Emerging Markets Offer Escape from Low Volatility Dollar, Sterling, Euro and Aussie

- Written by: James Skinner

- EM currencies could be favoured in a quiet summer

- As market pricing sees major FX running out of road

- After EM central banks take the lead in raising rates

Image © Adobe Images

Emerging market currencies would offer investors an escape from lethargy that could befall major exchange rates this summer if the largest of central banks fall behind their peers in developing economies, which are being more aggressive in their interest rate responses to rising levels of inflation.

Currencies have this year been mainly a developed world story of swift progress on vaccination programmes in the UK and U.S. among others, which has furthered a domestic and international containment process that is now raising expectations for economic growth and inflation in many places.

As a result prices in certain financial markets have shifted and now assign high probabilities of mid-to-late 2022 interest rate rises from the Bank of Canada, Bank of England, Federal Reserve, Bank of Canada and Reserve Bank of Australia among others.

Meanwhile, the Reserve Bank of New Zealand and Norges Bank are seen moving even sooner than that, although the rub for the currency market is that these central banks can do little other than neglect to indulge those expectations for at least some months yet.

“The CAD, GBP and NOK are the three best performing G10 currencies in the year to date, with perceptions regarding central bank policy playing a key part in this performance,” says Jane Foley, head of FX strategy at Rabobank.

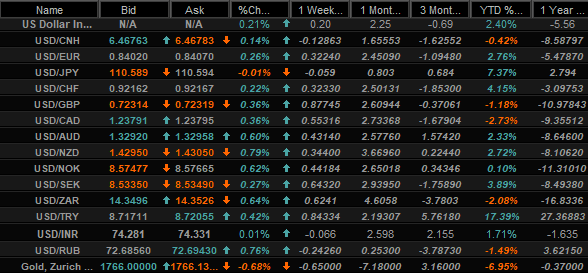

Above: U.S. Dollar performance against major currencies this year. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Current lofty expectations of central banks could be near impossible for many, if not all, to improve upon, and would be easily disappointed if the recent increases in inflation seen across many countries were to fade quickly or if economic recoveries meet obstacles along their paths.

In any case, it will be some months at the very least before developed market central banks have enough information to decide whether or not to indulge those wagering that employment markets will be quick to normalise as the pandemic fades, and that inflation will prove more stubborn than anticipated.

Many exchange rates may have little place to go in the short-term as central banks wait to see if reopening economies will live up to expectations and whether nascent price pressures are really as “transitory” as has been commonly assumed.

That could in turn make for a lethargic, low volatility and docile environment around major exchange rates, which is a tried and tested recipe for outperformance among emerging market currencies:

Above: Dollar Index shown at daily intervals with Pound-Dollar rate.

Some analysts say emerging market currencies are likely to be the better performers throughout the summer months as a result, and that this could easily come at the expense of even popular major currencies like the Australian Dollar, Pound and Euro.

“After a brief boost around the FOMC, FX volatility is falling again. We expect it to remain low in the medium-term and particularly in the coming Months. Carry trades are the natural domain of FX investors in periods of low vol. That necessarily means long EM, and every G10 currency is now a potential funding currency,” says Elsa Lignos, global head of FX strategy at RBC Capital Markets.

Like major counterparts many emerging market currencies came undone after June’s Fed policy decision indicated that some rate setters are beginning to think it might be appropriate to raise rates sooner rather than later, although a handful stood out from the crowd wherever not bucking the trend due to restless central banks that are now effectively offering investors enhanced rewards for buying their currencies.

“The stand out performers in recent weeks have been the BRL, MXN and RUB. Most notably the BRL has bucked the overall trend for EM FX by strengthening in both of the last two weeks despite the Fed’s hawkish policy update,” says Lee Hardman, a currency analyst at MUFG.

Above: MUFG graph showing U.S. Dollar performance Vs emerging market currencies.

Many developed world central banks have struggled and in some cases failed to generate more inflation in recent years, and enough to meet their targets so may be more reluctant to chase away tentatively returning price pressures by raising interest rates than those elsewhere in the world.

But emerging market economies, whose currencies had received less attention from investors this year, have a different experience with inflation and some of their central banks are already raising interest rates in order to keep it at bay.

“In the emerging markets space, where the experience of inflation tends to be far more perilous than in the G10, various central banks have been flexing their muscles,” says Foley. “With the carry trade back in the limelight, the market will be paying close heed to the possibility of any shifts in central bank rhetoric."

Outperformers are so far clustered mainly in Central and Eastern Europe as well as in the Americas emerging market space.

“The Central Bank of Russia’s hawkish policy credentials were on show again yesterday when Governor Nabiullina stated that they are ready to consider a rate increase of 0.25% up to 1.00% at their next meeting on 23rd July,” MUFG’s Hardman says.

“Unlike developed market central banks, they “don’t see the inflation acceleration as transitory, but more persistent”, and aim to react “fast, but predictably” on rates. We continue to favour EM FX where domestic central banks are leading the way in tightening policy,” Hardman adds.

In Europe the Czech National Bank (CNB) and National Bank of Hungary (NBH) grabbed the headlines in Europe last week when the former lifting Czech Republic’s cash rate from 0.25% to 0.50% in its first monetary step out of the pandemic.

Above: RBC Capital Markets analysis showing optimal choice of currencies to sell in exchange for emerging market counterparts.

The CNB said “interest rates can be expected to continue rising in the second half of this year,” while the NBH raised its base rate 0.30% to 0.90%.

“Central Europe and the region is in what we think will turn out to be a prolonged period of above-target inflation. But how this affects monetary policy will differ across the region. Interest rates in Poland and Hungary are likely to remain low for longer than investors assume, while the Czech tightening cycle is likely to be more aggressive,” says Liam Peach, an emerging markets economist at Capital Economics.

“We think this will be associated with a marked divergence in the performance of currencies and bonds across the region,” Peach adds.

Meanwhile, and over in North America Banxico surprised the market by lifting Mexican interest rates 0.25% to 4.25%, following in the footsteps of others including although these are not by any means the first to offer higher payouts, following in the footsteps of the Bank of Brazil which delivered its third consecutive interest rate rise this month when lifting the South American country’s cash rate to 4.25%.

“We have heard investors voice concern that Banxico would struggle to be hawkish, though it is clearly trying to get ahead of the market with this week’s surprise hike. We still like the short AUD/MXN trade and though it is flat YTD, we look for better performance in H2,” says RBC’s Lignos.

“Attractive funding currencies will generally be those that trade like risky assets, but have yields associated with safe havens in more normal times. AUD crops up most frequently as an efficient funding currency, ranking first against MXN, RUB and ZAR,” Lignos adds.