of normalising monetary policy which, combined with the negative impact of the third wave and higher restrictions, will be harmful to the economic recovery,” Investec’s Bishop says.